NZD/USD: technical analysis

24 June 2019, 10:52

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.6607 |

| Take Profit | 0.6660 |

| Stop Loss | 0.6580 |

| Key Levels | 0.6480, 0.6486, 0.6508, 0.6539, 0.6555, 0.6568, 0.6587, 0.6614, 0.6628, 0.6665, 0.6681 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6550 |

| Take Profit | 0.6500 |

| Stop Loss | 0.6580 |

| Key Levels | 0.6480, 0.6486, 0.6508, 0.6539, 0.6555, 0.6568, 0.6587, 0.6614, 0.6628, 0.6665, 0.6681 |

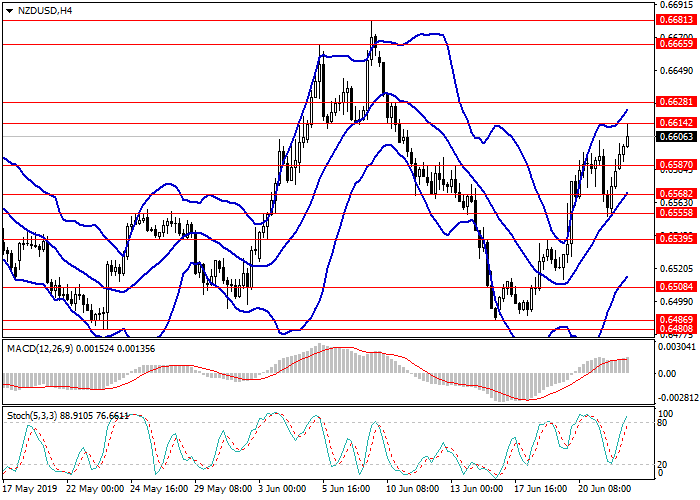

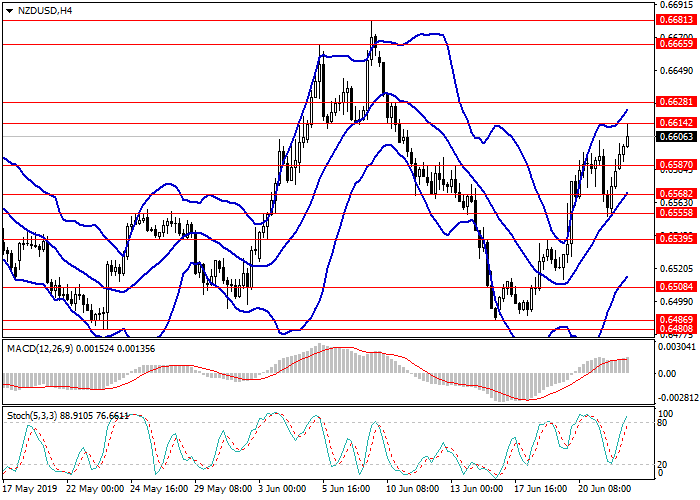

NZD/USD, H4

On the H4 chart, the instrument returned to growth after a short-term downward correction; the pair is trading near the upper border of Bollinger Bands, the indicator cloud has expanded. MACD histogram is in the positive area keeping a signal for the opening of long positions. Stochastic crosses the overbought zone from below, keeping the buy signal.

