NZD/USD: the pair strengthens

12 July 2019, 09:50

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6695, 0.6705 |

| Take Profit | 0.6750 |

| Stop Loss | 0.6665 |

| Key Levels | 0.6580, 0.6610, 0.6640, 0.6655, 0.6687, 0.6707, 0.6725, 0.6750 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6660 |

| Take Profit | 0.6610, 0.6600 |

| Stop Loss | 0.6700 |

| Key Levels | 0.6580, 0.6610, 0.6640, 0.6655, 0.6687, 0.6707, 0.6725, 0.6750 |

Current trend

Yesterday, the pair NZD/USD grew slightly. The ambiguous dynamic was due to strong US consumer inflation data. In June, Core CPI rose by 0.3% MoM and 2.1% YoY, which was better than market expectations (+ 0.2% MoM and + 2.0% YoY). Strong statistics on inflation serves as a weighty argument in favor of keeping the current Fed’s interest rates but the market still expects a rate cut at a meeting of July 30–31.

Today, during the Asian session, the instrument grows, ready to renew the local highs formed yesterday. Published on Friday, the macroeconomic statistics from New Zealand was ambiguous but could not have a significant impact on the dynamics of the instrument. Thus, Manufacturing PMI of New Zealand in June rose from 50.2 to 51.3 points, which turned out to be significantly weaker than the forecast for growth to 53.1 points.

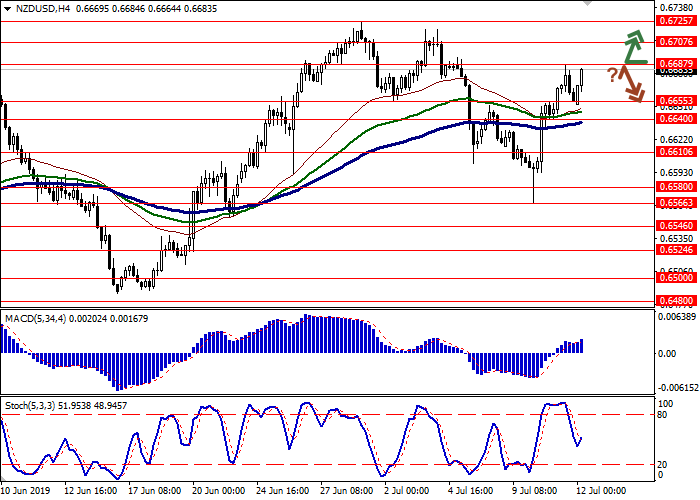

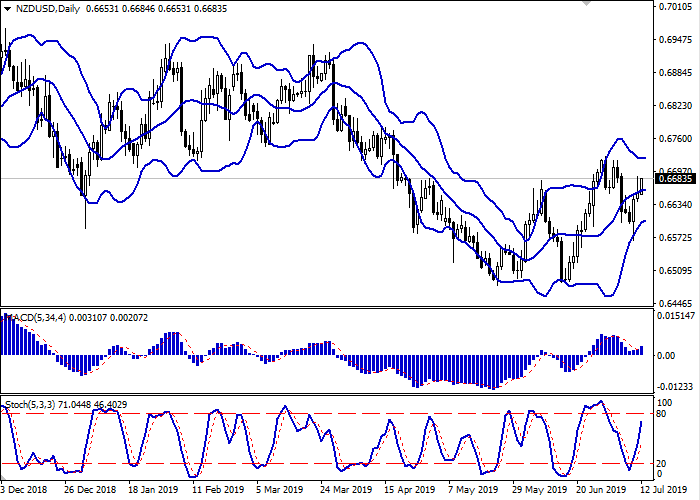

Support and resistance

On the daily chart, Bollinger bands grow moderately. The price range narrows, reflecting the ambiguous trading nature in the short term. The MACD grows, forming a new buy signal (the histogram is above the signal line). Stochastic is directed upwards but is rapidly approaching its highs, which indicates that NZD may become overbought in the super short term.

It is better to keep current long positions until the situation becomes clearer.

Resistance levels: 0.6687, 0.6707, 0.6725, 0.6750.

Support levels: 0.6655, 0.6640, 0.6610, 0.6580.

