USD/CAD: general analysis

03 June 2019, 13:47

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 1.3498 |

| Take Profit | 1.3395 |

| Stop Loss | 1.3530 |

| Key Levels | 1.3296, 1.3358, 1.3397, 1.3452, 1.3500, 1.3550, 1.3595, 1.3655 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3555 |

| Take Profit | 1.3640 |

| Stop Loss | 1.3510 |

| Key Levels | 1.3296, 1.3358, 1.3397, 1.3452, 1.3500, 1.3550, 1.3595, 1.3655 |

Current trend

Last Friday, USD declined after the Trump administration announced its intention to impose a 5% duty on Mexican goods on 10 June. New tariffs will have a negative impact on both the Mexican economy and large American companies that have placed their production in Mexico and will hit small businesses and ordinary consumers in the country. The US and China are taking new steps within the trade war. The escalation of the conflict guarantees a slowdown in global economic growth, which will lead to a fall in oil demand and decrease in CAD.

Today at 15:10 and at 19:25 (GMT+2) Fed officials Randal Quarles and James Bullard are scheduled to speak. At 16:00 (GMT+2) in the United States will be published production index from ISM. The market can ignore positive macroeconomic releases from the United States, as the damage to the American economy from the protectionism of Washington is not yet fully appreciated. Tomorrow at 15:55 (GMT+2) Fed Chairman Jerome Powell is expected to speak. At the beginning of this week, comments from representatives of the American regulator will affect the instrument.

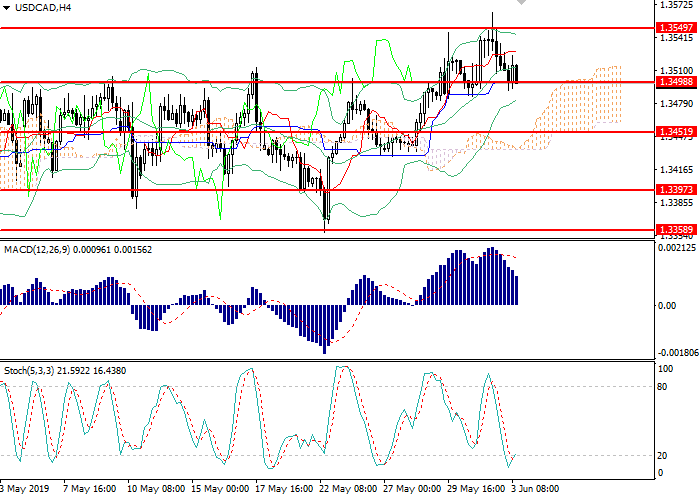

Support and resistance

On the 4-hour chart, the instrument consolidated below the middle moving line of Bollinger bands. The indicator reversed sideways, and the price range has decreased, indicating a continuation of the correction. The MACD is in the positive zone, keeping a poor buy signal. Stochastic leaves the oversold area, generating a strong buy signal.

Resistance levels: 1.3550, 1.3595, 1.3655.

Support levels: 1.3500, 1.3452, 1.3397, 1.3358, 1.3296.

Trading tips

Short positions can be opened from the current level with the target at 1.3395 and stop loss 1.3530.

Long positions can be opened above 1.3550 with the target at 1.3640 and stop loss 1.3510.

Implementation period: 1–3 days.

Last Friday, USD declined after the Trump administration announced its intention to impose a 5% duty on Mexican goods on 10 June. New tariffs will have a negative impact on both the Mexican economy and large American companies that have placed their production in Mexico and will hit small businesses and ordinary consumers in the country. The US and China are taking new steps within the trade war. The escalation of the conflict guarantees a slowdown in global economic growth, which will lead to a fall in oil demand and decrease in CAD.

Today at 15:10 and at 19:25 (GMT+2) Fed officials Randal Quarles and James Bullard are scheduled to speak. At 16:00 (GMT+2) in the United States will be published production index from ISM. The market can ignore positive macroeconomic releases from the United States, as the damage to the American economy from the protectionism of Washington is not yet fully appreciated. Tomorrow at 15:55 (GMT+2) Fed Chairman Jerome Powell is expected to speak. At the beginning of this week, comments from representatives of the American regulator will affect the instrument.

Support and resistance

On the 4-hour chart, the instrument consolidated below the middle moving line of Bollinger bands. The indicator reversed sideways, and the price range has decreased, indicating a continuation of the correction. The MACD is in the positive zone, keeping a poor buy signal. Stochastic leaves the oversold area, generating a strong buy signal.

Resistance levels: 1.3550, 1.3595, 1.3655.

Support levels: 1.3500, 1.3452, 1.3397, 1.3358, 1.3296.

Trading tips

Short positions can be opened from the current level with the target at 1.3395 and stop loss 1.3530.

Long positions can be opened above 1.3550 with the target at 1.3640 and stop loss 1.3510.

Implementation period: 1–3 days.

No comments:

Write comments