USD/CHF: dollar falls

20 June 2019, 10:10

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9920, 0.9925 |

| Take Profit | 1.0000 |

| Stop Loss | 0.9890 |

| Key Levels | 0.9800, 0.9853, 0.9878, 0.9900, 0.9935, 0.9960, 1.0000, 1.0020, 1.0047 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL |

| Entry Point | 0.9895 |

| Take Profit | 0.9853, 0.9820 |

| Stop Loss | 0.9920, 0.9930 |

| Key Levels | 0.9800, 0.9853, 0.9878, 0.9900, 0.9935, 0.9960, 1.0000, 1.0020, 1.0047 |

Current trend

Yesterday, USD fell sharply against CHF, retreating from the highs of the beginning of the month. The reason for the strengthening of corrective moods became quite pessimistic Fed’s commentaries after the meeting on June 19. As expected, the regulator did not change the course of monetary policy but signaled the possibility of such changes in the near future. CHF was supported by the growth in demand for risky assets after reports by Donald Trump about a planned meeting with PRC President Xi Jinping at the G20 summit.

During the Asian session, the instrument keeps a fairly confident upward trend, and investors are waiting for the appearance of new drivers in the market. Today in Switzerland, the data on the dynamics of exports and imports in May will be released. It is predicted that the trade surplus may grow from 2.2 billion to 2.8 billion dollars.

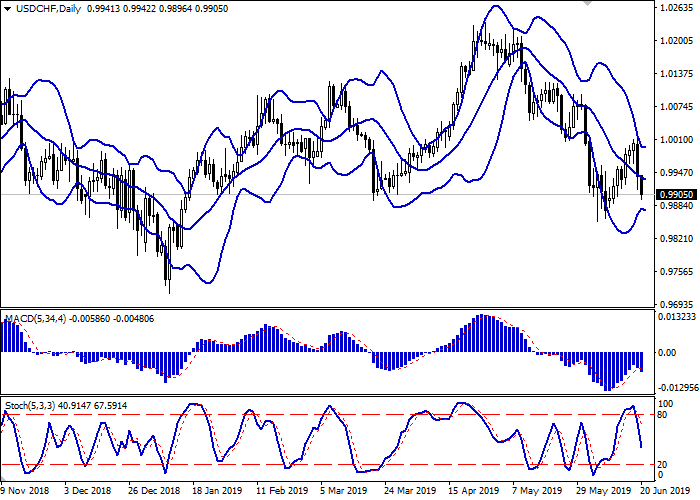

Support and resistance

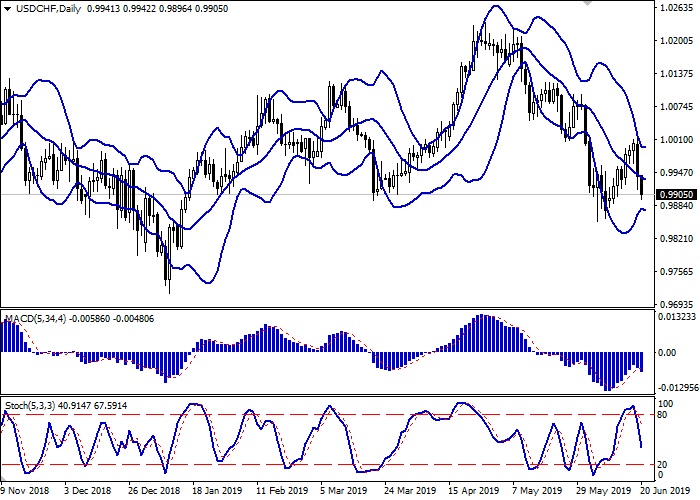

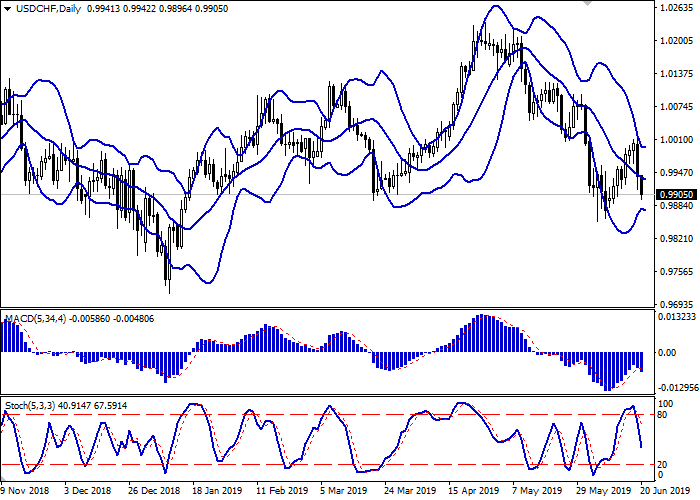

On the daily chart, Bollinger bands steadily decline. The price range tends to expand but not as fast as the “bearish” dynamic develops. The MACD reversed downwards, forming a sell signal (the histogram is below the signal line). Stochastic is directed downward, quickly approaching its lows. It does not contradict the further development of the downward trend in the super-short term.