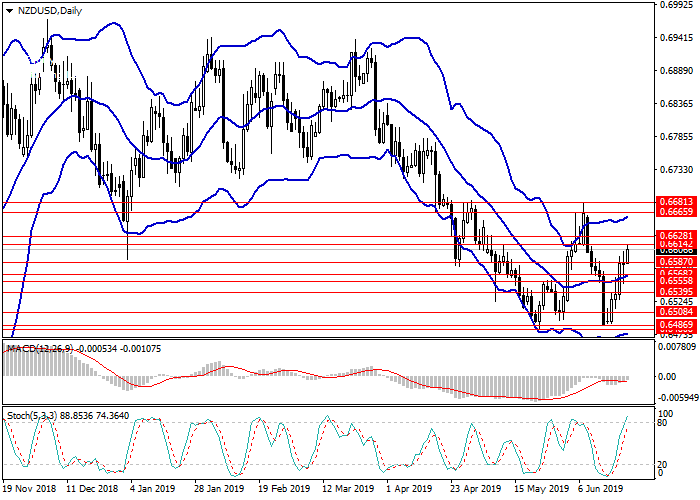

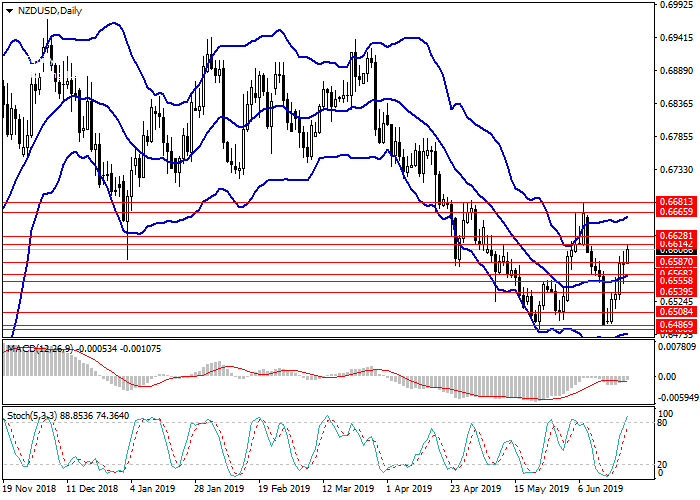

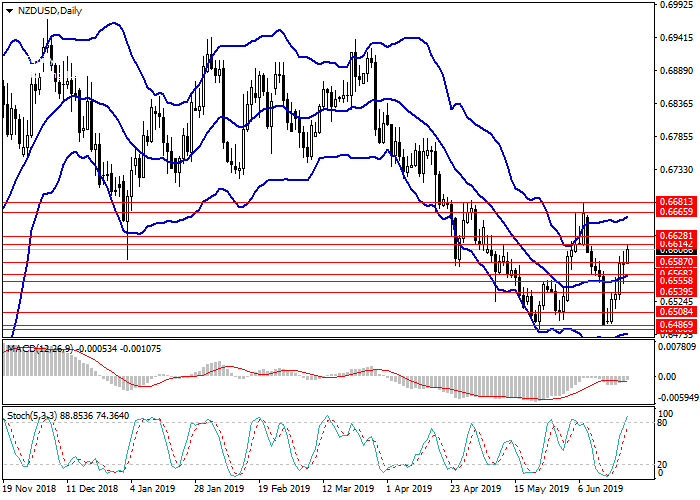

NZD/USD, D1

On the D1 chart, a lateral trend is forming; the instrument is trading within the corridor formed by the borders of Bollinger Bands. MACD histogram is in the negative zone, and its volume is minimal, the signal line is directed horizontally. Stochastic is preparing to cross the overbought zone from below, the signal to open long positions is still relevant.

Key levels

Support levels: 0.6587, 0.6568, 0.6555, 0.6539, 0.6508, 0.6486, 0.6480.

Resistance levels: 0.6614, 0.6628, 0.6665, 0.6681.

Trading tips

According to technical indicators, long positions could be opened from the current level with the target at 0.6660 and stop loss at 0.6580.

Short positions may be opened from the level of 0.6550 with the target at 0.6500 and stop loss at 0.6580.

Implementation period: 1-3 days.

On the H4 chart, the instrument returned to growth after a short-term downward correction; the pair is trading near the upper border of Bollinger Bands, the indicator cloud has expanded. MACD histogram is in the positive area keeping a signal for the opening of long positions. Stochastic crosses the overbought zone from below, keeping the buy signal.

NZD/USD, D1

On the D1 chart, a lateral trend is forming; the instrument is trading within the corridor formed by the borders of Bollinger Bands. MACD histogram is in the negative zone, and its volume is minimal, the signal line is directed horizontally. Stochastic is preparing to cross the overbought zone from below, the signal to open long positions is still relevant.

Key levels

Support levels: 0.6587, 0.6568, 0.6555, 0.6539, 0.6508, 0.6486, 0.6480.

Resistance levels: 0.6614, 0.6628, 0.6665, 0.6681.

Trading tips

According to technical indicators, long positions could be opened from the current level with the target at 0.6660 and stop loss at 0.6580.

Short positions may be opened from the level of 0.6550 with the target at 0.6500 and stop loss at 0.6580.

Implementation period: 1-3 days.

No comments:

Write comments