EUR/USD: EUR is declining

17 July 2019, 09:33

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1250 |

| Take Profit | 1.1343, 1.1370 |

| Stop Loss | 1.1200 |

| Key Levels | 1.1133, 1.1159, 1.1180, 1.1200, 1.1244, 1.1284, 1.1316, 1.1343 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1195 |

| Take Profit | 1.1133, 1.1120 |

| Stop Loss | 1.1230 |

| Key Levels | 1.1133, 1.1159, 1.1180, 1.1200, 1.1244, 1.1284, 1.1316, 1.1343 |

Current trend

EUR showed a steady decline against USD yesterday, retreating to new weekly lows. The reason for the emergence of negative dynamics was the macroeconomic statistics from Germany and the USA. The ZEW business sentiment index in July decreased from −21.1 to −24.5 points, which turned out to be worse than expectations of −22.3 points. The index of the current economic conditions for the same period decreased from 7.8 to -1.1 points, with a forecast of 5.0 points. The Eurozone sentiment index in July fell from −20.2 to −20.3 points but turned out to be better than the forecast of −20.9 points. Investors were optimistic about US retail sales statistics. In June, the sales of the control group increased from 0.6% to 0.7% MoM, while analysts expected sales to slow to 0.3% MoM. Strong data can help to maintain interest rates at the Fed meeting at the end of July.

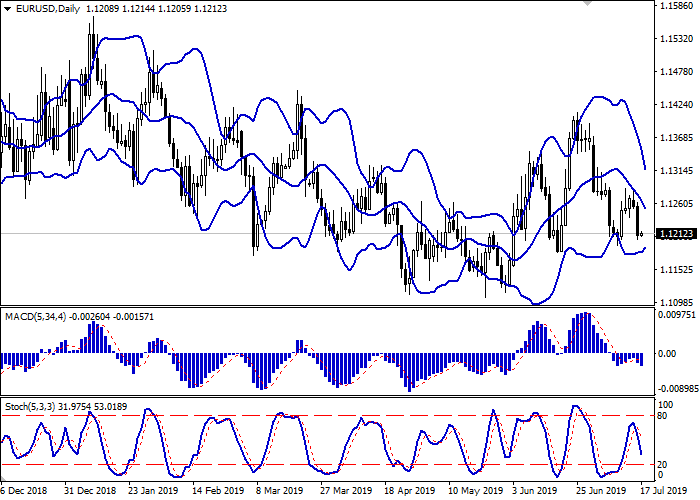

Support and resistance

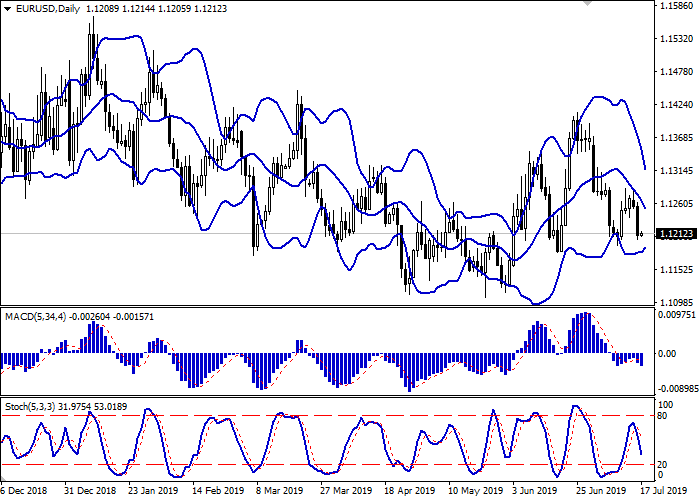

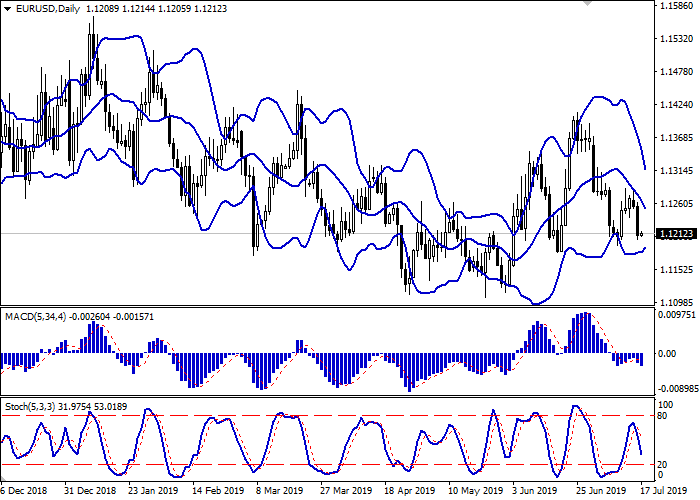

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is aggressively narrowing, reflecting the mixed dynamics of trading in the short term. MACD is going down preserving a weak sell signal (being located under the signal line). Stochastic shows similar dynamics, approaching its minima.

