GBP/USD: the pound remains pressured

10 July 2019, 09:33

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.2480 |

| Take Profit | 1.2600, 1.2624 |

| Stop Loss | 1.2420 |

| Key Levels | 1.2364, 1.2400, 1.2438, 1.2476, 1.2504, 1.2533, 1.2555 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2430 |

| Take Profit | 1.2364, 1.2350, 1.2330 |

| Stop Loss | 1.2480 |

| Key Levels | 1.2364, 1.2400, 1.2438, 1.2476, 1.2504, 1.2533, 1.2555 |

Current trend

The pound declined markedly against the US dollar on Tuesday, updating local lows of January 3. The "bearish" dynamics was facilitated by the uncertain macroeconomic statistics from the UK. In June, the BRC retail price index again showed a decline of 1.6% YoY after declining by 3.0% YoY last month. Analysts had expected positive dynamics of 0.8% YoY.

On July 10, the market expects the publication of a large block of statistics from the UK. Among other things, investors are focused on the dynamics of industrial output in May, GDP growth rates in May (and the forecast for June), as well as the trade balance. In the USA, the focus of attention will be the speech of Fed Chairman Jerome Powell in Congress.

Support and resistance

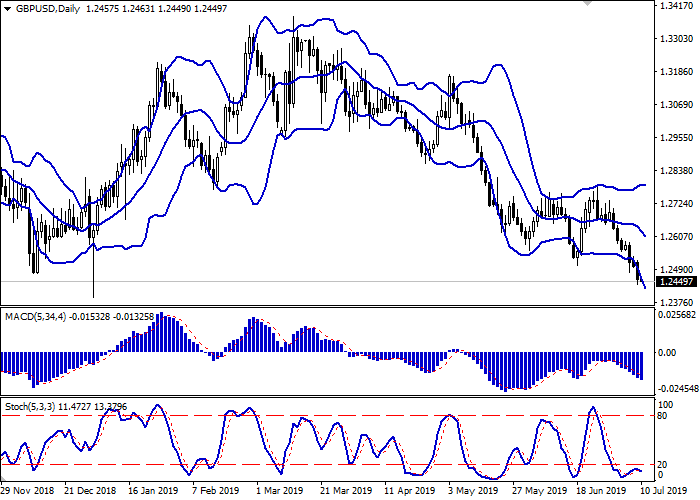

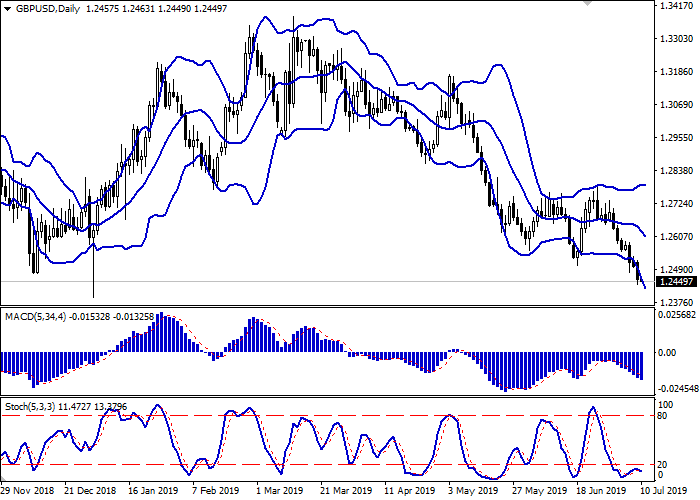

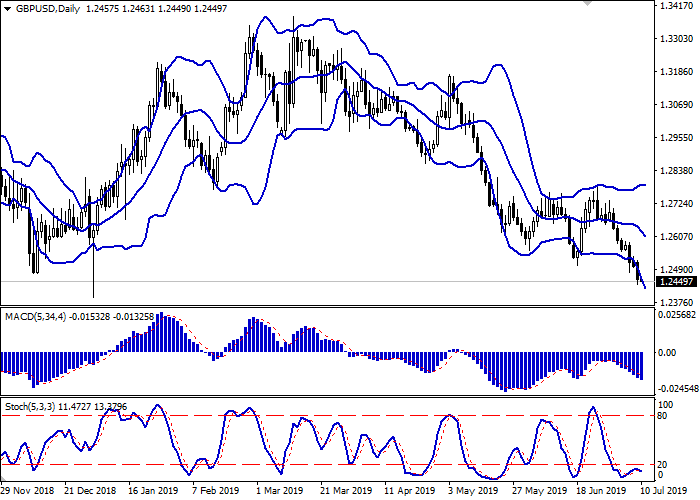

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is expanding, however, it fails to catch the development of "bullish" sentiments at the moment. MACD is going down preserving a stable sell signal (being located under the signal line). Stochastic, approaching its maximum levels, is reversing upwards, signaling the risks of the oversold pound in the ultra-short term.

