SPX: general review

18 January 2019, 08:39

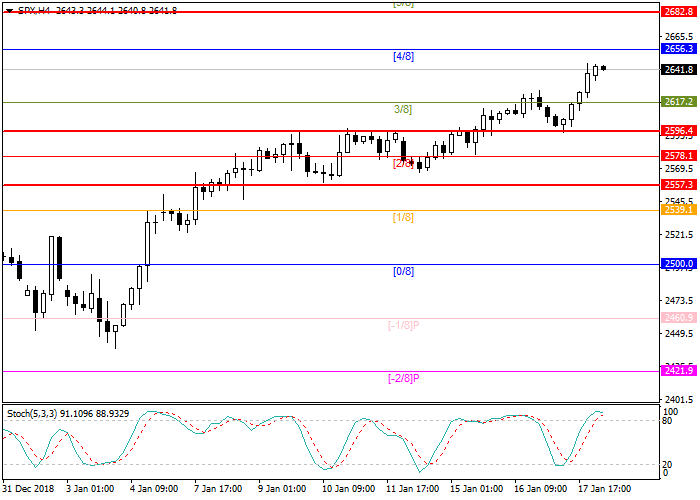

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL LIMIT |

| Entry Point | 2656.3 |

| Take Profit | 2596.4 |

| Stop Loss | 2673.5 |

| Key Levels | 2596.4, 2617.2, 2656.3, 2682.8 |

Current trend

The S&P 500 continues to rebound slightly. The instrument is trading near resistance level of 2656.3 (Murrey [4/8]).

Quarterly reports brought considerable support to the market, especially in the banking sector, which reported better than analytical forecasts. Bank of America's net income reached USD 7.3 billion (USD 0.7 per share versus expectations of USD 0.63). Another large bank, Goldman Sachs, whose net profit amounted to USD 6.04 per share as compared with a loss-making indicator a year ago, did not stand aside. On the other hand, strong volatility in the international financial markets has reduced part of the profits of large investment banks: revenues from trading in bonds, currencies and commodities decreased by 18%.

A negative factor for the US stock market is the US government shutdown, which has been going on for more than 25 days. Each week of the shutdown costs the national economy 0.1% of GDP.

Investors continue monitoring the development of the situation around Brexit. 432 British MPs did not support Theresa May's plan on leaving the EU. The Prime-Minister will have to submit a new plan of the agreement until January 21. Otherwise, it may create additional volatility in global markets.

Support and resistance

Stochastic is at the level of 78 points and indicates the possible correction.

Resistance levels: 2656.3, 2682.8.

Support levels: 2617.2, 2596.4.

Trading tips

Short positions may be opened from the resistance level of 2656.3 with take profit at 2596.4 and stop loss at 2673.5.

The S&P 500 continues to rebound slightly. The instrument is trading near resistance level of 2656.3 (Murrey [4/8]).

Quarterly reports brought considerable support to the market, especially in the banking sector, which reported better than analytical forecasts. Bank of America's net income reached USD 7.3 billion (USD 0.7 per share versus expectations of USD 0.63). Another large bank, Goldman Sachs, whose net profit amounted to USD 6.04 per share as compared with a loss-making indicator a year ago, did not stand aside. On the other hand, strong volatility in the international financial markets has reduced part of the profits of large investment banks: revenues from trading in bonds, currencies and commodities decreased by 18%.

A negative factor for the US stock market is the US government shutdown, which has been going on for more than 25 days. Each week of the shutdown costs the national economy 0.1% of GDP.

Investors continue monitoring the development of the situation around Brexit. 432 British MPs did not support Theresa May's plan on leaving the EU. The Prime-Minister will have to submit a new plan of the agreement until January 21. Otherwise, it may create additional volatility in global markets.

Support and resistance

Stochastic is at the level of 78 points and indicates the possible correction.

Resistance levels: 2656.3, 2682.8.

Support levels: 2617.2, 2596.4.

Trading tips

Short positions may be opened from the resistance level of 2656.3 with take profit at 2596.4 and stop loss at 2673.5.

No comments:

Write comments