It is better to open short positions in the short and/or ultra-short term.

Resistance levels: 0.9935, 0.9960, 1.0000, 1.0020, 1.0047.

Support levels: 0.9900, 0.9878, 0.9853, 0.9800.

Trading tips

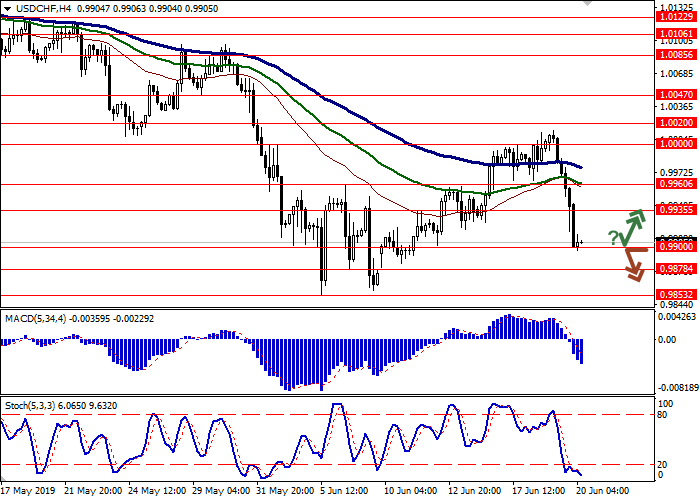

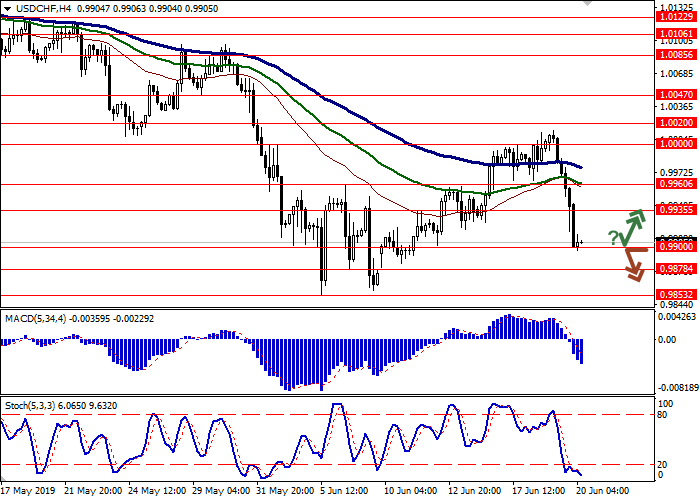

Long positions can be opened after a rebound from 0.9900 and a breakout of 0.9915–0.9920 with the target at 1.0000. Stop loss is 0.9890. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of 0.9900 with the target at 0.9853 or 0.9820. Stop loss is 0.9920–0.9930. Implementation period: 1–2 days.

Yesterday, USD fell sharply against CHF, retreating from the highs of the beginning of the month. The reason for the strengthening of corrective moods became quite pessimistic Fed’s commentaries after the meeting on June 19. As expected, the regulator did not change the course of monetary policy but signaled the possibility of such changes in the near future. CHF was supported by the growth in demand for risky assets after reports by Donald Trump about a planned meeting with PRC President Xi Jinping at the G20 summit.

During the Asian session, the instrument keeps a fairly confident upward trend, and investors are waiting for the appearance of new drivers in the market. Today in Switzerland, the data on the dynamics of exports and imports in May will be released. It is predicted that the trade surplus may grow from 2.2 billion to 2.8 billion dollars.

Support and resistance

On the daily chart, Bollinger bands steadily decline. The price range tends to expand but not as fast as the “bearish” dynamic develops. The MACD reversed downwards, forming a sell signal (the histogram is below the signal line). Stochastic is directed downward, quickly approaching its lows. It does not contradict the further development of the downward trend in the super-short term.

It is better to open short positions in the short and/or ultra-short term.

Resistance levels: 0.9935, 0.9960, 1.0000, 1.0020, 1.0047.

Support levels: 0.9900, 0.9878, 0.9853, 0.9800.

Trading tips

Long positions can be opened after a rebound from 0.9900 and a breakout of 0.9915–0.9920 with the target at 1.0000. Stop loss is 0.9890. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of 0.9900 with the target at 0.9853 or 0.9820. Stop loss is 0.9920–0.9930. Implementation period: 1–2 days.

No comments:

Write comments