EUR/USD: the euro is trading in both directions

04 July 2019, 09:48

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1305 |

| Take Profit | 1.1370, 1.1400, 1.1410 |

| Stop Loss | 1.1250 |

| Key Levels | 1.0700, 1.0735, 1.0765, 1.0800, 1.0855, 1.0900, 1.1035 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1260 |

| Take Profit | 1.1198, 1.1180 |

| Stop Loss | 1.1300 |

| Key Levels | 1.0700, 1.0735, 1.0765, 1.0800, 1.0855, 1.0900, 1.1035 |

Current trend

EUR showed ambiguous dynamics against USD on Wednesday, updating local highs of June 20. The support came from good macroeconomic statistics. The Markit Services PMI in June rose from 52.9 to 53.6 points, while the forecast was for growth to 53.4 points. The Composite Manufacturing PMI for the same period strengthened from 51.8 to 52.2 points (forecast 52.1 points). Another supporting factor remains the likelihood of lowering interest rates by the Fed at the July meeting. In addition, US President Donald Trump continues to exert strong pressure on the regulator, openly calling for the devaluation of the dollar.

Today, EUR is correcting. Investors are focused on a block of European statistics on retail sales for May, as well as a speech by ECB representative Philip Lane and ECB Vice President Luis de Guindos.

Support and resistance

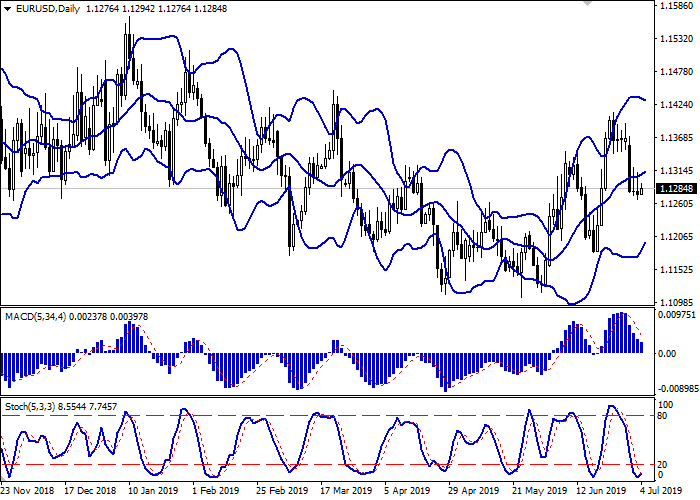

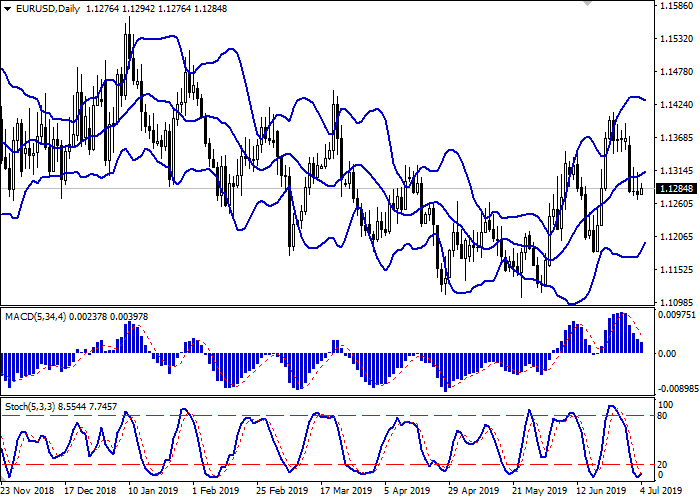

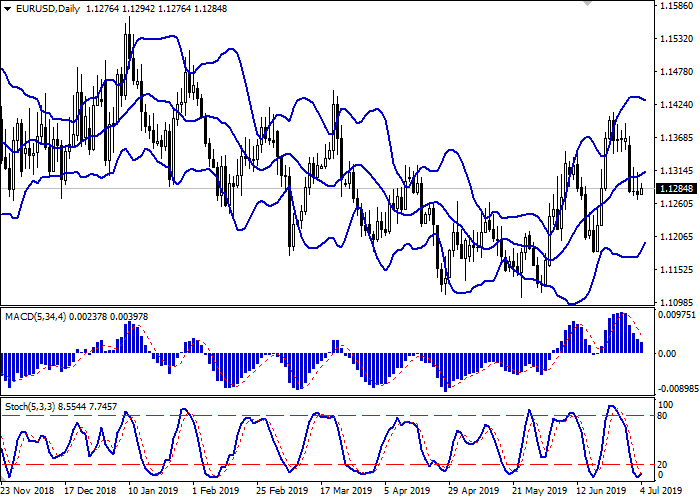

Bollinger Bands in D1 chart show moderate growth. The price range is aggressively narrowing, reflecting the mixed dynamics of trading in the short term. MACD is going down preserving a stable sell signal (being located under the signal line). Stochastic, approaching its minimum levels, tends to reverse upwards, signaling the growing risks of oversold euro in the ultra-short term.

