USD/JPY: the trend is about to change

03 June 2019, 15:19

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 108.35 |

| Take Profit | 110.00, 110.65 |

| Stop Loss | 107.80 |

| Key Levels | 104.70, 105.45, 106.75, 107.50, 108.05, 108.40, 109.00, 109.60, 110.00, 110.65, 111.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 107.50, 106.75 |

| Take Profit | 110.00, 110.65 |

| Stop Loss | 106.40 |

| Key Levels | 104.70, 105.45, 106.75, 107.50, 108.05, 108.40, 109.00, 109.60, 110.00, 110.65, 111.00 |

Current trend

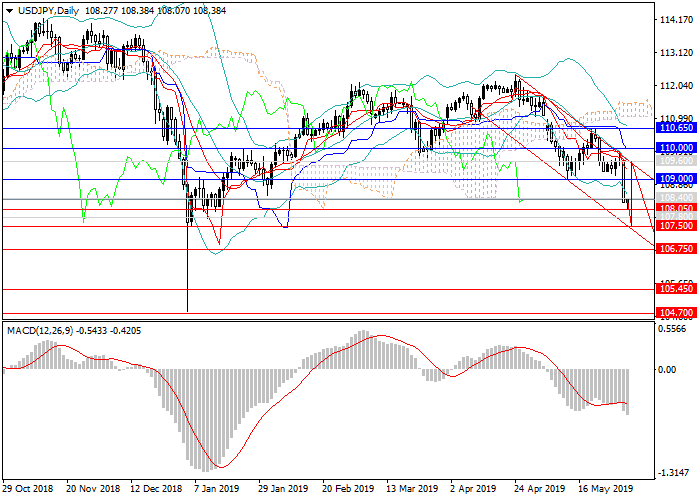

The US dollar against the Japanese yen continues to move within the downward range.

At the end of May, the pair again reached the upper border of the channel at 109.60, but, having failed to break out of this level, went down sharply, having passed more than 150 points in a couple of days, and tested the new local minimum of 108.05. The last few weeks there has been a high demand for the yen, and it is growing now (against the US dollar, too), despite favorable statistics on the growth rate of the US economy in Q1 and negative releases from Japan at the end of last week.

At the end of the week, the main publications are scheduled, namely, data on the US labor market, in particular, on Nonfarm Payrolls.

Support and resistance

The impulse has noticeably weakened, but the pair can still fall to the levels of 107.50, 106.75. Later, one should consider the possibility of the lateral trend with the subsequent change of direction. Most likely, the US dollar will continue to strengthen rapidly, so soon the instrument may reach the levels of 110.00, 110.65.

Technically, the pair continues to be within the descending channel, and the indicators continue to give a sell signal: MACD indicates the growth of the volume of short positions, and Bollinger Bands are pointing downwards.

Support levels: 108.40, 108.05, 107.50, 106.75, 105.45, 104.70.

Resistance levels: 109.00, 109.60, 110.00, 110.65, 111.00.

Trading tips

Long positions may be opened from the current level; deferred long positions may be opened from 107.50, 106.75 with targets at 110.00, 110.65 and stop loss at 106.40.

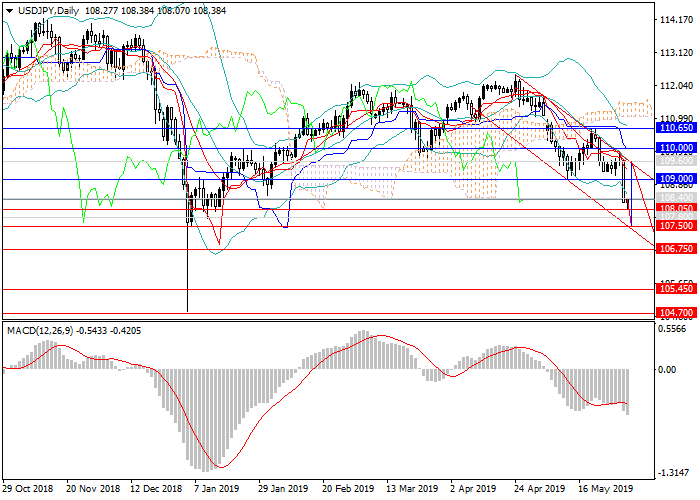

The US dollar against the Japanese yen continues to move within the downward range.

At the end of May, the pair again reached the upper border of the channel at 109.60, but, having failed to break out of this level, went down sharply, having passed more than 150 points in a couple of days, and tested the new local minimum of 108.05. The last few weeks there has been a high demand for the yen, and it is growing now (against the US dollar, too), despite favorable statistics on the growth rate of the US economy in Q1 and negative releases from Japan at the end of last week.

At the end of the week, the main publications are scheduled, namely, data on the US labor market, in particular, on Nonfarm Payrolls.

Support and resistance

The impulse has noticeably weakened, but the pair can still fall to the levels of 107.50, 106.75. Later, one should consider the possibility of the lateral trend with the subsequent change of direction. Most likely, the US dollar will continue to strengthen rapidly, so soon the instrument may reach the levels of 110.00, 110.65.

Technically, the pair continues to be within the descending channel, and the indicators continue to give a sell signal: MACD indicates the growth of the volume of short positions, and Bollinger Bands are pointing downwards.

Support levels: 108.40, 108.05, 107.50, 106.75, 105.45, 104.70.

Resistance levels: 109.00, 109.60, 110.00, 110.65, 111.00.

Trading tips

Long positions may be opened from the current level; deferred long positions may be opened from 107.50, 106.75 with targets at 110.00, 110.65 and stop loss at 106.40.

No comments:

Write comments