GBP/USD: GBP is correcting

25 July 2019, 09:42

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.2510 |

| Take Profit | 1.2600, 1.2624 |

| Stop Loss | 1.2460 |

| Key Levels | 1.2334, 1.2380, 1.2400, 1.2438, 1.2504, 1.2533, 1.2556, 1.2600 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2438 |

| Take Profit | 1.2350, 1.2334 |

| Stop Loss | 1.2480 |

| Key Levels | 1.2334, 1.2380, 1.2400, 1.2438, 1.2504, 1.2533, 1.2556, 1.2600 |

Current trend

The pound showed quite active growth against the US dollar on July 24, recovering from a three-day decline. The reason for the emergence of positive dynamics were hopes for changes in the situation around Brexit after the new British Prime Minister Boris Johnson took office. The British currency received additional support from the euro, which is weakening amid disappointing macroeconomic statistics on the business activity ahead of the ECB meeting.

The US data also proved ambiguous. The Markit Manufacturing PMI in July showed a decline from 50.6 to 50.0 points, while the forecast was 51.0 points. The composite PMI in July showed a slight increase from 51.5 to 51.6 points, not reaching forecasts of 52.1 points.

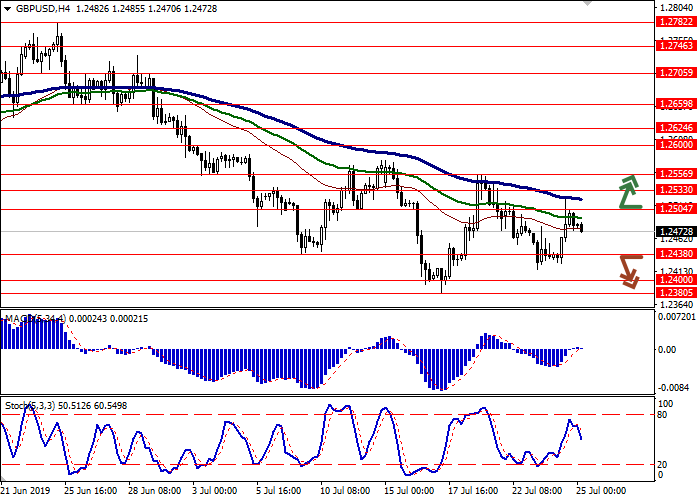

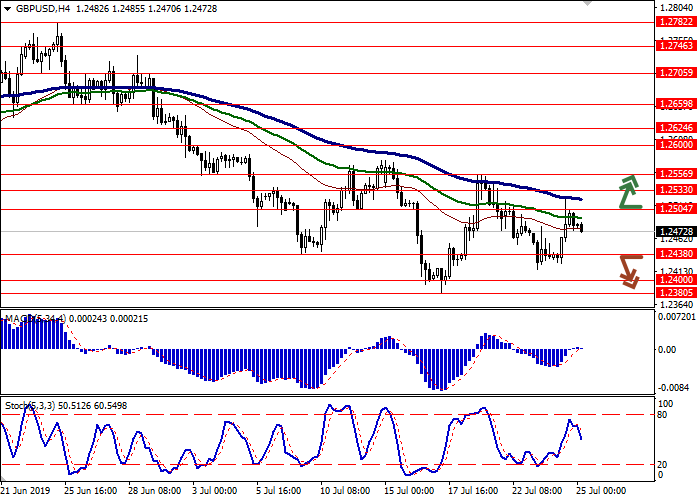

Support and resistance

On the D1 chart, Bollinger Bands are reversing horizontally. The price range is trying to fix, remaining rather spacious, given the current level of activity in the market. MACD indicator is growing preserving a weak buy signal (histogram is above the signal line). Stochastic, being approximately in the center of its working area, maintains a downward direction, reacting poorly to the restoration of "bullish" activity in the market.

To open new transactions, one should wait for clarification.

Resistance levels: 1.2504, 1.2533, 1.2556, 1.2600.

Support levels: 1.2438, 1.2400, 1.2380, 1.2334.

