USD/CAD: general review

11 January 2019, 13:13

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1.3189 |

| Take Profit | 1.3450, 1.3595, 1.3665 |

| Stop Loss | 1.2990 |

| Key Levels | 1.2930, 1.3050, 1.3130, 1.3170, 1.3290, 1.3355, 1.3390, 1.3450 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 1.3130, 1.3050 |

| Take Profit | 1.3450, 1.3595, 1.3665 |

| Stop Loss | 1.2990 |

| Key Levels | 1.2930, 1.3050, 1.3130, 1.3170, 1.3290, 1.3355, 1.3390, 1.3450 |

Current trend

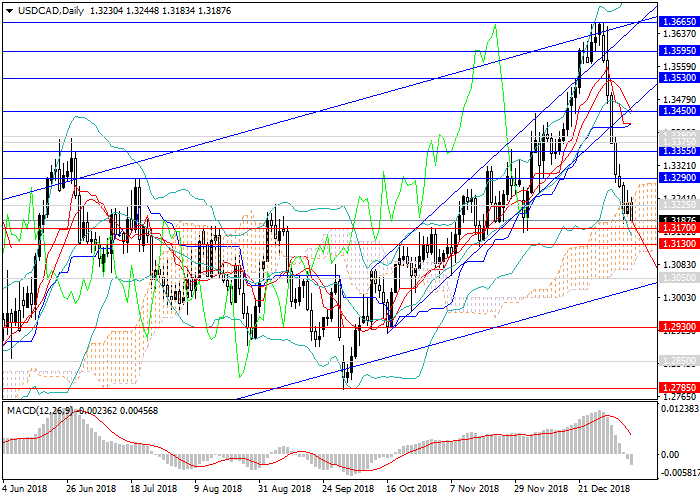

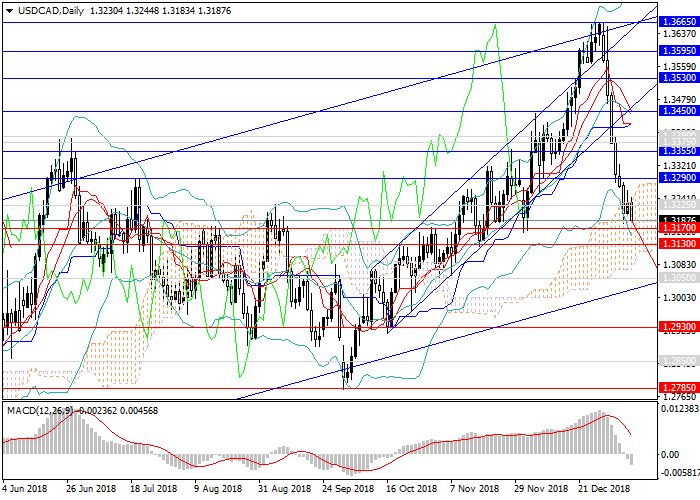

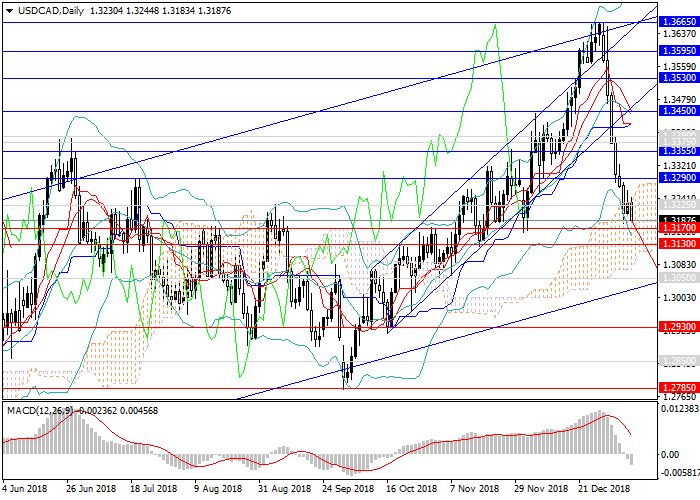

The rapid growth of the American dollar against the Canadian one at the end of last year was replaced by an even sharper fall.

Since the new year, the pair fell by more than 450 points without upward correction. The main catalyst of this movement was a significant drop in demand for USD due to the release of weak statistics on the labor market and major indices. The Canadian currency, by contrast, received support from favorable data on unemployment and the number of employees. An additional catalyst has been the formation of a long-term wide upward channel since September. Within this trend, the pair reached the upper border of the range, rebounded from it and headed down due to the high volume of fixed long positions and the growth of short positions.

Today, special attention should be paid to US inflation and indices. Early next week, there will be data on the US retail sales and construction sector.

Support and resistance

Despite the high dynamics of the downward impulse, from the nearest serious support levels, it can be replaced by lateral consolidation or by an upward impulse that will grow into a new upward wave. The pair is likely to reach 1.3130, 1.3050 at the lower border of the channel. From them, the change of direction is possible.

Technical indicators on W1 chart and above keep the growth signal: MACD indicates the preservation of the high volume of short positions, Bollinger Bands are directed upwards.

Support levels: 1.3170, 1.3130, 1.3050, 1.2930.

Resistance levels: 1.3290, 1.3355, 1.3390, 1.3450.

Trading tips

Long positions may be opened from the current level; pending orders can be put from the levels of 1.3130, 1.3050 with targets at 1.3450, 1.3595, 1.3665 and stop loss at 1.2990.

The rapid growth of the American dollar against the Canadian one at the end of last year was replaced by an even sharper fall.

Since the new year, the pair fell by more than 450 points without upward correction. The main catalyst of this movement was a significant drop in demand for USD due to the release of weak statistics on the labor market and major indices. The Canadian currency, by contrast, received support from favorable data on unemployment and the number of employees. An additional catalyst has been the formation of a long-term wide upward channel since September. Within this trend, the pair reached the upper border of the range, rebounded from it and headed down due to the high volume of fixed long positions and the growth of short positions.

Today, special attention should be paid to US inflation and indices. Early next week, there will be data on the US retail sales and construction sector.

Support and resistance

Despite the high dynamics of the downward impulse, from the nearest serious support levels, it can be replaced by lateral consolidation or by an upward impulse that will grow into a new upward wave. The pair is likely to reach 1.3130, 1.3050 at the lower border of the channel. From them, the change of direction is possible.

Technical indicators on W1 chart and above keep the growth signal: MACD indicates the preservation of the high volume of short positions, Bollinger Bands are directed upwards.

Support levels: 1.3170, 1.3130, 1.3050, 1.2930.

Resistance levels: 1.3290, 1.3355, 1.3390, 1.3450.

Trading tips

Long positions may be opened from the current level; pending orders can be put from the levels of 1.3130, 1.3050 with targets at 1.3450, 1.3595, 1.3665 and stop loss at 1.2990.

No comments:

Write comments