USD/CHF: the dollar is correcting

16 January 2019, 09:14

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9905 |

| Take Profit | 0.9962, 0.9980 |

| Stop Loss | 0.9871 |

| Key Levels | 0.9760, 0.9800, 0.9847, 0.9871, 0.9900, 0.9919, 0.9936, 0.9962 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9865, 0.9840 |

| Take Profit | 0.9800, 0.9780, 0.9760 |

| Stop Loss | 0.9900 |

| Key Levels | 0.9760, 0.9800, 0.9847, 0.9871, 0.9900, 0.9919, 0.9936, 0.9962 |

Current trend

USD showed significant growth against CHF on Tuesday, having updated local highs of January 4.

Investors are focused on the US government shutdown. Recently, President Donald Trump rejected Senator Lindsey Graham’s proposal to temporarily resume government work for three weeks and to try to negotiate with the Democrats during that time. Thus, the shutdown has been continuing for the fourth week and, according to representatives of the administration, may last until the end of February. This situation threatens the market with possible negative consequences. Even ministries working at the expense of their own reserves may soon exhaust them and stop working. Failure of salaries payments to hundreds of thousands of employees may adversely affect retail sales.

CHF in turn is under pressure from the speech by the ECB President Mario Draghi. Among other things, the official said that the eurozone economy remains weak and still needs considerable support from the regulator.

Support and resistance

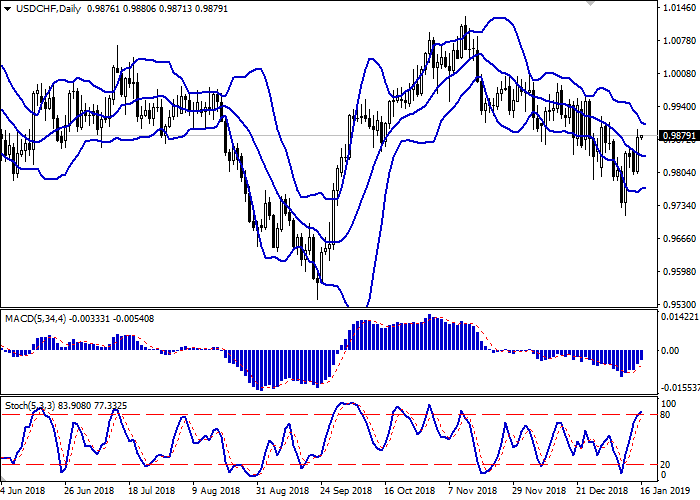

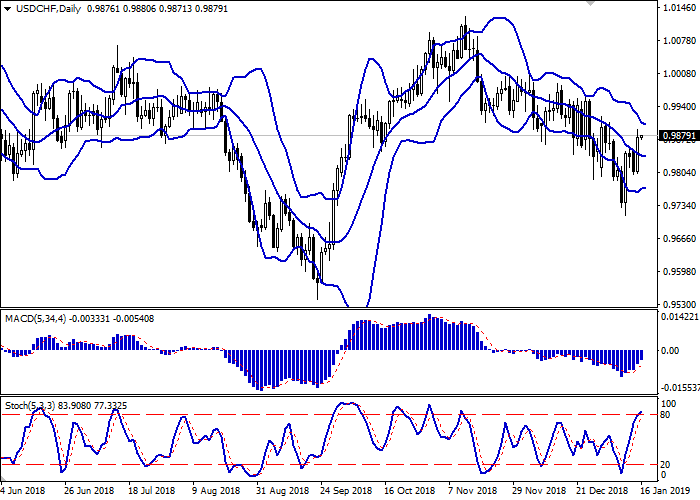

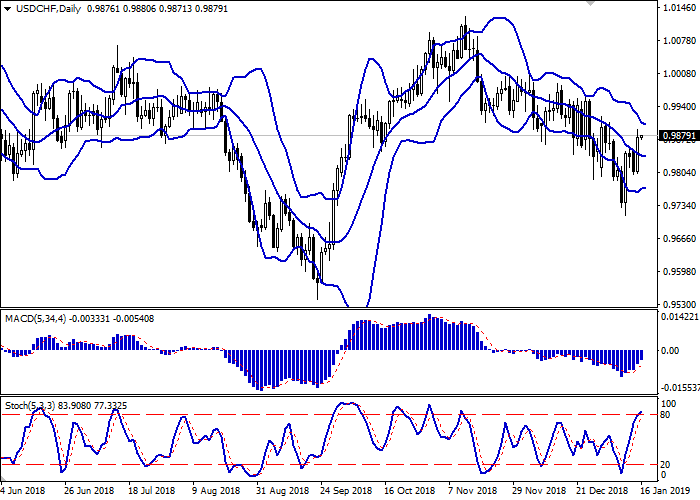

On the D1 chart Bollinger Bands are reversing horizontally. The price range is narrowing from above, reflecting the emergence of ambiguous dynamics in the short term. MACD indicator is growing, keeping a stable buy signal (located above the signal line). Stochastic also maintains a steady upward direction but is already approaching its highs, which indicates the growing risks of overbought USD.

