EUR/USD: general review

28 May 2019, 09:38

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 1.1185 |

| Take Profit | 1.1225 |

| Stop Loss | 1.1165 |

| Key Levels | 1.1111, 1.1127, 1.1143, 1.1160, 1.1180, 1.1201, 1.1223, 1.1247, 1.1264 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1160 |

| Take Profit | 1.1110 |

| Stop Loss | 1.1185 |

| Key Levels | 1.1111, 1.1127, 1.1143, 1.1160, 1.1180, 1.1201, 1.1223, 1.1247, 1.1264 |

Current trend

At the end of last week, EUR strengthened against USD amid weak macroeconomic releases from the US. Negative data heightened investor concerns about the growing tensions between the US and China, which threaten the growth of the American economy.

At the same time, EUR is still holding back from falling, despite the fact that the European Commission may in the near future fine Italy by 0.2% of GDP (about EUR 3.5 billion) due to the exceeded level of public debt. At the same time, EUR received moderate support from the results of European Parliament elections, where pro-European parties retained a majority.

Today at 10:00 (GMT+2), statistics on Private Sector Loans in the euro area is expected to be published, and at 11:00 (GMT+2), the results of the Business and Consumer Survey in the euro area will be published. In the afternoon, statistics on House Price Index (15:00 GMT+2) and CB Consumer Confidence in the US (16:00 GMT+2) are scheduled to be released. The recent fall in the stock market may adversely affect the confidence of American consumers, which will help strengthen the pair.

Support and resistance

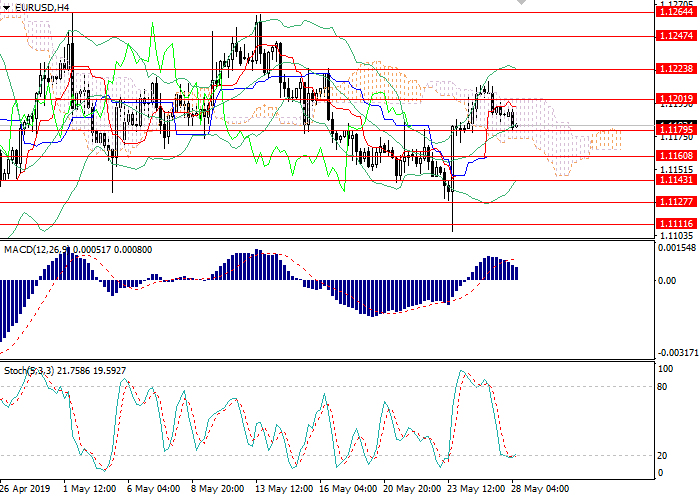

On the H4 chart, the instrument is trading below the center line of Bollinger Bands. The indicator is directed upwards and the price range is reduced, which indicates the change of the downtrend. MACD histogram is in the positive zone keeping a weak buy signal. Stochastic is leaving the oversold zone having formed a buy signal.

Resistance levels: 1.1201, 1.1223, 1.1247, 1.1264.

Support levels: 1.1180, 1.1160, 1.1143, 1.1127, 1.1111.

Trading tips

Long positions may be opened from the current level with target at 1.1225 and stop loss at 1.1165.

Short positions may be opened below 1.1165 with target at 1.1110 and stop loss at 1.1185.

Implementation time: 1-2 days.

At the end of last week, EUR strengthened against USD amid weak macroeconomic releases from the US. Negative data heightened investor concerns about the growing tensions between the US and China, which threaten the growth of the American economy.

At the same time, EUR is still holding back from falling, despite the fact that the European Commission may in the near future fine Italy by 0.2% of GDP (about EUR 3.5 billion) due to the exceeded level of public debt. At the same time, EUR received moderate support from the results of European Parliament elections, where pro-European parties retained a majority.

Today at 10:00 (GMT+2), statistics on Private Sector Loans in the euro area is expected to be published, and at 11:00 (GMT+2), the results of the Business and Consumer Survey in the euro area will be published. In the afternoon, statistics on House Price Index (15:00 GMT+2) and CB Consumer Confidence in the US (16:00 GMT+2) are scheduled to be released. The recent fall in the stock market may adversely affect the confidence of American consumers, which will help strengthen the pair.

Support and resistance

On the H4 chart, the instrument is trading below the center line of Bollinger Bands. The indicator is directed upwards and the price range is reduced, which indicates the change of the downtrend. MACD histogram is in the positive zone keeping a weak buy signal. Stochastic is leaving the oversold zone having formed a buy signal.

Resistance levels: 1.1201, 1.1223, 1.1247, 1.1264.

Support levels: 1.1180, 1.1160, 1.1143, 1.1127, 1.1111.

Trading tips

Long positions may be opened from the current level with target at 1.1225 and stop loss at 1.1165.

Short positions may be opened below 1.1165 with target at 1.1110 and stop loss at 1.1185.

Implementation time: 1-2 days.

No comments:

Write comments