SPX: general review

15 January 2019, 08:33

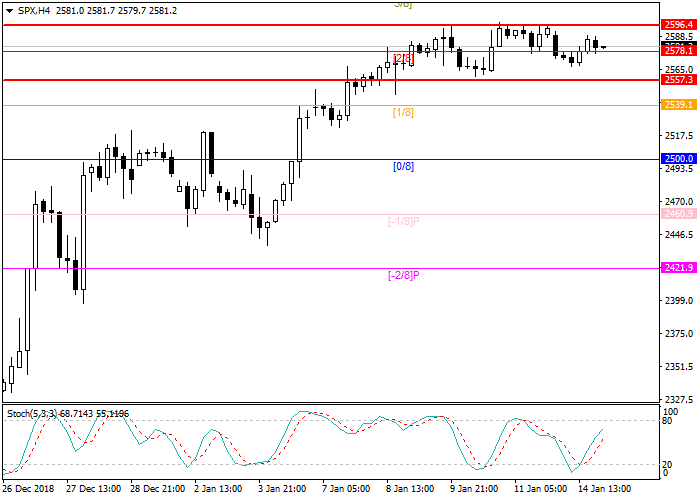

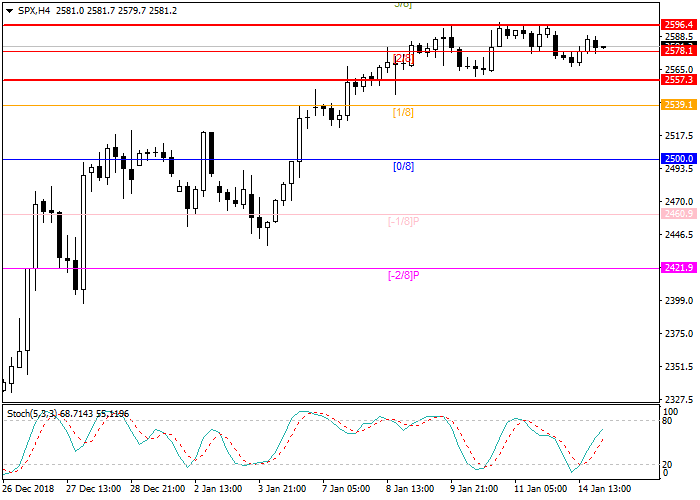

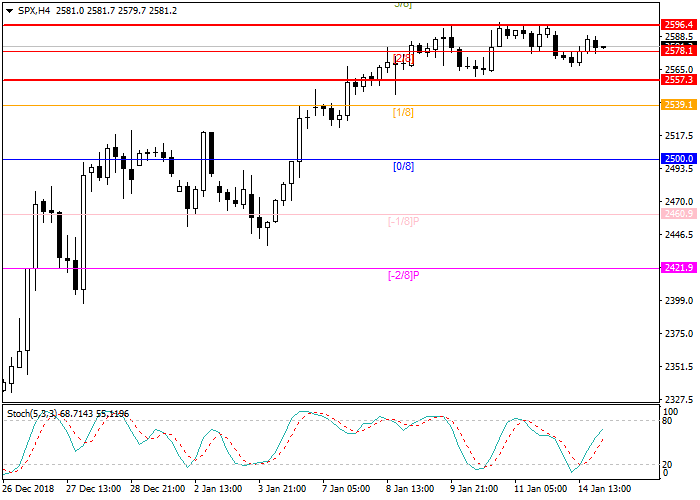

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 2556.0 |

| Take Profit | 2500.0 |

| Stop Loss | 2578.1 |

| Key Levels | 2500.0, 2557.0, 2596.1, 2617.2 |

Current trend

The S&P 500 is trading near the level of 2578.1 (Murrey [2/8]). If the asset can consolidate higher and break through the previous high, the next target will be the level of 2617.2. In the case of a breakdown, the target for the decline will be the psychological level of 2500.0.

The government shutdown in the US, which has been lasting for 24 days and affects about 800,000 public sector employees, still exerts pressure on the market. If this issue is not resolved soon, it may adversely affect the country's economy. Market participants expect the outcome of the US-China trade negotiations. Last week, US Treasury Secretary Steven Mnuchin said that a delegation from the PRC would visit Washington in January to continue negotiations and conclude a final deal, otherwise trade duties will be raised in early March. Released statistics on exports from China disappointed investors: the indicator fell by 4.4%, which is a record for the last two years and may signal a serious economic downturn. Analysts predicted a growth rate of 3%. One of the key events today is the vote on Brexit in the UK Parliament. It is expected that the procedure will be launched after March 29.

Support and resistance

Stochastic is at 32 points and does not provide a signal for the opening of positions.

Resistance levels: 2596.1, 2617.2.

Support levels: 2557.0, 2500.0.

Trading tips

Open short positions after the breakdown of the level of 2557.0 with take profit at 2500.0 and stop loss at 2578.1.

The S&P 500 is trading near the level of 2578.1 (Murrey [2/8]). If the asset can consolidate higher and break through the previous high, the next target will be the level of 2617.2. In the case of a breakdown, the target for the decline will be the psychological level of 2500.0.

The government shutdown in the US, which has been lasting for 24 days and affects about 800,000 public sector employees, still exerts pressure on the market. If this issue is not resolved soon, it may adversely affect the country's economy. Market participants expect the outcome of the US-China trade negotiations. Last week, US Treasury Secretary Steven Mnuchin said that a delegation from the PRC would visit Washington in January to continue negotiations and conclude a final deal, otherwise trade duties will be raised in early March. Released statistics on exports from China disappointed investors: the indicator fell by 4.4%, which is a record for the last two years and may signal a serious economic downturn. Analysts predicted a growth rate of 3%. One of the key events today is the vote on Brexit in the UK Parliament. It is expected that the procedure will be launched after March 29.

Support and resistance

Stochastic is at 32 points and does not provide a signal for the opening of positions.

Resistance levels: 2596.1, 2617.2.

Support levels: 2557.0, 2500.0.

Trading tips

Open short positions after the breakdown of the level of 2557.0 with take profit at 2500.0 and stop loss at 2578.1.

No comments:

Write comments