One should keep existing short positions until clarification.

Resistance levels: 1.2476, 1.2504, 1.2533, 1.2555.

Support levels: 1.2438, 1.2400, 1.2364.

Trading tips

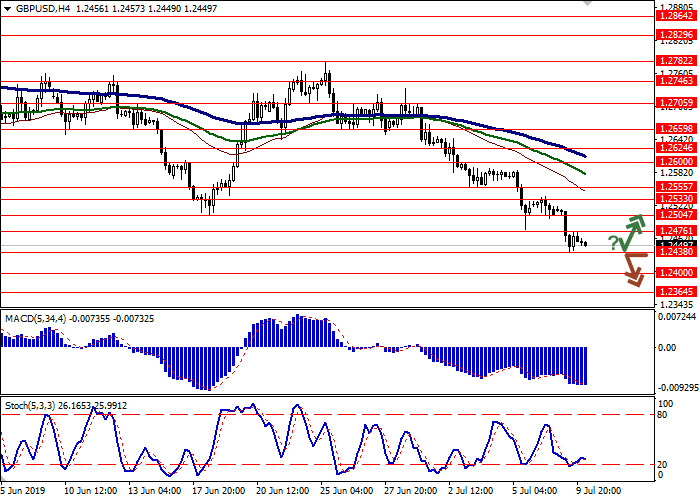

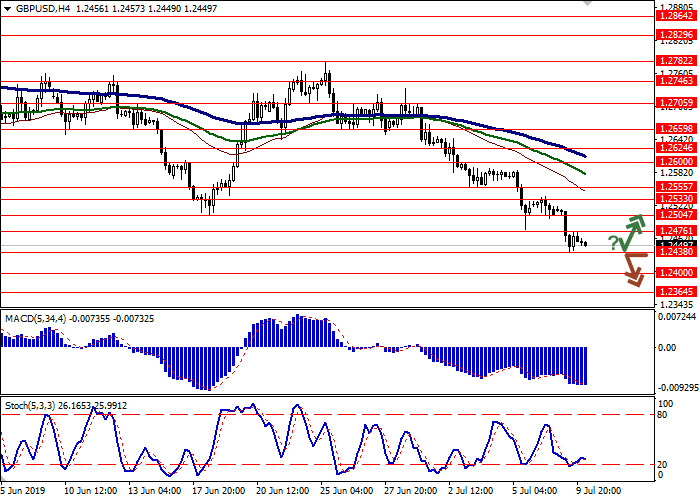

Long positions may be opened if the price moves away from 1.2438, as from support, followed by the breakout of 1.2476. Take profit – 1.2600 or 1.2624. Stop loss – 1.2420. Implementation period: 2-3 days.

A confident breakdown of 1.2438 may serve as a signal for sales with the target at 1.2364–1.2350 or 1.2330. Stop loss – 1.2480. Implementation period: 1-2 days.

The pound declined markedly against the US dollar on Tuesday, updating local lows of January 3. The "bearish" dynamics was facilitated by the uncertain macroeconomic statistics from the UK. In June, the BRC retail price index again showed a decline of 1.6% YoY after declining by 3.0% YoY last month. Analysts had expected positive dynamics of 0.8% YoY.

On July 10, the market expects the publication of a large block of statistics from the UK. Among other things, investors are focused on the dynamics of industrial output in May, GDP growth rates in May (and the forecast for June), as well as the trade balance. In the USA, the focus of attention will be the speech of Fed Chairman Jerome Powell in Congress.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is expanding, however, it fails to catch the development of "bullish" sentiments at the moment. MACD is going down preserving a stable sell signal (being located under the signal line). Stochastic, approaching its maximum levels, is reversing upwards, signaling the risks of the oversold pound in the ultra-short term.

One should keep existing short positions until clarification.

Resistance levels: 1.2476, 1.2504, 1.2533, 1.2555.

Support levels: 1.2438, 1.2400, 1.2364.

Trading tips

Long positions may be opened if the price moves away from 1.2438, as from support, followed by the breakout of 1.2476. Take profit – 1.2600 or 1.2624. Stop loss – 1.2420. Implementation period: 2-3 days.

A confident breakdown of 1.2438 may serve as a signal for sales with the target at 1.2364–1.2350 or 1.2330. Stop loss – 1.2480. Implementation period: 1-2 days.

No comments:

Write comments