XAU/USD: general review

16 January 2019, 11:03

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1290.55 |

| Take Profit | 1300.00, 1320.00, 1335.00, 1350.00 |

| Stop Loss | 1281.15, 1264.00 |

| Key Levels | 1237.00, 1243.00, 1255.50, 1266.00, 1275.00, 1285.00, 1300.00, 1310.00, 1320.00, 1335.00, 1350.00, 1365.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 1285.00, 1275.00 |

| Take Profit | 1300.00, 1320.00, 1335.00, 1350.00 |

| Stop Loss | 1270.00, 1264.00 |

| Key Levels | 1237.00, 1243.00, 1255.50, 1266.00, 1275.00, 1285.00, 1300.00, 1310.00, 1320.00, 1335.00, 1350.00, 1365.00 |

Current trend

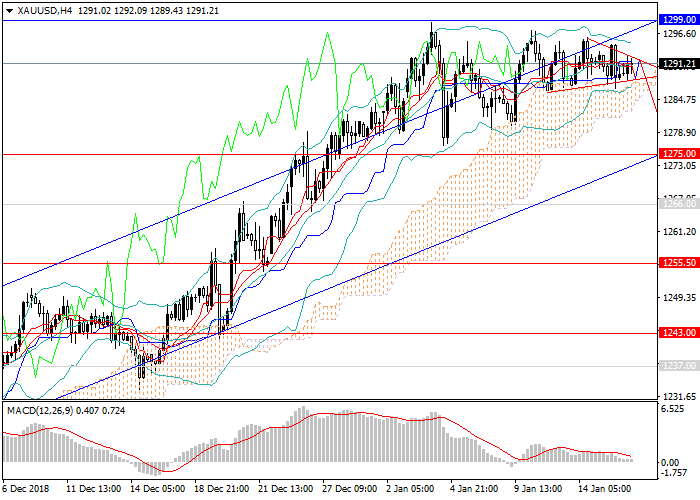

The rapid growth in the price of gold in the last months of 2019 was replaced by lateral consolidation in a narrowing channel. The asset remains in an upward trend, but at the moment has come close to the resistance level.

The main catalyst for the growth of the instrument remains the increased demand for gold due to the ambiguous political situation in the United States, as well as decisions on Brexit in the UK. This week in the US, data on retail sales, the construction sector and industrial production will be published, which may affect the dynamics of the US dollar and gold.

Support and resistance

In the short term, the price may make several short waves in the framework of lateral consolidation, after which a corrective decline to the lower border of the medium-term upward range is expected. The upward momentum is maintained, which indicates a high probability of further price movement up to the levels of 1310.00, 1320.00, 1335.00, 1350.00.

Technical analysis confirms this forecast. In the long run, the price moves within a wide side channel, the upper limit of which is the level of 1350.00. Technical indicators on the D1 chart confirm the forecast. MACD indicates the preservation of the high volume of long positions, and Bollinger Bands are directed upwards.

Resistance levels: 1300.00, 1310.00, 1320.00, 1335.00, 1350.00, 1365.00.

Support levels: 1285.00, 1275.00, 1266.00, 1255.50, 1243.00, 1237.00.

Trading tips

Long positions can be opened from the current level, and pending long positions can be set from support levels of 1285.00, 1275.00 with targets at 1300.00, 1320.00, 1335.00, 1350.00 and stop loss at 1264.00.

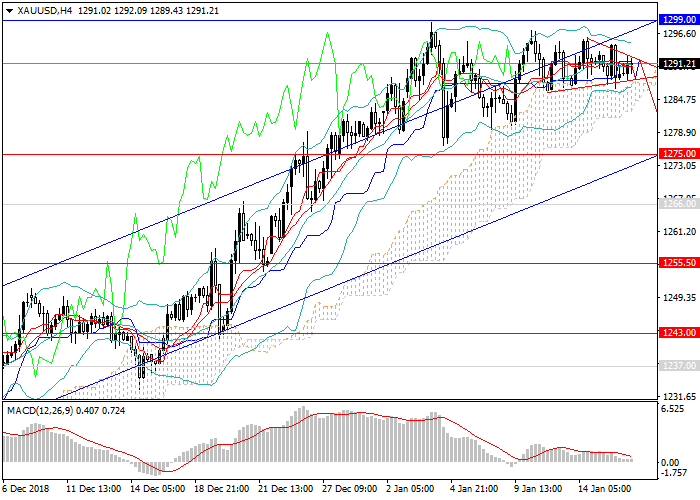

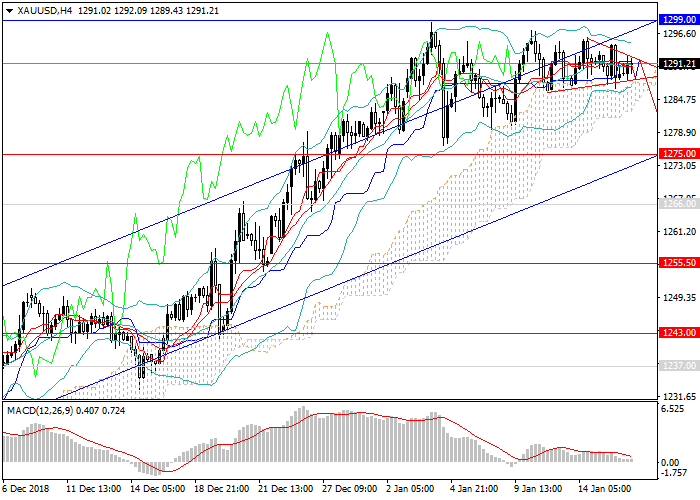

The rapid growth in the price of gold in the last months of 2019 was replaced by lateral consolidation in a narrowing channel. The asset remains in an upward trend, but at the moment has come close to the resistance level.

The main catalyst for the growth of the instrument remains the increased demand for gold due to the ambiguous political situation in the United States, as well as decisions on Brexit in the UK. This week in the US, data on retail sales, the construction sector and industrial production will be published, which may affect the dynamics of the US dollar and gold.

Support and resistance

In the short term, the price may make several short waves in the framework of lateral consolidation, after which a corrective decline to the lower border of the medium-term upward range is expected. The upward momentum is maintained, which indicates a high probability of further price movement up to the levels of 1310.00, 1320.00, 1335.00, 1350.00.

Technical analysis confirms this forecast. In the long run, the price moves within a wide side channel, the upper limit of which is the level of 1350.00. Technical indicators on the D1 chart confirm the forecast. MACD indicates the preservation of the high volume of long positions, and Bollinger Bands are directed upwards.

Resistance levels: 1300.00, 1310.00, 1320.00, 1335.00, 1350.00, 1365.00.

Support levels: 1285.00, 1275.00, 1266.00, 1255.50, 1243.00, 1237.00.

Trading tips

Long positions can be opened from the current level, and pending long positions can be set from support levels of 1285.00, 1275.00 with targets at 1300.00, 1320.00, 1335.00, 1350.00 and stop loss at 1264.00.

No comments:

Write comments