Brent Crude Oil: oil prices are consolidating

23 July 2019, 09:38

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 64.05 |

| Take Profit | 65.98, 66.68 |

| Stop Loss | 63.20 |

| Key Levels | 60.64, 61.51, 62.67, 64.00, 64.73, 65.24, 65.98 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 62.60 |

| Take Profit | 60.64, 60.00 |

| Stop Loss | 63.40, 63.50 |

| Key Levels | 60.64, 61.51, 62.67, 64.00, 64.73, 65.24, 65.98 |

Current trend

Oil prices showed ambiguous dynamics on July 22, closing with almost zero results. Quotes are still supported by growing tensions in the Persian Gulf. Last week, investors reacted violently to the seizure of a British tanker by Iran in response to similar actions by Britain in early July. In turn, the pressure on prices is exerted by a further decline in demand for petroleum products amid a slowdown in global economic growth.

Today, in addition to the publication of macroeconomic statistics from the United States, the API report on oil reserves for the week of July 19 is expected. The previous report reflected a decline in stocks by 1,401 million barrels.

Support and resistance

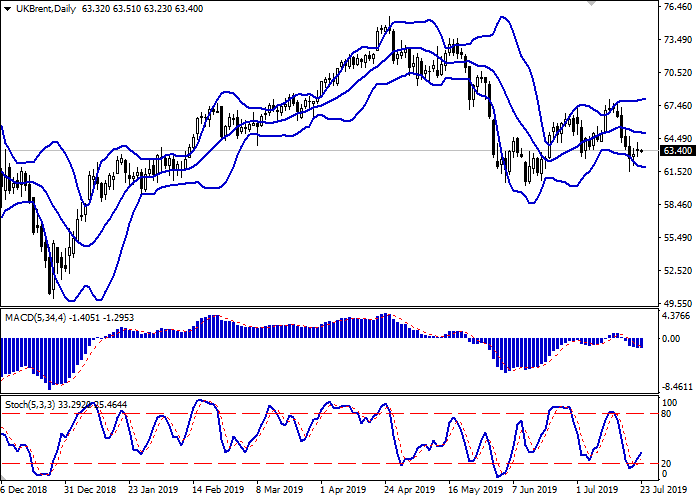

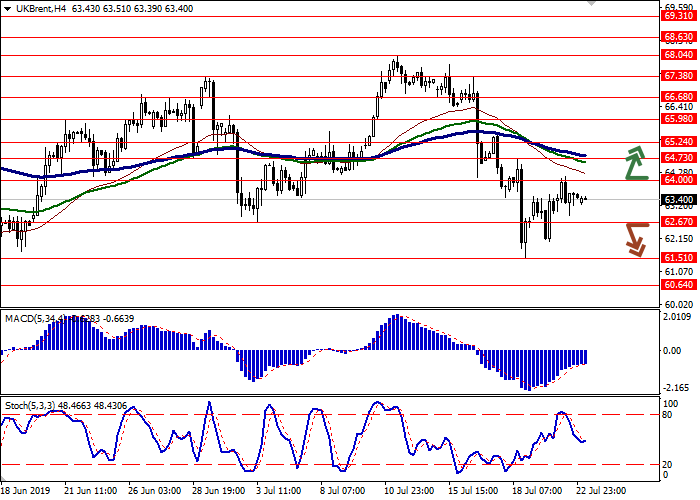

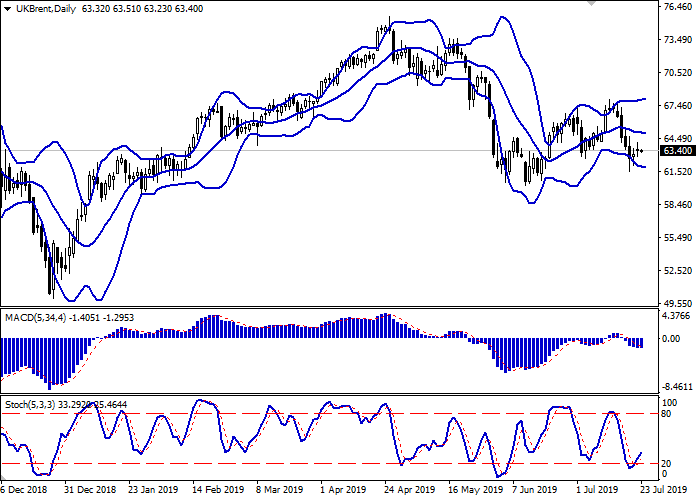

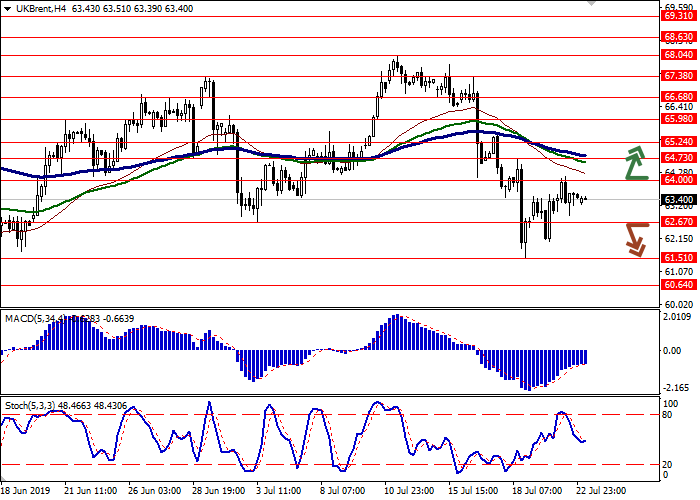

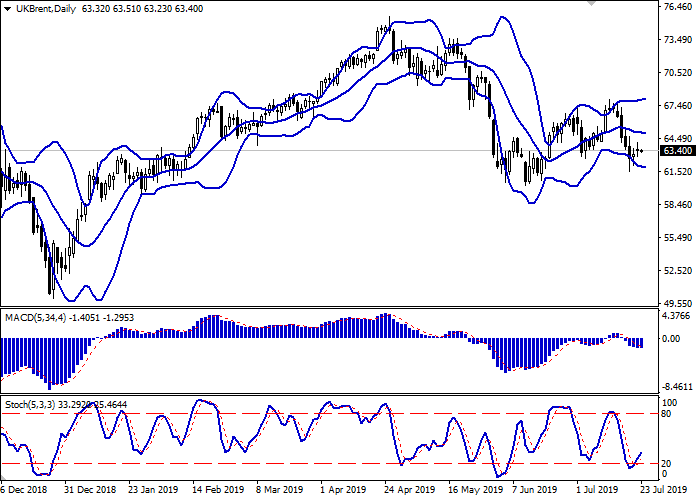

Bollinger Bands in D1 chart demonstrate a gradual decrease. The price range is expanding, remaining rather spacious, given the current level of activity in the market. MACD is going down preserving a weak sell signal (being located under the signal line). Stochastic, showing a reverse near its minima, retains a moderate upward direction, indicating the development of corrective growth of the instrument.

There's a possibility of a "bullish" dynamics in the short and/or ultra-short term.

Resistance levels: 64.00, 64.73, 65.24, 65.98.

