USD/CAD: the instrument is correcting

15 January 2019, 09:38

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3325 |

| Take Profit | 1.3419, 1.3443 |

| Stop Loss | 1.3280 |

| Key Levels | 1.3140, 1.3179, 1.3200, 1.3251, 1.3321, 1.3368, 1.3419, 1.3443 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3245, 1.3225 |

| Take Profit | 1.3179, 1.3140 |

| Stop Loss | 1.3270, 1.3290 |

| Key Levels | 1.3140, 1.3179, 1.3200, 1.3251, 1.3321, 1.3368, 1.3419, 1.3443 |

Current trend

On Monday, USD has significantly grown against CAD, having updated the local high of January 8.

USD is trading under the influence of external factors. In December, instead of the expected growth, the volume of Chinese exports decreased by 4.4%, and the volume of imports fell by 7.6%. The trade war with the United States and the general decline in global demand continue to slow down the Chinese economy. USD is under pressure from the government shutdown continues to affect it negatively, as it has been going on for the fourth week already. A consensus solution is not predicted, moreover, the presidential administration continues to work out the option of introducing a state of emergency and receiving money for the construction of the wall on the Mexican border bypassing the Congress.

Support and resistance

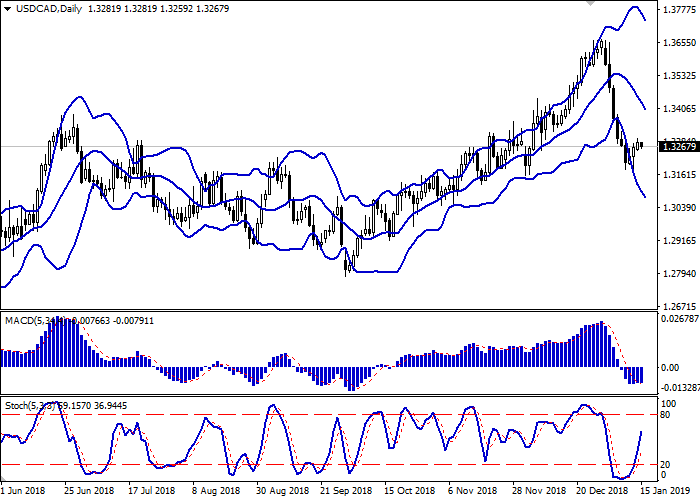

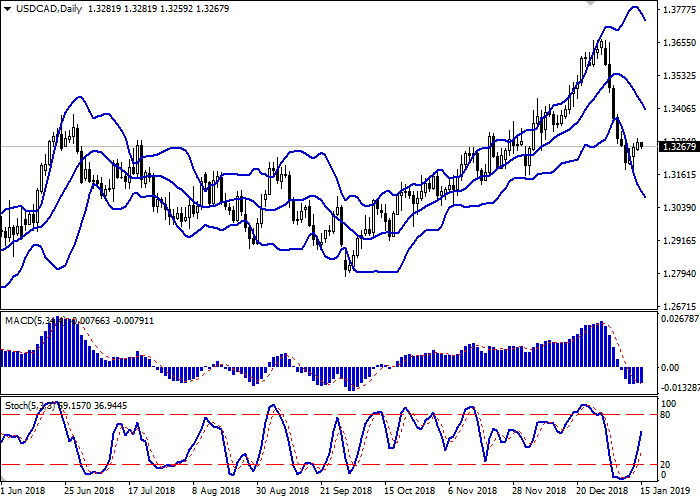

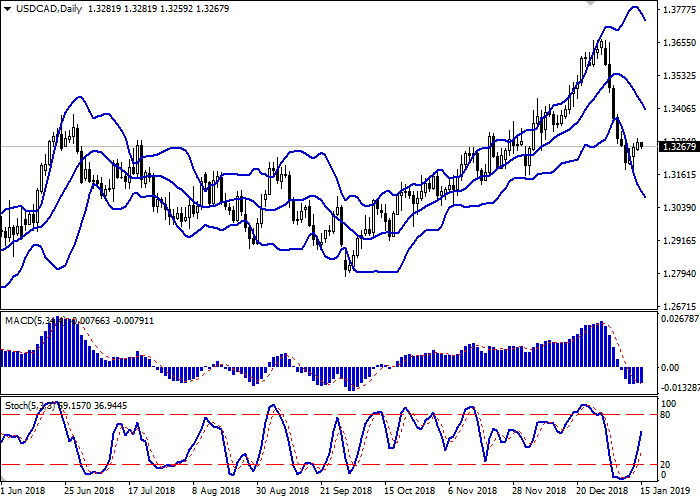

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range continues expanding, opening up broad prospects for further movement of the instrument. MACD is reversing to growth forming a buy signal (located above the signal line). Stochastic has been growing for quite a long time now and is rapidly approaching its maximum levels, pointing to the growing risks associated with overbought instrument in the ultra-short term.