The current showings of the indicators do not contradict the further development of the downtrend in the short and/or ultra-short term.

Resistance levels: 1.1244, 1.1284, 1.1316, 1.1343.

Support levels: 1.1200, 1.1180, 1.1159, 1.1133.

Trading tips

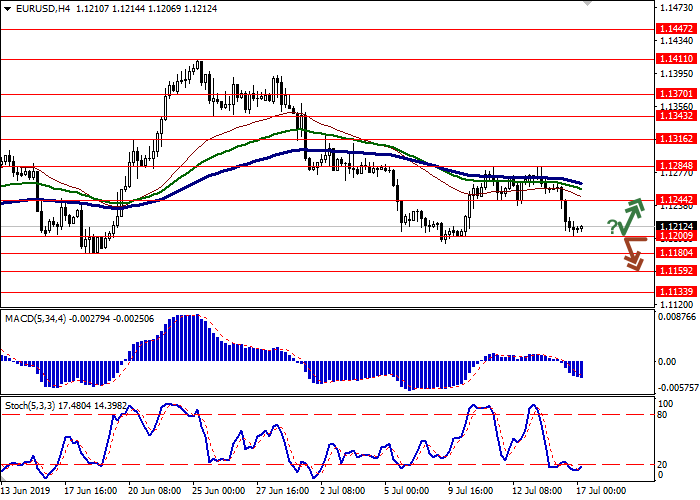

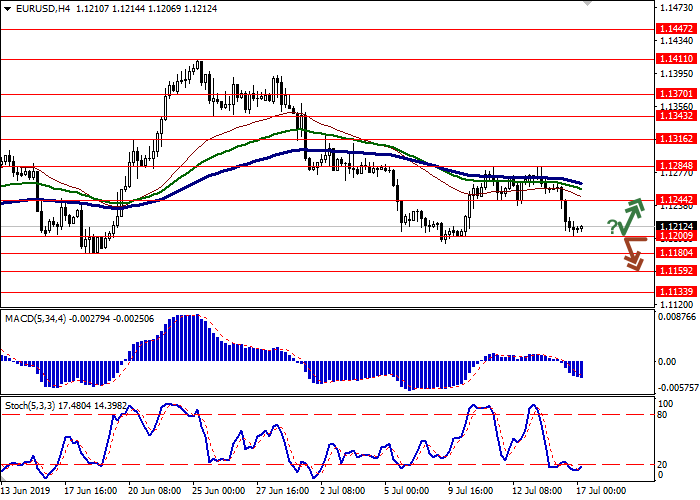

Long positions may be opened if the price moves away from 1.1200, as from support, followed by the breakout of 1.1244. Take profit – 1.1343 or 1.1370. Stop loss – 1.1200. Implementation period: 2-3 days.

A confident breakdown of 1.1200 may serve as a signal to further sales with the target at 1.1133–1.1120. Stop loss – 1.1230. Implementation period: 1-2 days.

EUR showed a steady decline against USD yesterday, retreating to new weekly lows. The reason for the emergence of negative dynamics was the macroeconomic statistics from Germany and the USA. The ZEW business sentiment index in July decreased from −21.1 to −24.5 points, which turned out to be worse than expectations of −22.3 points. The index of the current economic conditions for the same period decreased from 7.8 to -1.1 points, with a forecast of 5.0 points. The Eurozone sentiment index in July fell from −20.2 to −20.3 points but turned out to be better than the forecast of −20.9 points. Investors were optimistic about US retail sales statistics. In June, the sales of the control group increased from 0.6% to 0.7% MoM, while analysts expected sales to slow to 0.3% MoM. Strong data can help to maintain interest rates at the Fed meeting at the end of July.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is aggressively narrowing, reflecting the mixed dynamics of trading in the short term. MACD is going down preserving a weak sell signal (being located under the signal line). Stochastic shows similar dynamics, approaching its minima.

The current showings of the indicators do not contradict the further development of the downtrend in the short and/or ultra-short term.

Resistance levels: 1.1244, 1.1284, 1.1316, 1.1343.

Support levels: 1.1200, 1.1180, 1.1159, 1.1133.

Trading tips

Long positions may be opened if the price moves away from 1.1200, as from support, followed by the breakout of 1.1244. Take profit – 1.1343 or 1.1370. Stop loss – 1.1200. Implementation period: 2-3 days.

A confident breakdown of 1.1200 may serve as a signal to further sales with the target at 1.1133–1.1120. Stop loss – 1.1230. Implementation period: 1-2 days.

No comments:

Write comments