NZD/USD: NZD is consolidating

03 July 2019, 09:56

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6695, 0.6710 |

| Take Profit | 0.6750, 0.6770 |

| Stop Loss | 0.6670, 0.6660 |

| Key Levels | 0.6580, 0.6610, 0.6640, 0.6655, 0.6691, 0.6707, 0.6725, 0.6750 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6650, 0.6635 |

| Take Profit | 0.6600, 0.6580 |

| Stop Loss | 0.6670, 0.6685 |

| Key Levels | 0.6580, 0.6610, 0.6640, 0.6655, 0.6691, 0.6707, 0.6725, 0.6750 |

Current trend

NZD showed ambiguous dynamics on Tuesday, updating the local minima of June 26.

Published macroeconomic statistics from New Zealand had an ambiguous impact on the instrument. The NZIER business confidence index in Q2 decreased by 34% QoQ after falling by 29% QoQ. The number of issued construction permits in May grew by 13.2% MoM after a decrease of 7.9% last month. Analysts had expected negative dynamics at –0.5% MoM. The index of dairy products declined just by 0.4% MoM after declining by 3.8% last month. Analysts were expecting a decline of −3.6% MoM.

Today, the instrument shows a more confident growth, despite the persistence of an uncertain news background. The ANZ commodity price index in June fell by 3.9% MoM after rising by 0.1% MoM last month. Investors also drew attention to the Chinese statistics. Caixin Services PMI in June declined from 52.7 to 52.0 points against the forecast of growth to 53.0 points.

Support and resistance

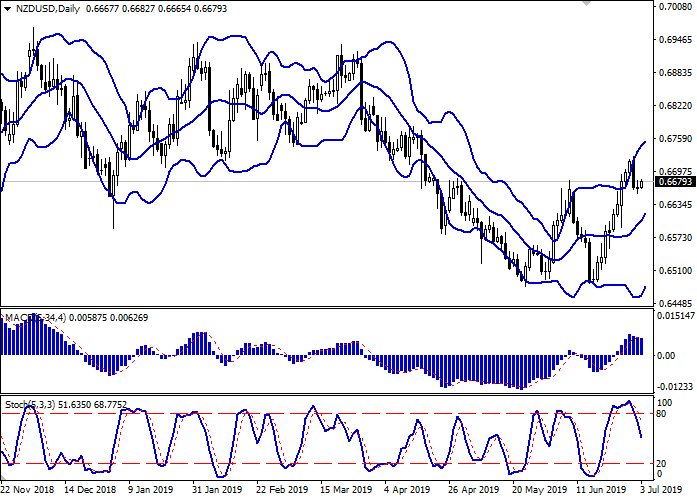

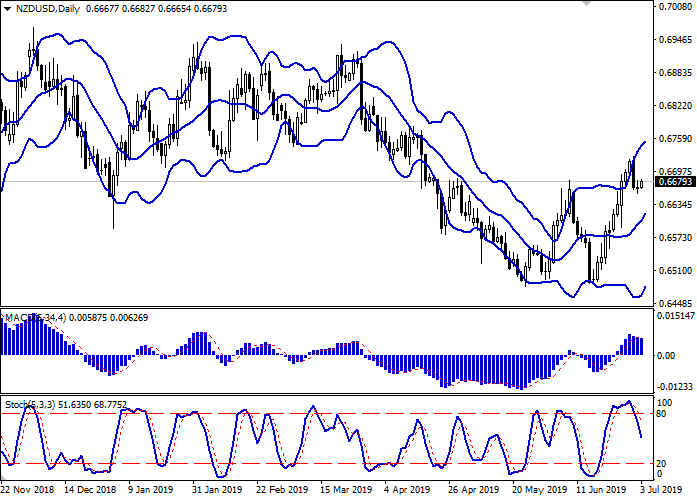

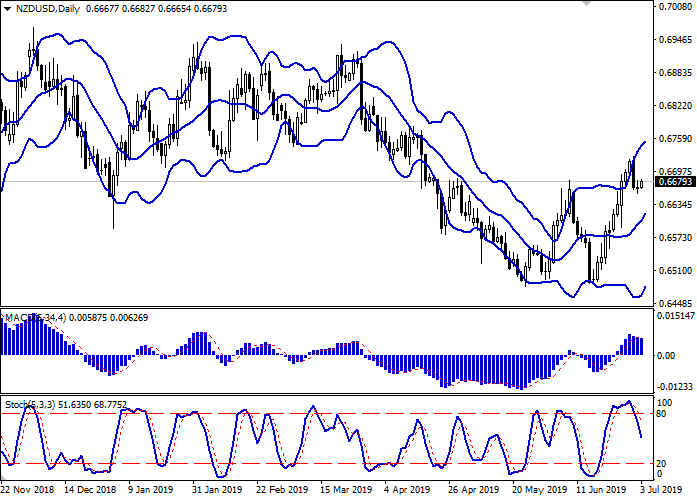

Bollinger Bands in D1 chart show stable growth. The price range is slightly narrowed, remaining rather spacious for the current dynamics of the instrument. MACD is going down having formed a weak sell signal (histogram is located under the signal line). Stochastic shows a more confident decline and practically does not respond to attempts to resume growth in the ultra-short term.

