NZD/USD: instrument consolidates

17 July 2019, 09:42

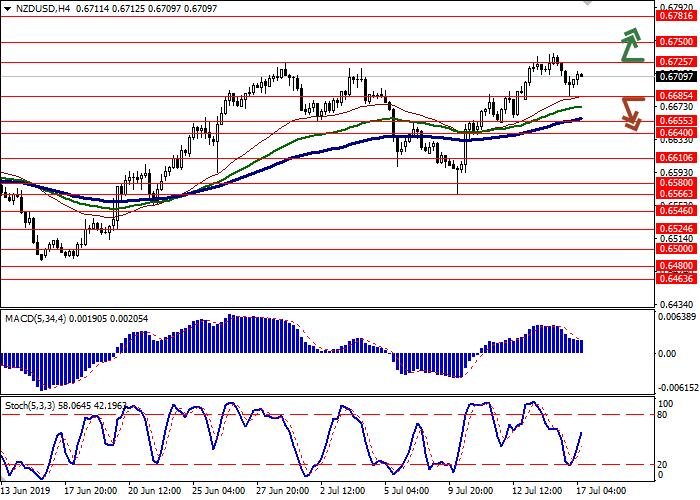

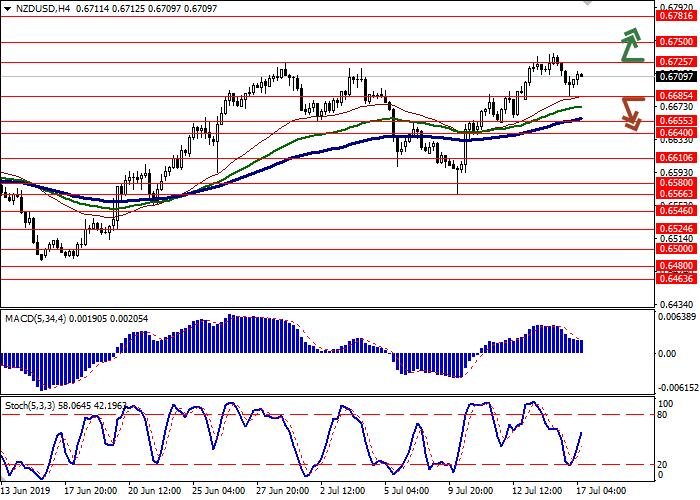

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6730, 0.6755 |

| Take Profit | 0.6800 |

| Stop Loss | 0.6700, 0.6685 |

| Key Levels | 0.6610, 0.6640, 0.6655, 0.6685, 0.6725, 0.6750, 0.6781 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6680 |

| Take Profit | 0.6610, 0.6580 |

| Stop Loss | 0.6725 |

| Key Levels | 0.6610, 0.6640, 0.6655, 0.6685, 0.6725, 0.6750, 0.6781 |

Current trend

Yesterday, the dynamics of the NZD/USD pair was controversial, and the daily session ended in the red zone, while during the day the instrument was mostly trading upwards. The negative dynamics was due to the strong US Retail Sales data, which may be another argument in favor of keeping current interest rates at the Fed meeting at the end of July.

NZD was supported by statistics on consumer inflation in New Zealand. Q2 2019 CPI rose by 0.6% QoQ and 1.7% YoY, which fully coincided with market expectations. The index significantly accelerated from the previous dynamics +0.1% QoQ and +1.5% YoY. NZD was also supported by a published price index for dairy products. In June, the index rose by 2.7% MoM after a decline of 0.4% MoM last month. Analysts expected a sharp increase in negative dynamics to –2.5% MoM.

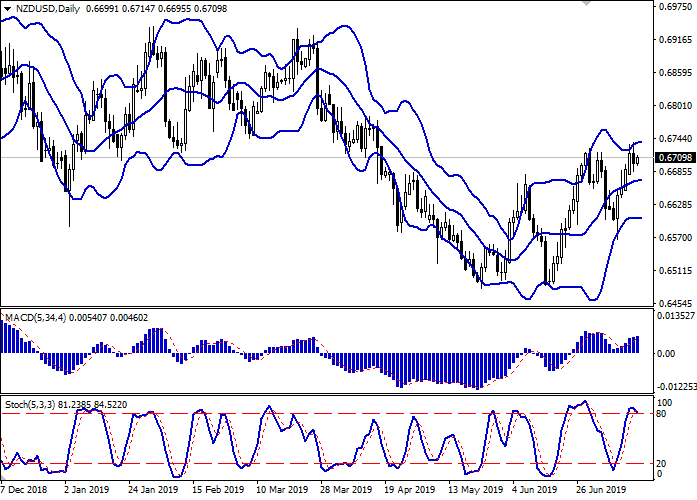

Support and resistance

On the daily chart, Bollinger bands reverse horizontally. The price range tries to consolidate, reflecting the ambiguous dynamics in the super-short term. The MACD grows, keeping a moderate buy signal (the histogram is above the signal line). Stochastic, approaching its highs, is prone to reverse downwards, reflecting that NZD is overbought in the super short term.

To open new trading positions, it is better to wait until the signals are clear.

Resistance levels: 0.6725, 0.6750, 0.6781.

Support levels: 0.6685, 0.6655, 0.6640, 0.6610.

Trading tips

Long positions can be opened after the breakout of 0.6725 or 0.6750 with the target at 0.6800. Stop loss is 0.6700 or 0.6685.

Short positions can be opened after the breakdown of 0.6685 with the target at 0.6610 or 0.6580. Stop loss is 0.6725.

Implementation period: 2–3 days.

Yesterday, the dynamics of the NZD/USD pair was controversial, and the daily session ended in the red zone, while during the day the instrument was mostly trading upwards. The negative dynamics was due to the strong US Retail Sales data, which may be another argument in favor of keeping current interest rates at the Fed meeting at the end of July.

NZD was supported by statistics on consumer inflation in New Zealand. Q2 2019 CPI rose by 0.6% QoQ and 1.7% YoY, which fully coincided with market expectations. The index significantly accelerated from the previous dynamics +0.1% QoQ and +1.5% YoY. NZD was also supported by a published price index for dairy products. In June, the index rose by 2.7% MoM after a decline of 0.4% MoM last month. Analysts expected a sharp increase in negative dynamics to –2.5% MoM.

Support and resistance

On the daily chart, Bollinger bands reverse horizontally. The price range tries to consolidate, reflecting the ambiguous dynamics in the super-short term. The MACD grows, keeping a moderate buy signal (the histogram is above the signal line). Stochastic, approaching its highs, is prone to reverse downwards, reflecting that NZD is overbought in the super short term.

To open new trading positions, it is better to wait until the signals are clear.

Resistance levels: 0.6725, 0.6750, 0.6781.

Support levels: 0.6685, 0.6655, 0.6640, 0.6610.

Trading tips

Long positions can be opened after the breakout of 0.6725 or 0.6750 with the target at 0.6800. Stop loss is 0.6700 or 0.6685.

Short positions can be opened after the breakdown of 0.6685 with the target at 0.6610 or 0.6580. Stop loss is 0.6725.

Implementation period: 2–3 days.

No comments:

Write comments