USD/JPY: general review

14 February 2019, 11:04

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 111.00 |

| Take Profit | 112.00 |

| Stop Loss | 110.65 |

| Key Levels | 109.41, 109.60, 109.89, 110.20, 110.32, 110.65, 110.85, 111.12, 111.38, 112.18 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 110.50 |

| Take Profit | 110.00 |

| Stop Loss | 110.80 |

| Key Levels | 109.41, 109.60, 109.89, 110.20, 110.32, 110.65, 110.85, 111.12, 111.38, 112.18 |

Current trend

On Wednesday, the US dollar strengthened against the Japanese yen amid the release of positive inflation data for the US economy.

In January, the consumer price index fell less than expected by the market and amounted to 1.6%. Core CPI remained at 2.2%. The pair continued its growth today amid the publication of negative data on Japan's GDP: in 4Q2018, it grew only by 0.3%, failing to prove the forecast of 0.4%.

In the United States, statistics on sales will be published. According to forecasts, the indicator may reduce from 0.2% to 0.1%, which may cause pressure on USD; high volatility is expected on the market.

Support and resistance

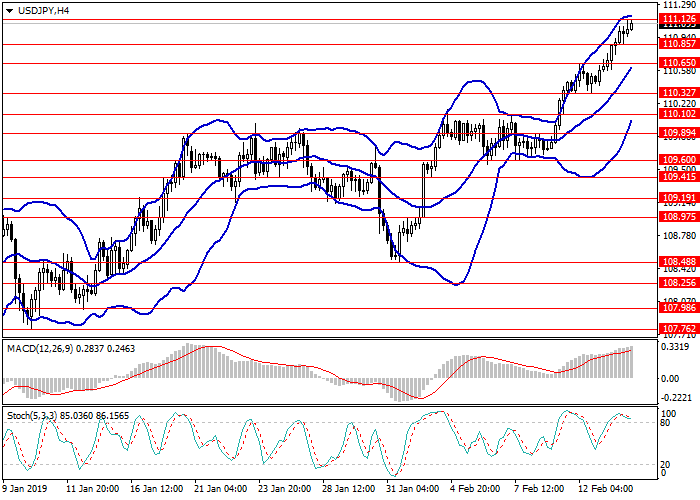

On H4 chart, the instrument is growing along the upper border of Bollinger Bands. MACD histogram is in the positive area, the signal line is crossing its body from below giving a strong signal for the opening of short positions.

Support levels: 110.85, 110.65, 110.32, 110.20, 109.89, 109.60, 109.41.

Resistance levels: 111.12, 111.38, 112.18.

Trading tips

Long positions may be opened from the current level with the target at 112.00 and stop loss at 110.65.

Short positions may be opened from the level of 110.50 with the target at 110.00 and stop loss at 110.80.

Implementation time: 1-3 days.

On Wednesday, the US dollar strengthened against the Japanese yen amid the release of positive inflation data for the US economy.

In January, the consumer price index fell less than expected by the market and amounted to 1.6%. Core CPI remained at 2.2%. The pair continued its growth today amid the publication of negative data on Japan's GDP: in 4Q2018, it grew only by 0.3%, failing to prove the forecast of 0.4%.

In the United States, statistics on sales will be published. According to forecasts, the indicator may reduce from 0.2% to 0.1%, which may cause pressure on USD; high volatility is expected on the market.

Support and resistance

On H4 chart, the instrument is growing along the upper border of Bollinger Bands. MACD histogram is in the positive area, the signal line is crossing its body from below giving a strong signal for the opening of short positions.

Support levels: 110.85, 110.65, 110.32, 110.20, 109.89, 109.60, 109.41.

Resistance levels: 111.12, 111.38, 112.18.

Trading tips

Long positions may be opened from the current level with the target at 112.00 and stop loss at 110.65.

Short positions may be opened from the level of 110.50 with the target at 110.00 and stop loss at 110.80.

Implementation time: 1-3 days.

No comments:

Write comments