To open new transactions, one should wait for clarification.

Resistance levels: 0.6691, 0.6707, 0.6725, 0.6750.

Support levels: 0.6655, 0.6640, 0.6610, 0.6580

Trading tips

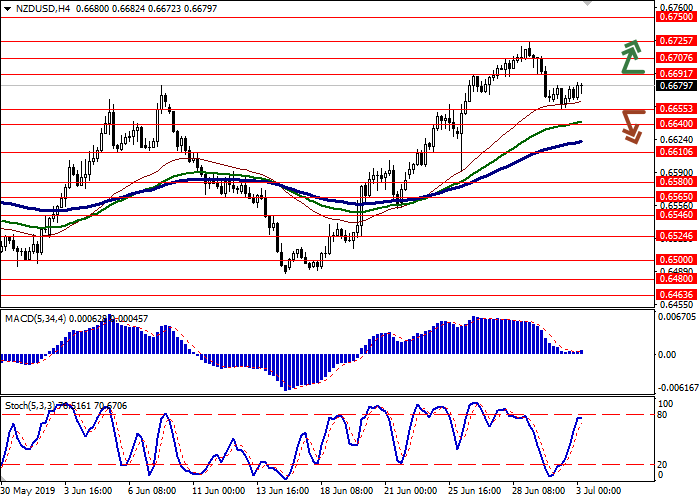

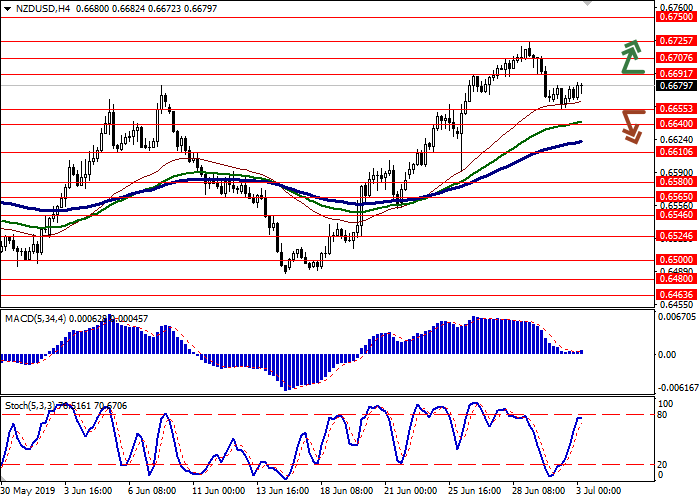

To open long positions, one can rely on the breakout of 0.6691 or 0.6707. Take-profit – 0.6750–0.6770. Stop loss – 0.6670–0.6660. Implementation period: 1-2 days.

A confident breakdown of 0.6655–0.6640 may serve as a signal for sales with the target at 0.6600 or 0.6580. Stop loss – 0.6670–0.6685. Implementation period: 2-3 days.

NZD showed ambiguous dynamics on Tuesday, updating the local minima of June 26.

Published macroeconomic statistics from New Zealand had an ambiguous impact on the instrument. The NZIER business confidence index in Q2 decreased by 34% QoQ after falling by 29% QoQ. The number of issued construction permits in May grew by 13.2% MoM after a decrease of 7.9% last month. Analysts had expected negative dynamics at –0.5% MoM. The index of dairy products declined just by 0.4% MoM after declining by 3.8% last month. Analysts were expecting a decline of −3.6% MoM.

Today, the instrument shows a more confident growth, despite the persistence of an uncertain news background. The ANZ commodity price index in June fell by 3.9% MoM after rising by 0.1% MoM last month. Investors also drew attention to the Chinese statistics. Caixin Services PMI in June declined from 52.7 to 52.0 points against the forecast of growth to 53.0 points.

Support and resistance

Bollinger Bands in D1 chart show stable growth. The price range is slightly narrowed, remaining rather spacious for the current dynamics of the instrument. MACD is going down having formed a weak sell signal (histogram is located under the signal line). Stochastic shows a more confident decline and practically does not respond to attempts to resume growth in the ultra-short term.

To open new transactions, one should wait for clarification.

Resistance levels: 0.6691, 0.6707, 0.6725, 0.6750.

Support levels: 0.6655, 0.6640, 0.6610, 0.6580

Trading tips

To open long positions, one can rely on the breakout of 0.6691 or 0.6707. Take-profit – 0.6750–0.6770. Stop loss – 0.6670–0.6660. Implementation period: 1-2 days.

A confident breakdown of 0.6655–0.6640 may serve as a signal for sales with the target at 0.6600 or 0.6580. Stop loss – 0.6670–0.6685. Implementation period: 2-3 days.

No comments:

Write comments