NZD/USD: technical analysis

28 May 2019, 09:38

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.6556 |

| Take Profit | 0.6670 |

| Stop Loss | 0.6516 |

| Key Levels | 0.6410, 0.6454, 0.6490, 0.6534, 0.6575, 0.6611, 0.6656, 0.6726 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6510 |

| Take Profit | 0.6460 |

| Stop Loss | 0.6542 |

| Key Levels | 0.6410, 0.6454, 0.6490, 0.6534, 0.6575, 0.6611, 0.6656, 0.6726 |

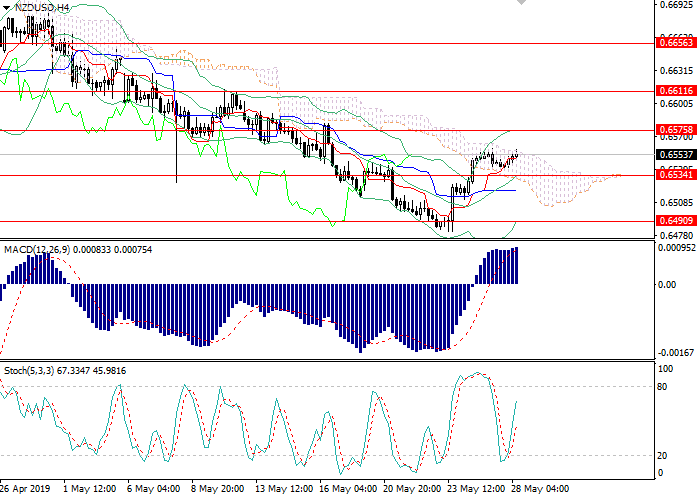

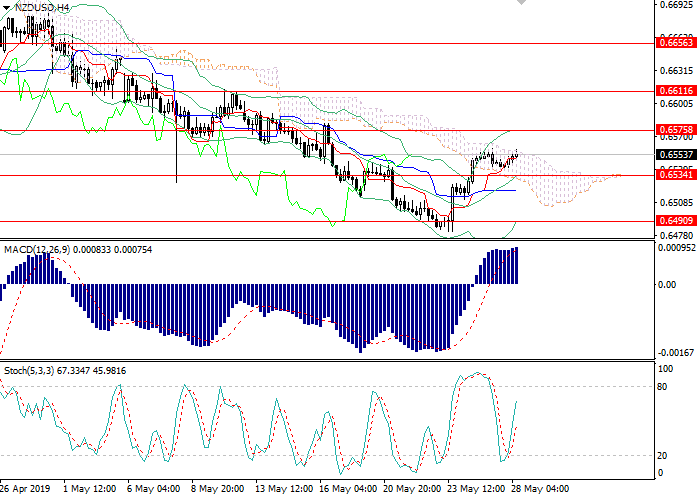

NZD/USD, H4

On the 4-hour chart, the instrument is being corrected at the top of Bollinger bands. The indicator is directed upwards, and the price range has slightly decreased, which indicates the continuation of the correction dynamics. The MACD histogram is in the positive zone, its volumes are growing, keeping the buy signal. Stochastic is approaching the oversold area, a signal to enter the market has not been formed.