Trading tips

To open long positions, one can rely on the breakout of 1.2504. Take profit – 1.2600 or 1.2624. Stop loss – 1.2460.

A confident breakdown of 1.2438 may serve as a signal to start sales with the target at 1.2350–1.2334. Stop loss – 1.2480.

Implementation period: 2-3 days.

The pound showed quite active growth against the US dollar on July 24, recovering from a three-day decline. The reason for the emergence of positive dynamics were hopes for changes in the situation around Brexit after the new British Prime Minister Boris Johnson took office. The British currency received additional support from the euro, which is weakening amid disappointing macroeconomic statistics on the business activity ahead of the ECB meeting.

The US data also proved ambiguous. The Markit Manufacturing PMI in July showed a decline from 50.6 to 50.0 points, while the forecast was 51.0 points. The composite PMI in July showed a slight increase from 51.5 to 51.6 points, not reaching forecasts of 52.1 points.

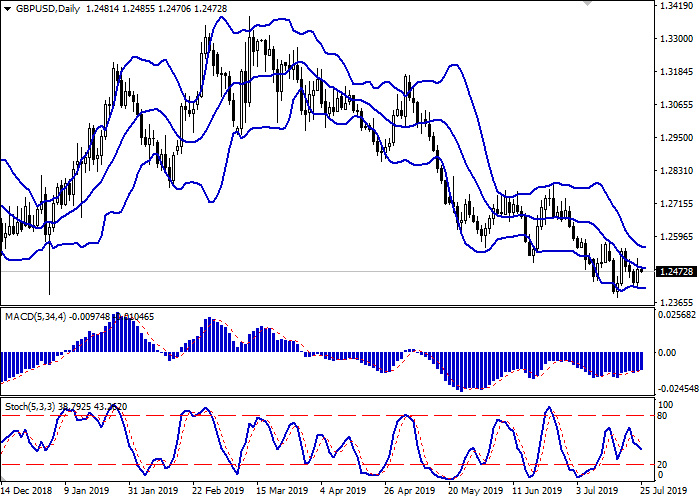

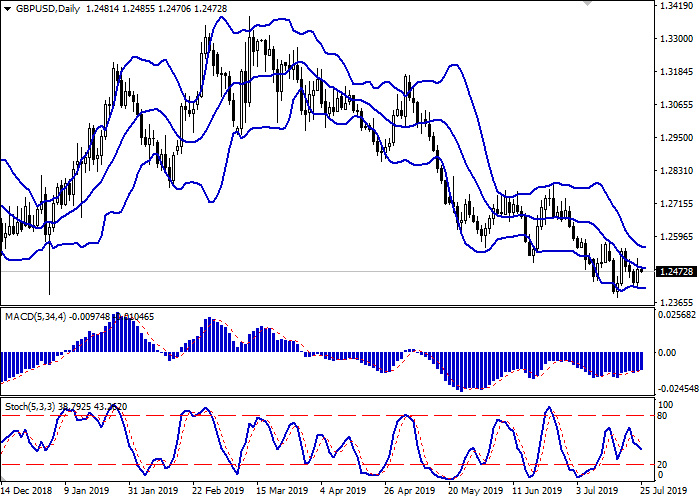

Support and resistance

On the D1 chart, Bollinger Bands are reversing horizontally. The price range is trying to fix, remaining rather spacious, given the current level of activity in the market. MACD indicator is growing preserving a weak buy signal (histogram is above the signal line). Stochastic, being approximately in the center of its working area, maintains a downward direction, reacting poorly to the restoration of "bullish" activity in the market.

To open new transactions, one should wait for clarification.

Resistance levels: 1.2504, 1.2533, 1.2556, 1.2600.

Support levels: 1.2438, 1.2400, 1.2380, 1.2334.

Trading tips

To open long positions, one can rely on the breakout of 1.2504. Take profit – 1.2600 or 1.2624. Stop loss – 1.2460.

A confident breakdown of 1.2438 may serve as a signal to start sales with the target at 1.2350–1.2334. Stop loss – 1.2480.

Implementation period: 2-3 days.

No comments:

Write comments