Existing long positions should be kept until the situation clears up.

Resistance levels: 0.9900, 0.9919, 0.9936, 0.9962.

Support levels: 0.9871, 0.9847, 0.9800, 0.9760.

Trading tips

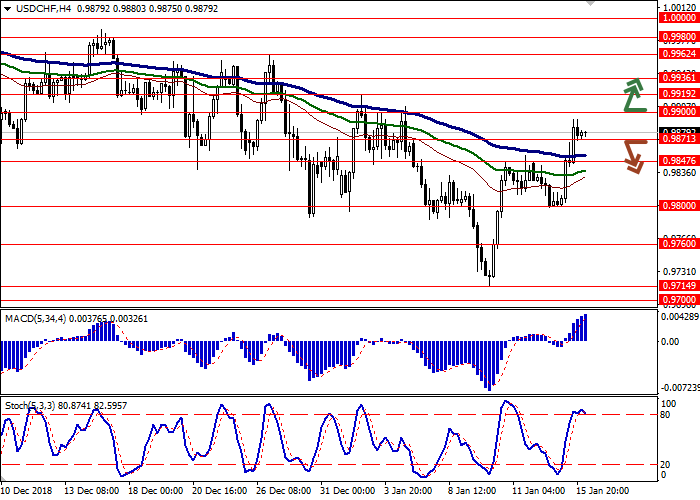

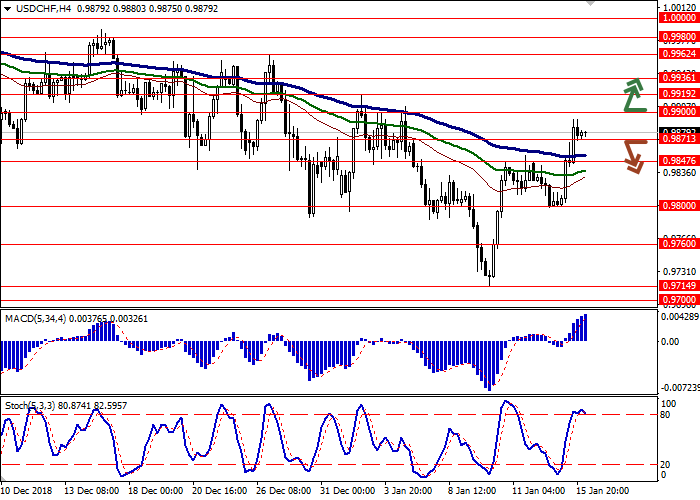

To open long positions, one can rely on the breakout of 0.9900. Take profit — 0.9962 or 0.9980. Stop loss — 0.9871.

A breakdown of 0.9871 or 0.9847 may become a signal to return to sales with target at 0.9800 or 0.9780, 0.9760. Stop loss — 0.9880 or 0.9900.

Implementation period: 2-3 days.

USD showed significant growth against CHF on Tuesday, having updated local highs of January 4.

Investors are focused on the US government shutdown. Recently, President Donald Trump rejected Senator Lindsey Graham’s proposal to temporarily resume government work for three weeks and to try to negotiate with the Democrats during that time. Thus, the shutdown has been continuing for the fourth week and, according to representatives of the administration, may last until the end of February. This situation threatens the market with possible negative consequences. Even ministries working at the expense of their own reserves may soon exhaust them and stop working. Failure of salaries payments to hundreds of thousands of employees may adversely affect retail sales.

CHF in turn is under pressure from the speech by the ECB President Mario Draghi. Among other things, the official said that the eurozone economy remains weak and still needs considerable support from the regulator.

Support and resistance

On the D1 chart Bollinger Bands are reversing horizontally. The price range is narrowing from above, reflecting the emergence of ambiguous dynamics in the short term. MACD indicator is growing, keeping a stable buy signal (located above the signal line). Stochastic also maintains a steady upward direction but is already approaching its highs, which indicates the growing risks of overbought USD.

Existing long positions should be kept until the situation clears up.

Resistance levels: 0.9900, 0.9919, 0.9936, 0.9962.

Support levels: 0.9871, 0.9847, 0.9800, 0.9760.

Trading tips

To open long positions, one can rely on the breakout of 0.9900. Take profit — 0.9962 or 0.9980. Stop loss — 0.9871.

A breakdown of 0.9871 or 0.9847 may become a signal to return to sales with target at 0.9800 or 0.9780, 0.9760. Stop loss — 0.9880 or 0.9900.

Implementation period: 2-3 days.

No comments:

Write comments