Brent Crude Oil: general review

27 June 2019, 10:08

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 67.60 |

| Take Profit | 73.55 |

| Stop Loss | 66.70 |

| Key Levels | 62.39, 64.26, 67.56, 73.55 |

Current trend

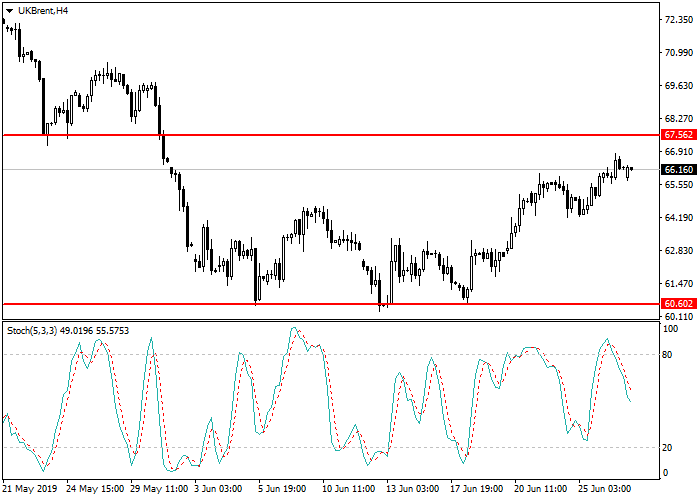

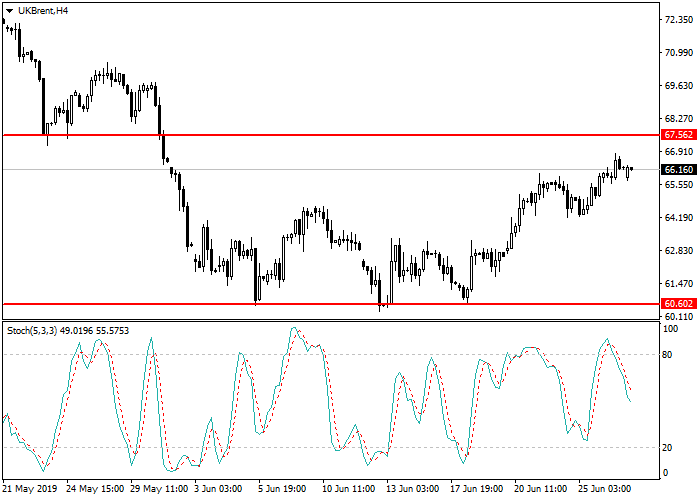

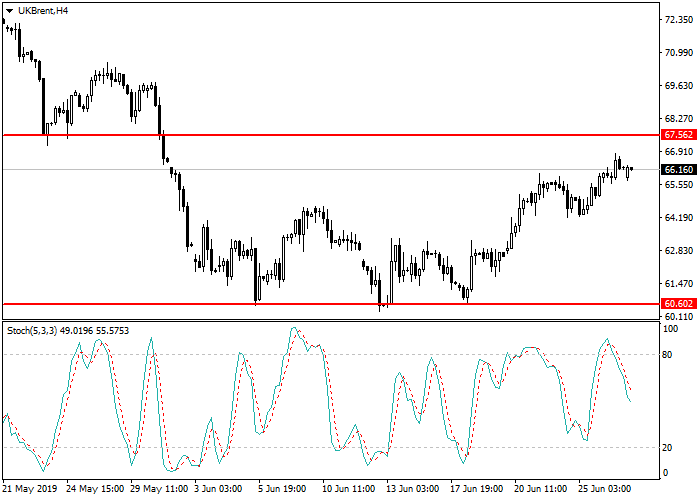

Brent oil is trading near the resistance level of 67.56. If it is broken out, the next target will be 73.55.

Rising energy prices are caused by statistics from the US, where, according to the Department of Energy, commercial oil stocks last week fell by 12.8 million barrels against analysts' forecasts of 2.5 million. Gasoline inventories fell by 0.996 million barrels, and refinery utilization rose to 94.2%. However, this week the G20 summit will take place, where the meeting of the leaders of the USA and China is expected. There is a possibility that the parties will not be able to agree on a trade deal, and this will adversely affect the price of "black gold". Early Donald Trump has already mentioned that if an agreement is not reached, Washington plans to raise trade duties on imports from China in the amount of USD 300 billion, which ultimately will lead to a decrease in trade and deterioration of business relations.

Next week, the OPEC meeting will take place, where the current situation on the market will be discussed and whether the cartel will continue to reduce total production or leave it at the current level.

Support and resistance

Stochastic is at the level of 89 points and indicates the possible correction.

Resistance levels: 67.56, 73.55.

Support levels: 64.26, 62.39.

Trading tips

Long positions may be opened after the breakout of the resistance level of 67.56 with take profit at 73.55 and stop loss at 66.70.

Brent oil is trading near the resistance level of 67.56. If it is broken out, the next target will be 73.55.

Rising energy prices are caused by statistics from the US, where, according to the Department of Energy, commercial oil stocks last week fell by 12.8 million barrels against analysts' forecasts of 2.5 million. Gasoline inventories fell by 0.996 million barrels, and refinery utilization rose to 94.2%. However, this week the G20 summit will take place, where the meeting of the leaders of the USA and China is expected. There is a possibility that the parties will not be able to agree on a trade deal, and this will adversely affect the price of "black gold". Early Donald Trump has already mentioned that if an agreement is not reached, Washington plans to raise trade duties on imports from China in the amount of USD 300 billion, which ultimately will lead to a decrease in trade and deterioration of business relations.

Next week, the OPEC meeting will take place, where the current situation on the market will be discussed and whether the cartel will continue to reduce total production or leave it at the current level.

Support and resistance

Stochastic is at the level of 89 points and indicates the possible correction.

Resistance levels: 67.56, 73.55.

Support levels: 64.26, 62.39.

Trading tips

Long positions may be opened after the breakout of the resistance level of 67.56 with take profit at 73.55 and stop loss at 66.70.

No comments:

Write comments