Support levels: 62.67, 61.51, 60.64.

Trading tips

To open long positions, one can rely on the breakout of 64.00. Take profit – 65.98 or 66.68. Stop loss – 63.20.

A confident breakdown of 62.67 may serve as a signal for sales with the target at 60.64 or 60.00. Stop loss – 63.40–63.50.

Implementation period: 2-3 days.

Oil prices showed ambiguous dynamics on July 22, closing with almost zero results. Quotes are still supported by growing tensions in the Persian Gulf. Last week, investors reacted violently to the seizure of a British tanker by Iran in response to similar actions by Britain in early July. In turn, the pressure on prices is exerted by a further decline in demand for petroleum products amid a slowdown in global economic growth.

Today, in addition to the publication of macroeconomic statistics from the United States, the API report on oil reserves for the week of July 19 is expected. The previous report reflected a decline in stocks by 1,401 million barrels.

Support and resistance

Bollinger Bands in D1 chart demonstrate a gradual decrease. The price range is expanding, remaining rather spacious, given the current level of activity in the market. MACD is going down preserving a weak sell signal (being located under the signal line). Stochastic, showing a reverse near its minima, retains a moderate upward direction, indicating the development of corrective growth of the instrument.

There's a possibility of a "bullish" dynamics in the short and/or ultra-short term.

Resistance levels: 64.00, 64.73, 65.24, 65.98.

Support levels: 62.67, 61.51, 60.64.

Trading tips

To open long positions, one can rely on the breakout of 64.00. Take profit – 65.98 or 66.68. Stop loss – 63.20.

A confident breakdown of 62.67 may serve as a signal for sales with the target at 60.64 or 60.00. Stop loss – 63.40–63.50.

Implementation period: 2-3 days.

No comments:

Write comments