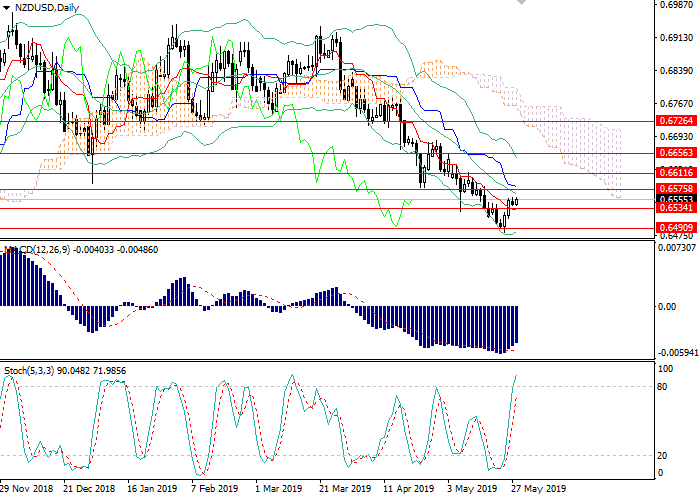

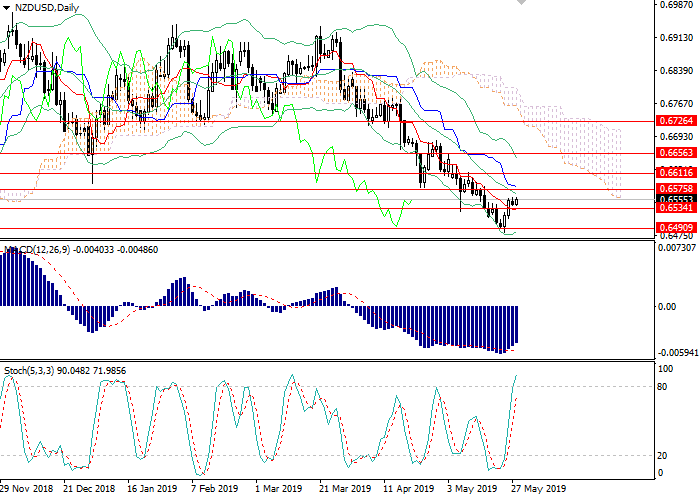

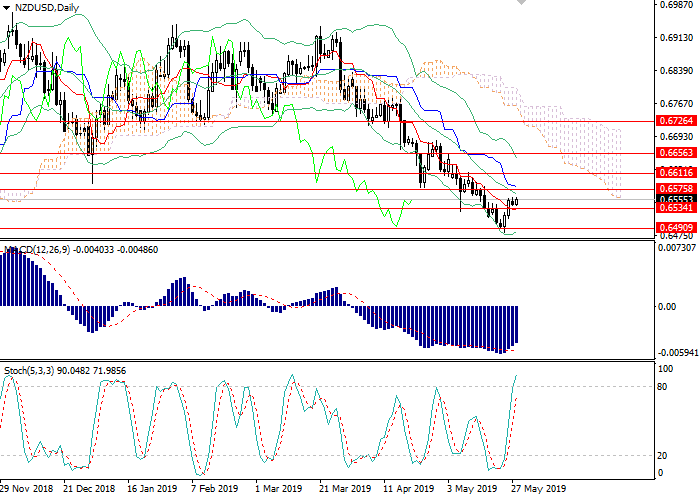

NZD/USD, D1

On the daily chart, the instrument is strengthening at the bottom of Bollinger bands. The indicator is directed downwards, and the price range has decreased, indicating correction of an upward trend. The MACD histogram keeps a strong sell signal. Stochastic entered the overbought area, a strong sell signal can be formed within 1–3 days.

Key levels

Resistance levels: 0.6575, 0.6611, 0.6656, 0.6726.

Support levels: 0.6410, 0.6454, 0.6490, 0.6534.

On the 4-hour chart, the instrument is being corrected at the top of Bollinger bands. The indicator is directed upwards, and the price range has slightly decreased, which indicates the continuation of the correction dynamics. The MACD histogram is in the positive zone, its volumes are growing, keeping the buy signal. Stochastic is approaching the oversold area, a signal to enter the market has not been formed.

On the 4-hour chart, the instrument is being corrected at the top of Bollinger bands. The indicator is directed upwards, and the price range has slightly decreased, which indicates the continuation of the correction dynamics. The MACD histogram is in the positive zone, its volumes are growing, keeping the buy signal. Stochastic is approaching the oversold area, a signal to enter the market has not been formed.

NZD/USD, D1

On the daily chart, the instrument is strengthening at the bottom of Bollinger bands. The indicator is directed downwards, and the price range has decreased, indicating correction of an upward trend. The MACD histogram keeps a strong sell signal. Stochastic entered the overbought area, a strong sell signal can be formed within 1–3 days.

Key levels

Resistance levels: 0.6575, 0.6611, 0.6656, 0.6726.

Support levels: 0.6410, 0.6454, 0.6490, 0.6534.

On the 4-hour chart, the instrument is being corrected at the top of Bollinger bands. The indicator is directed upwards, and the price range has slightly decreased, which indicates the continuation of the correction dynamics. The MACD histogram is in the positive zone, its volumes are growing, keeping the buy signal. Stochastic is approaching the oversold area, a signal to enter the market has not been formed.

No comments:

Write comments