One should wait for the clarification of the situation and of the prospects for the correctional growth of EUR at the end of the week.

Resistance levels: 1.0855, 1.0900, 1.1035.

Support levels: 1.0800, 1.0765, 1.0735, 1.0700.

Trading tips

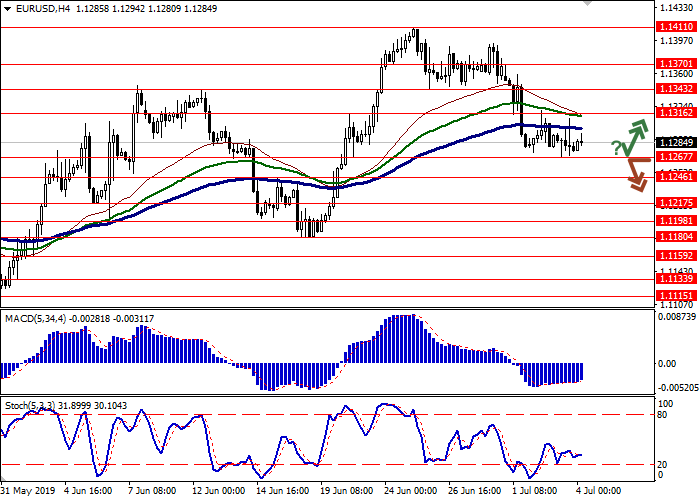

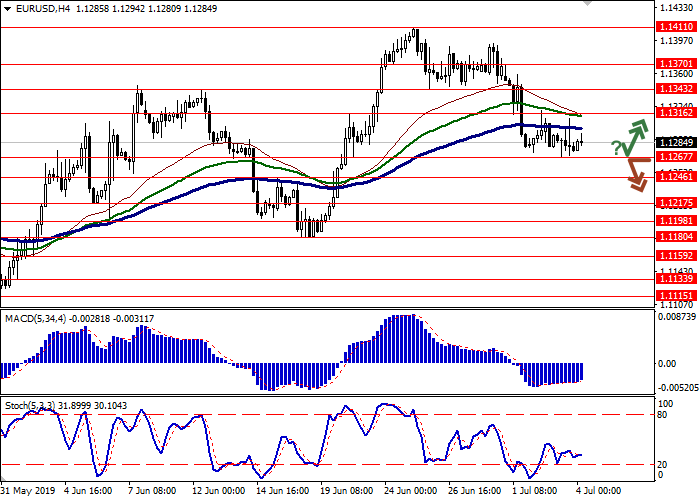

Long positions may be opened if the price moves away from 1.1267, as from support, followed by the breakout of 1.1300. Take profit – 1.1370 or 1.1400–1.1410. Stop loss – 1.1250.

A confident breakdown of 1.1267 may serve as a signal to further sales with the target at 1.1198 or 1.1180. Stop loss – 1.1300.

Implementation period: 2-3 days.

EUR showed ambiguous dynamics against USD on Wednesday, updating local highs of June 20. The support came from good macroeconomic statistics. The Markit Services PMI in June rose from 52.9 to 53.6 points, while the forecast was for growth to 53.4 points. The Composite Manufacturing PMI for the same period strengthened from 51.8 to 52.2 points (forecast 52.1 points). Another supporting factor remains the likelihood of lowering interest rates by the Fed at the July meeting. In addition, US President Donald Trump continues to exert strong pressure on the regulator, openly calling for the devaluation of the dollar.

Today, EUR is correcting. Investors are focused on a block of European statistics on retail sales for May, as well as a speech by ECB representative Philip Lane and ECB Vice President Luis de Guindos.

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range is aggressively narrowing, reflecting the mixed dynamics of trading in the short term. MACD is going down preserving a stable sell signal (being located under the signal line). Stochastic, approaching its minimum levels, tends to reverse upwards, signaling the growing risks of oversold euro in the ultra-short term.

One should wait for the clarification of the situation and of the prospects for the correctional growth of EUR at the end of the week.

Resistance levels: 1.0855, 1.0900, 1.1035.

Support levels: 1.0800, 1.0765, 1.0735, 1.0700.

Trading tips

Long positions may be opened if the price moves away from 1.1267, as from support, followed by the breakout of 1.1300. Take profit – 1.1370 or 1.1400–1.1410. Stop loss – 1.1250.

A confident breakdown of 1.1267 may serve as a signal to further sales with the target at 1.1198 or 1.1180. Stop loss – 1.1300.

Implementation period: 2-3 days.

No comments:

Write comments