NZD/USD: the New Zealand dollar is growing

05 June 2019, 10:22

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6650 |

| Take Profit | 0.6683, 0.6700 |

| Stop Loss | 0.6620, 0.6615 |

| Key Levels | 0.6546, 0.6562, 0.6581, 0.6613, 0.6645, 0.6664, 0.6683 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6615, 0.6610 |

| Take Profit | 0.6562, 0.6546 |

| Stop Loss | 0.6650 |

| Key Levels | 0.6546, 0.6562, 0.6581, 0.6613, 0.6645, 0.6664, 0.6683 |

Current trend

Yesterday, NZD rose slightly against USD, continuing the development of a powerful “bullish” impulse formed at the beginning of the week. Today, during the Asian session, the instrument is also trading in an upward manner, renewing local highs since May 3. NZD grows against the background of corrective sentiment on the US currency and increased demand for shelter assets due to the aggravation of trade conflicts. However, the macroeconomic background from New Zealand remains ambiguous. The price index for dairy products published the day before dropped sharply by 3.4% MoM in April after falling by 1.2% MoM last month. Analysts expected a decline of 2.8% MoM.

Support and resistance

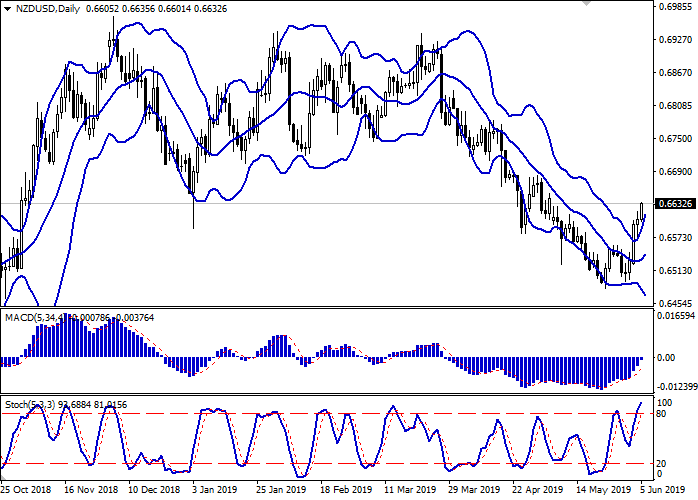

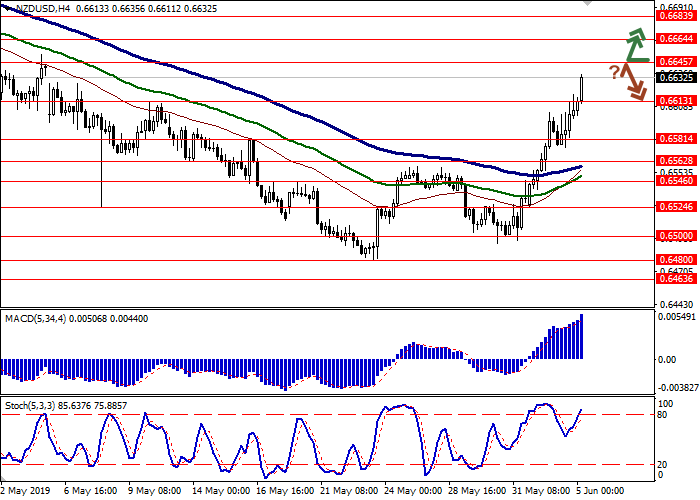

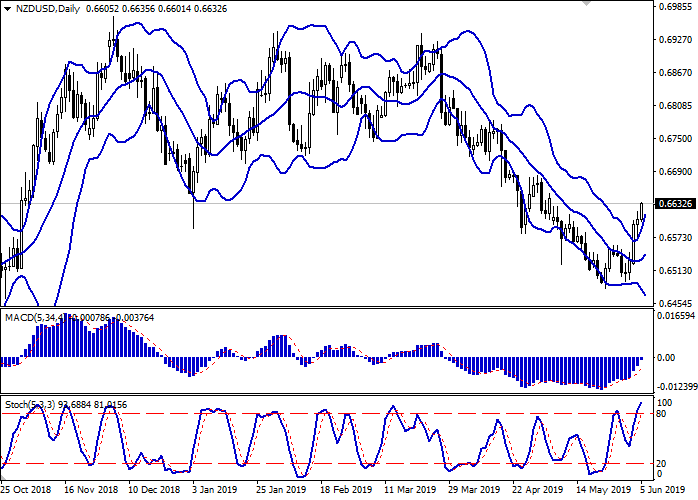

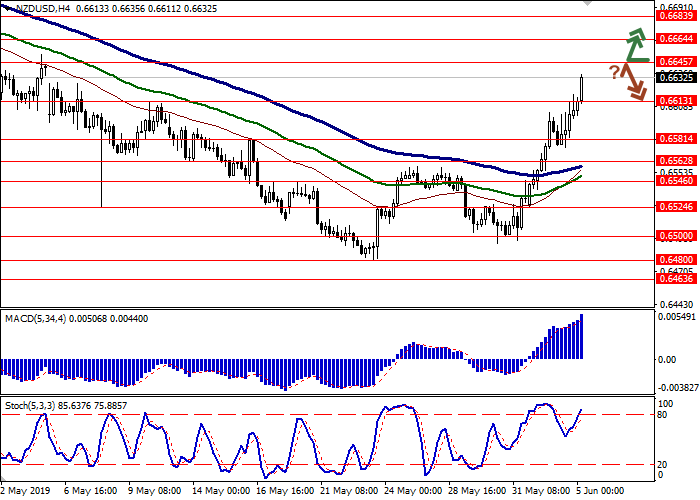

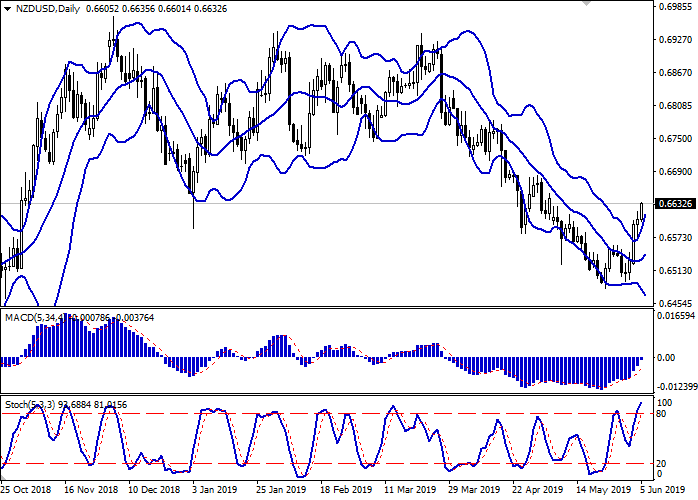

On the daily chart, Bollinger bands are smoothly reversing into an upward plane. The price range is expanding, however, not as fast as the upward trend is developing in the short term. The MACD indicator is growing, keeping a strong buy signal (the histogram is above the signal line), and is preparing to test for a breakout of the zero line. Stochastic keeps upward direction but has already reached its high, signaling that the instrument is overbought in the super-short term.

It is better to keep current positions until the market situation becomes clearer.

Resistance levels: 0.6645, 0.6664, 0.6683.

Support levels: 0.6613, 0.6581, 0.6562, 0.6546.

