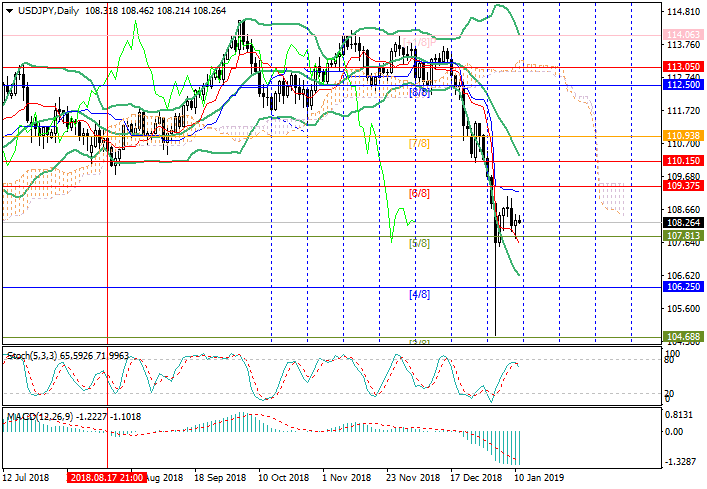

USD/JPY: Murrey analysis

11 January 2019, 13:24

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 107.75 |

| Take Profit | 107.03, 106.25 |

| Stop Loss | 108.30 |

| Key Levels | 106.25, 107.03, 107.81, 109.37, 110.15, 110.93 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 109.40 |

| Take Profit | 110.15, 110.93 |

| Stop Loss | 108.90 |

| Key Levels | 106.25, 107.03, 107.81, 109.37, 110.15, 110.93 |

On the daily chart, the pair continues to trade within the downward trend,

although the decline slowed down around 107.81 ([5/8]). The breakdown of this

level will let the price fall to the level of 107.03 ([1/8], H4) and 106.25

([4/8]). The likelihood of continued decline is confirmed by technical

indicators. Bollinger bands reversed downwards, Stochastic is reversing

downwards near the overbought zone, MACD histogram increases in the negative

zone.

The resumption of growth to the levels of 110.15 (the middle line of Bollinger bands, [5/8] H4) and 110.93 ([5/8]) will be possible if the price is fixed above the level of 109.37 ([6/8]).

Support and resistance

Resistance levels: 109.37, 110.15, 110.93.

Support levels: 107.81, 107.03, 106.25.

Trading tips

Short positions can be opened after the price fixes below the level of 107.81 with the targets at 107.03 and 106.25 and stop loss around 108.30.

Long positions can be opened above the level of 109.37 with the targets at 110.15, 110.93 and stop loss 108.90.

Implementation period: 4–5 days.

The resumption of growth to the levels of 110.15 (the middle line of Bollinger bands, [5/8] H4) and 110.93 ([5/8]) will be possible if the price is fixed above the level of 109.37 ([6/8]).

Support and resistance

Resistance levels: 109.37, 110.15, 110.93.

Support levels: 107.81, 107.03, 106.25.

Trading tips

Short positions can be opened after the price fixes below the level of 107.81 with the targets at 107.03 and 106.25 and stop loss around 108.30.

Long positions can be opened above the level of 109.37 with the targets at 110.15, 110.93 and stop loss 108.90.

Implementation period: 4–5 days.

No comments:

Write comments