EUR/USD: the Euro remains under pressure

17 January 2019, 08:36

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1405 |

| Take Profit | 1.1442, 1.1460, 1.1471 |

| Stop Loss | 1.1370 |

| Key Levels | 1.1300, 1.1333, 1.1359, 1.1376, 1.1400, 1.1421, 1.1442, 1.1471 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1370 |

| Take Profit | 1.1300 |

| Stop Loss | 1.1400, 1.1410 |

| Key Levels | 1.1300, 1.1333, 1.1359, 1.1376, 1.1400, 1.1421, 1.1442, 1.1471 |

Current trend

EUR showed a decline against USD on Wednesday, continuing the development of a powerful "bearish" impetus formed the day before.

Investors are focused on Brexit and German inflation data. The failure of the EU deal vote in the British Parliament caused the uncertainty of further action. On the one hand, EU representatives have repeatedly stated that there will be no changes in the contract; on the other hand, they are calling for further negotiations.

The inflation data published yesterday in Germany, as expected, remained unchanged. In January, CPI remained at 0.1% MoM and at 1.7% YoY. Today, EU countries’ corresponding data will be published. According to the forecast, CPI will remain at –0.2% MoM and at 1.6% YoY.

Support and resistance

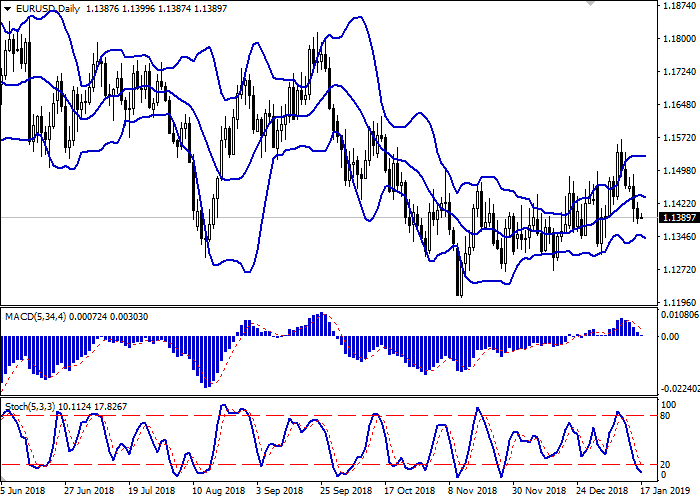

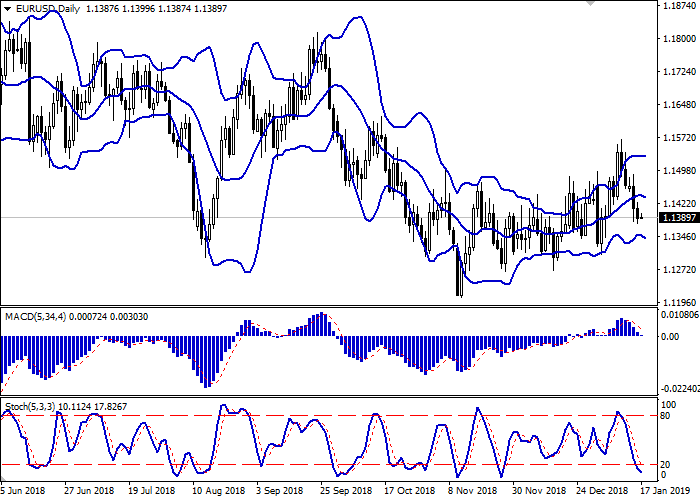

Bollinger Bands in D1 chart demonstrate a slight decrease. The price range expands from below, making way for new local lows for the "bears". MACD is declining keeping a stable sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic keeps the downtrend, but approaches its lows, which indicates the risks associated with oversold EUR.

Existing short positions should be kept until the situation clears up.

Resistance levels: 1.1400, 1.1421, 1.1442, 1.1471.

Support levels: 1.1376, 1.1359, 1.1333, 1.1300.

