XAG/USD: silver prices are rising

25 June 2019, 09:29

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 15.55 |

| Take Profit | 15.75 |

| Stop Loss | 15.45 |

| Key Levels | 15.00, 15.12, 15.24, 15.31, 15.40, 15.52, 15.60, 15.75 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 15.38 |

| Take Profit | 15.12, 15.00 |

| Stop Loss | 15.52 |

| Key Levels | 15.00, 15.12, 15.24, 15.31, 15.40, 15.52, 15.60, 15.75 |

Current trend

Yesterday, silver prices rose moderately, recovering from a correction at the end of the last trading week. The instrument is supported by poor positions of USD, as well as growing anxious market sentiment, which contributes to the purchase of safer assets. Investors focus on US conflicts with Iran and China. Traders have high hopes for the meeting of Donald Trump and Xi Jinping at the G20 summit sites, which will be held in Japan at the end of this week.

Additional support for quotes provides "dovish" rhetoric of the Fed. The regulator has recently said a lot about the need to support the national economy, which also correlates with criticism of Donald Trump, who accuses the Fed of excessive overvaluation of the dollar.

Support and resistance

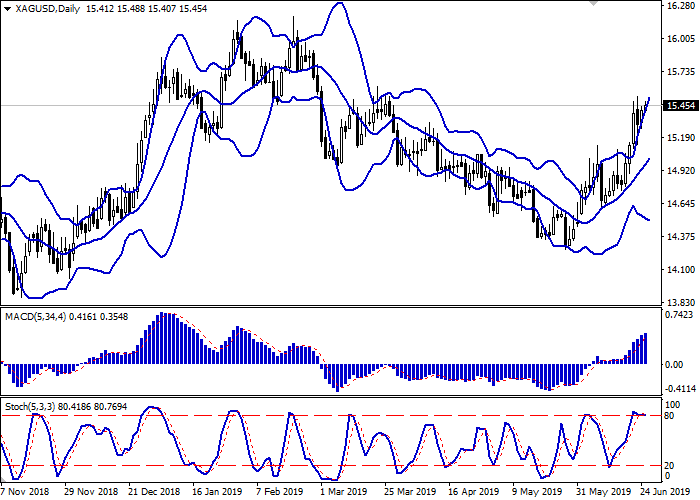

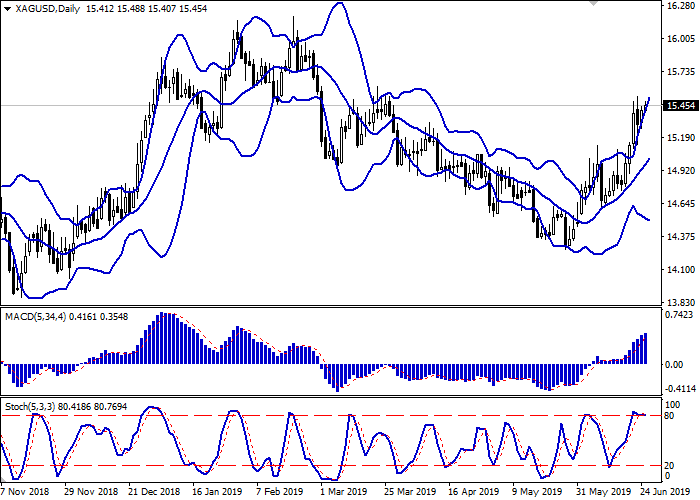

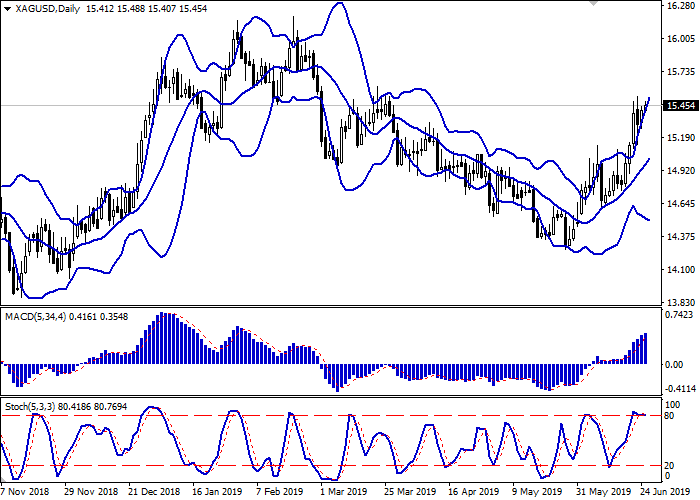

Bollinger bands are actively growing on the daily chart. The price range is actively expanding but not as fast as the “bullish” moods develop. The MACD indicator is growing, keeping a strong buy signal (the histogram is above the signal line). Stochastic, reaching 80, reversed into a horizontal plane, reflecting the approximate balance of forces in the super short term.