Trading tips

Long positions can be opened after the breakout of 0.6645 with the target at 0.6683 or 0.6700. Stop loss is 0.6620–0.6615.

Short positions can be opened after a rebound from 0.6645 and breakdown of 0.6620–0.6613 with the targets at 0.6562–0.6546. Stop loss is 0.6650.

Implementation period: 2–3 days.

Yesterday, NZD rose slightly against USD, continuing the development of a powerful “bullish” impulse formed at the beginning of the week. Today, during the Asian session, the instrument is also trading in an upward manner, renewing local highs since May 3. NZD grows against the background of corrective sentiment on the US currency and increased demand for shelter assets due to the aggravation of trade conflicts. However, the macroeconomic background from New Zealand remains ambiguous. The price index for dairy products published the day before dropped sharply by 3.4% MoM in April after falling by 1.2% MoM last month. Analysts expected a decline of 2.8% MoM.

Support and resistance

On the daily chart, Bollinger bands are smoothly reversing into an upward plane. The price range is expanding, however, not as fast as the upward trend is developing in the short term. The MACD indicator is growing, keeping a strong buy signal (the histogram is above the signal line), and is preparing to test for a breakout of the zero line. Stochastic keeps upward direction but has already reached its high, signaling that the instrument is overbought in the super-short term.

It is better to keep current positions until the market situation becomes clearer.

Resistance levels: 0.6645, 0.6664, 0.6683.

Support levels: 0.6613, 0.6581, 0.6562, 0.6546.

Trading tips

Long positions can be opened after the breakout of 0.6645 with the target at 0.6683 or 0.6700. Stop loss is 0.6620–0.6615.

Short positions can be opened after a rebound from 0.6645 and breakdown of 0.6620–0.6613 with the targets at 0.6562–0.6546. Stop loss is 0.6650.

Implementation period: 2–3 days.

No comments:

Write comments