Trading tips

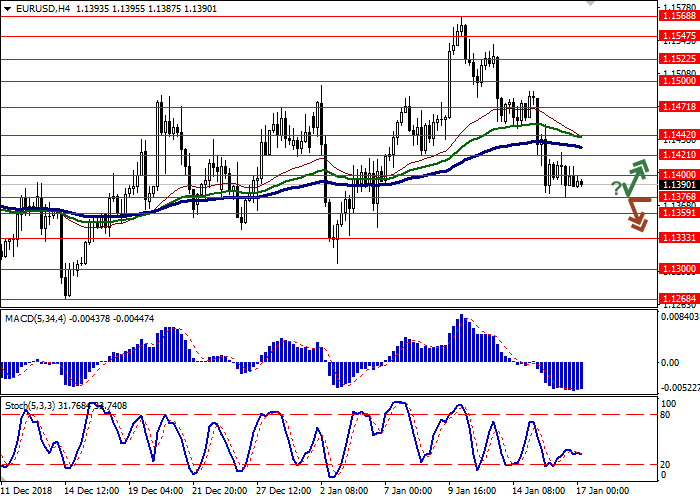

To open long positions, one can rely on the rebound from the support level of 1.1376 with the subsequent breakout of 1.1400. Take profit — 1.1442 or 1.1460, 1.1471. Stop loss — 1.1370.

The breakdown of 1.1376 may serve as a signal to further sales with the target at 1.1300. Stop loss — 1.1400 or 1.1410.

Implementation period: 2-3 days.

EUR showed a decline against USD on Wednesday, continuing the development of a powerful "bearish" impetus formed the day before.

Investors are focused on Brexit and German inflation data. The failure of the EU deal vote in the British Parliament caused the uncertainty of further action. On the one hand, EU representatives have repeatedly stated that there will be no changes in the contract; on the other hand, they are calling for further negotiations.

The inflation data published yesterday in Germany, as expected, remained unchanged. In January, CPI remained at 0.1% MoM and at 1.7% YoY. Today, EU countries’ corresponding data will be published. According to the forecast, CPI will remain at –0.2% MoM and at 1.6% YoY.

Support and resistance

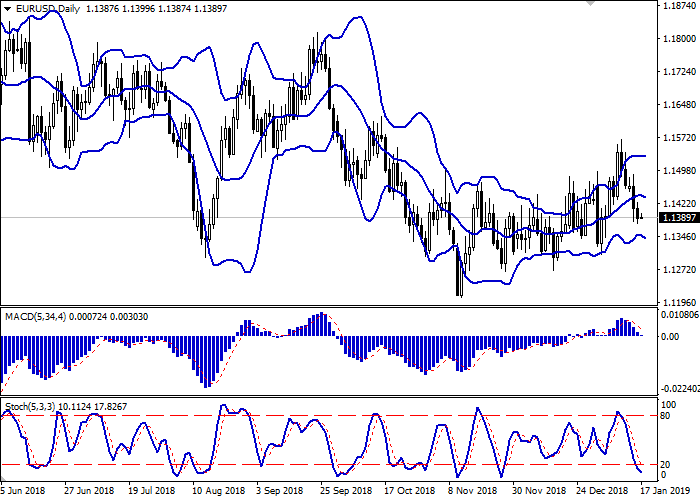

Bollinger Bands in D1 chart demonstrate a slight decrease. The price range expands from below, making way for new local lows for the "bears". MACD is declining keeping a stable sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic keeps the downtrend, but approaches its lows, which indicates the risks associated with oversold EUR.

Existing short positions should be kept until the situation clears up.

Resistance levels: 1.1400, 1.1421, 1.1442, 1.1471.

Support levels: 1.1376, 1.1359, 1.1333, 1.1300.

Trading tips

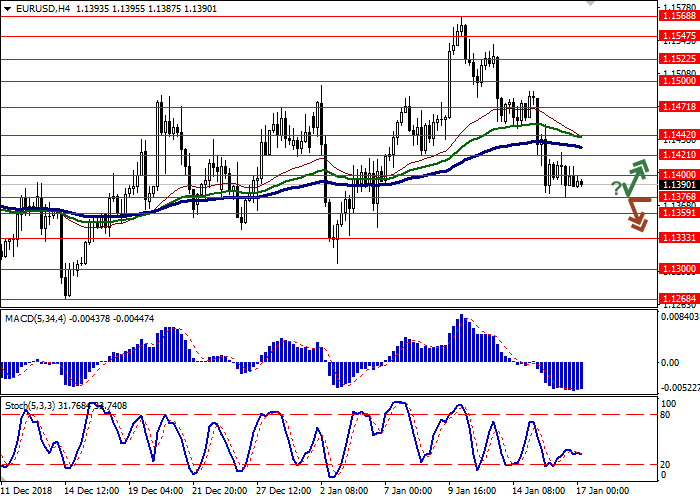

To open long positions, one can rely on the rebound from the support level of 1.1376 with the subsequent breakout of 1.1400. Take profit — 1.1442 or 1.1460, 1.1471. Stop loss — 1.1370.

The breakdown of 1.1376 may serve as a signal to further sales with the target at 1.1300. Stop loss — 1.1400 or 1.1410.

Implementation period: 2-3 days.

No comments:

Write comments