It is better to wait for the clarification of the situation until open new trading positions.

Resistance levels: 15.52, 15.60, 15.75.

Support levels: 15.40, 15.31, 15.24, 15.12, 15.00.

Trading tips

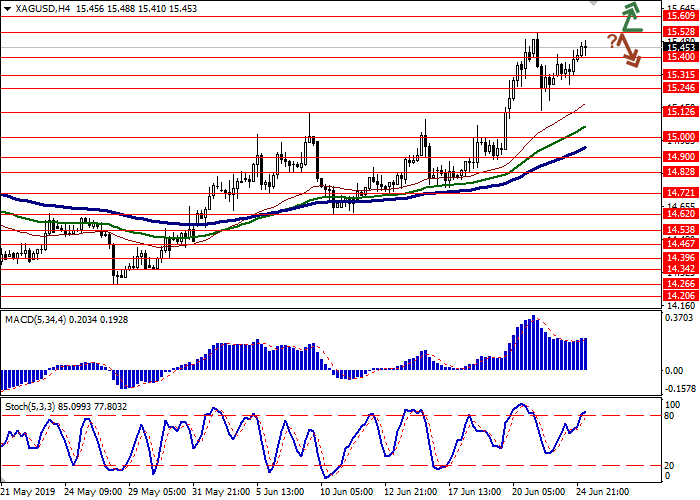

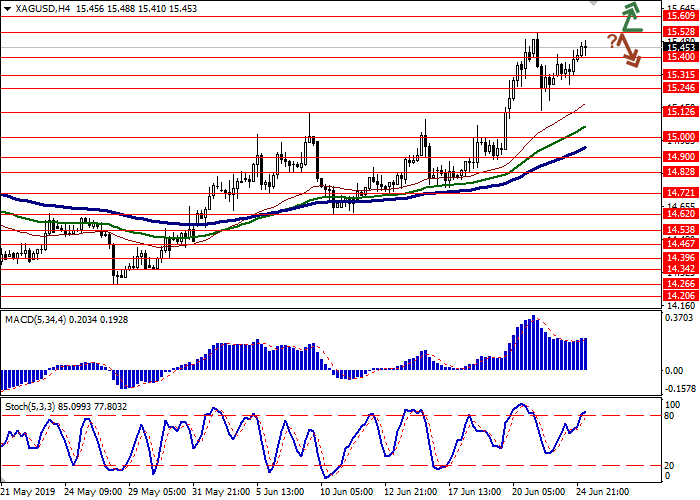

Long positions can be opened after the breakout of the level of 15.52 with the target at 15.75. Stop loss is 15.45. Implementation period: 1–2 days.

Short positions can be opened after the rebound from the level of 15.52 and the breakdown of the level of 15.40 with the target at 15.12 or 15.00. Stop loss is 15.52. Implementation period: 2–3 days.

Yesterday, silver prices rose moderately, recovering from a correction at the end of the last trading week. The instrument is supported by poor positions of USD, as well as growing anxious market sentiment, which contributes to the purchase of safer assets. Investors focus on US conflicts with Iran and China. Traders have high hopes for the meeting of Donald Trump and Xi Jinping at the G20 summit sites, which will be held in Japan at the end of this week.

Additional support for quotes provides "dovish" rhetoric of the Fed. The regulator has recently said a lot about the need to support the national economy, which also correlates with criticism of Donald Trump, who accuses the Fed of excessive overvaluation of the dollar.

Support and resistance

Bollinger bands are actively growing on the daily chart. The price range is actively expanding but not as fast as the “bullish” moods develop. The MACD indicator is growing, keeping a strong buy signal (the histogram is above the signal line). Stochastic, reaching 80, reversed into a horizontal plane, reflecting the approximate balance of forces in the super short term.

It is better to wait for the clarification of the situation until open new trading positions.

Resistance levels: 15.52, 15.60, 15.75.

Support levels: 15.40, 15.31, 15.24, 15.12, 15.00.

Trading tips

Long positions can be opened after the breakout of the level of 15.52 with the target at 15.75. Stop loss is 15.45. Implementation period: 1–2 days.

Short positions can be opened after the rebound from the level of 15.52 and the breakdown of the level of 15.40 with the target at 15.12 or 15.00. Stop loss is 15.52. Implementation period: 2–3 days.

No comments:

Write comments