Trading tips

Long positions can be opened after the breakout of 0.6687 or 0.6700 with the target at 0.6750. Stop loss is 0.6680–0.6665.

Short positions can be opened after a rebound from 0.6687 and a breakdown of 0.6665 with the targets at 0.6610–0.6600 with stop loss no further than 0.6700.

Implementation period: 2-3 days.

Yesterday, the pair NZD/USD grew slightly. The ambiguous dynamic was due to strong US consumer inflation data. In June, Core CPI rose by 0.3% MoM and 2.1% YoY, which was better than market expectations (+ 0.2% MoM and + 2.0% YoY). Strong statistics on inflation serves as a weighty argument in favor of keeping the current Fed’s interest rates but the market still expects a rate cut at a meeting of July 30–31.

Today, during the Asian session, the instrument grows, ready to renew the local highs formed yesterday. Published on Friday, the macroeconomic statistics from New Zealand was ambiguous but could not have a significant impact on the dynamics of the instrument. Thus, Manufacturing PMI of New Zealand in June rose from 50.2 to 51.3 points, which turned out to be significantly weaker than the forecast for growth to 53.1 points.

Support and resistance

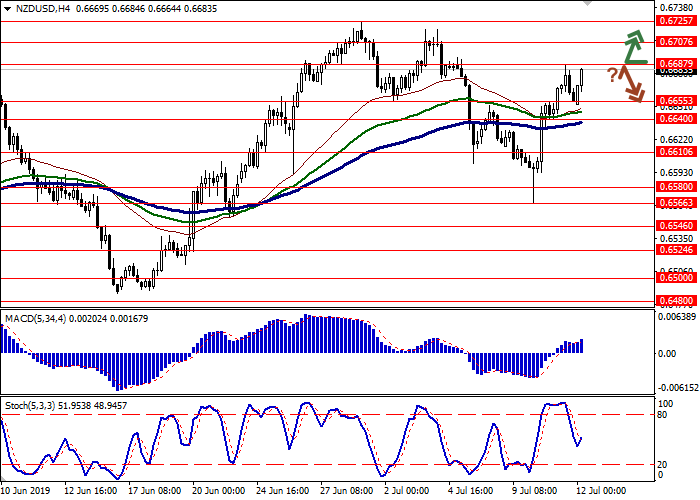

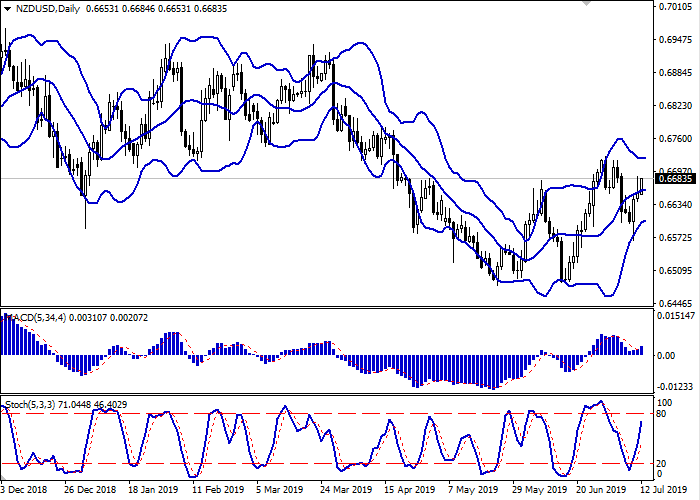

On the daily chart, Bollinger bands grow moderately. The price range narrows, reflecting the ambiguous trading nature in the short term. The MACD grows, forming a new buy signal (the histogram is above the signal line). Stochastic is directed upwards but is rapidly approaching its highs, which indicates that NZD may become overbought in the super short term.

It is better to keep current long positions until the situation becomes clearer.

Resistance levels: 0.6687, 0.6707, 0.6725, 0.6750.

Support levels: 0.6655, 0.6640, 0.6610, 0.6580.

Trading tips

Long positions can be opened after the breakout of 0.6687 or 0.6700 with the target at 0.6750. Stop loss is 0.6680–0.6665.

Short positions can be opened after a rebound from 0.6687 and a breakdown of 0.6665 with the targets at 0.6610–0.6600 with stop loss no further than 0.6700.

Implementation period: 2-3 days.

No comments:

Write comments