One should keep existing long positions and open new ones in the short and/or ultra-short term.

Resistance levels: 1.3321, 1.3368, 1.3419, 1.3443.

Support levels: 1.3251, 1.3200, 1.3179, 1.3140.

Trading tips

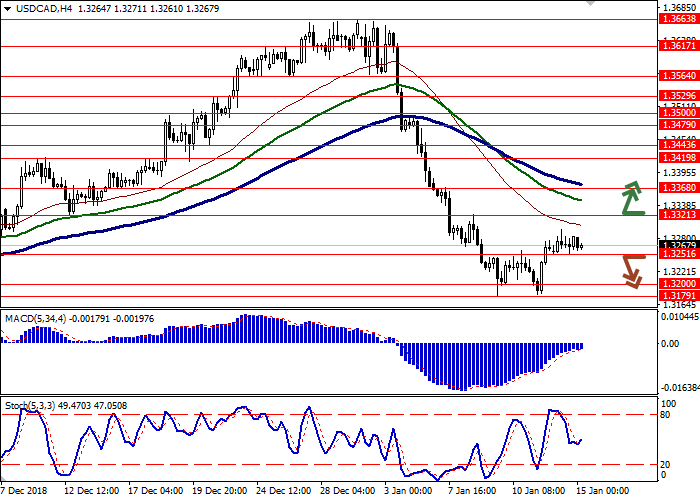

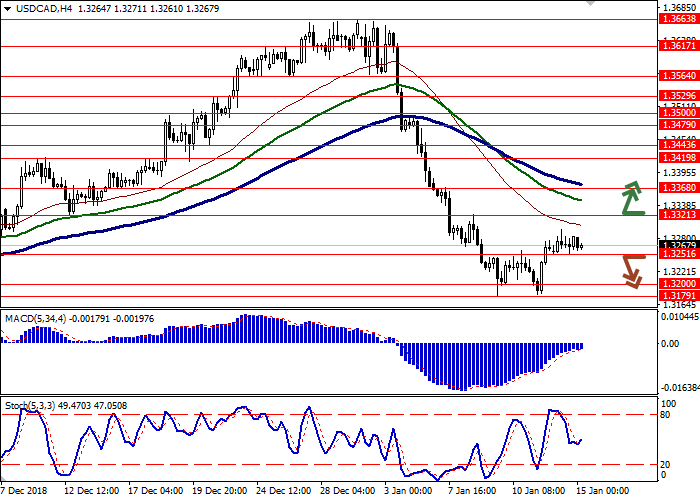

To open long positions, one can rely on the breakout of 1.3321. Take profit — 1.3419 or 1.3443. Stop loss – 1.3280. Implementation period: 2-3 days.

A breakdown of the level of 1.3251 or 1.3230 may be a signal to further sales with target at 1.3179 or 1.3140. Stop loss — 1.3270 or 1.3290. Implementation period: 1-2 days.

On Monday, USD has significantly grown against CAD, having updated the local high of January 8.

USD is trading under the influence of external factors. In December, instead of the expected growth, the volume of Chinese exports decreased by 4.4%, and the volume of imports fell by 7.6%. The trade war with the United States and the general decline in global demand continue to slow down the Chinese economy. USD is under pressure from the government shutdown continues to affect it negatively, as it has been going on for the fourth week already. A consensus solution is not predicted, moreover, the presidential administration continues to work out the option of introducing a state of emergency and receiving money for the construction of the wall on the Mexican border bypassing the Congress.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range continues expanding, opening up broad prospects for further movement of the instrument. MACD is reversing to growth forming a buy signal (located above the signal line). Stochastic has been growing for quite a long time now and is rapidly approaching its maximum levels, pointing to the growing risks associated with overbought instrument in the ultra-short term.

One should keep existing long positions and open new ones in the short and/or ultra-short term.

Resistance levels: 1.3321, 1.3368, 1.3419, 1.3443.

Support levels: 1.3251, 1.3200, 1.3179, 1.3140.

Trading tips

To open long positions, one can rely on the breakout of 1.3321. Take profit — 1.3419 or 1.3443. Stop loss – 1.3280. Implementation period: 2-3 days.

A breakdown of the level of 1.3251 or 1.3230 may be a signal to further sales with target at 1.3179 or 1.3140. Stop loss — 1.3270 or 1.3290. Implementation period: 1-2 days.

No comments:

Write comments