EUR/USD: the euro is showing ambiguous dynamics

14 January 2019, 08:33

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1485, 1.1505 |

| Take Profit | 1.1568, 1.1580 |

| Stop Loss | 1.1450 |

| Key Levels | 1.1400, 1.1421, 1.1442, 1.1455, 1.1500, 1.1522, 1.1547, 1.1568 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1450, 1.1435 |

| Take Profit | 1.1400, 1.1380 |

| Stop Loss | 1.1470, 1.1480 |

| Key Levels | 1.1400, 1.1421, 1.1442, 1.1455, 1.1500, 1.1522, 1.1547, 1.1568 |

Current trend

EUR declined against USD at the end of last week, retreating from local highs of October 17.

As there is a lack of significant economic releases, EUR is trading under the influence of American and British news. Investors remain optimistic about the negotiations between the US and China, which may become more specific. EUR is supported by the ongoing US government shutdown and the Fed's intention to wait with the next rate hike.

Today, investors are waiting for the publication of the November data on EU Industrial Production, which are expected to be poor. The indicator can fall by 1.5% MoM and by 2.3% YoY. The implementation of the forecast will affect EUR negatively. Investors expect the speech of the ECB President Mario Draghi on Tuesday. The official will focus on monetary policy prospects and updated assessments of the economic situation.

Support and resistance

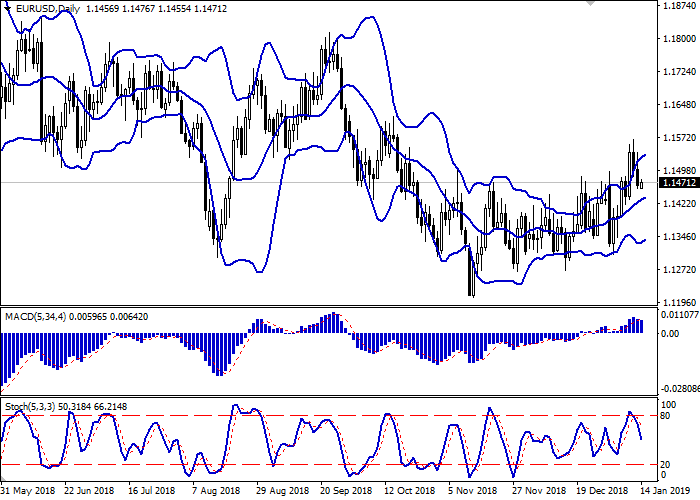

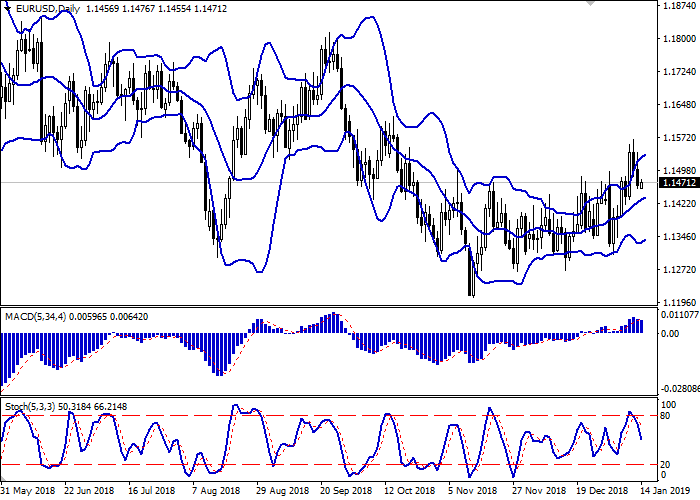

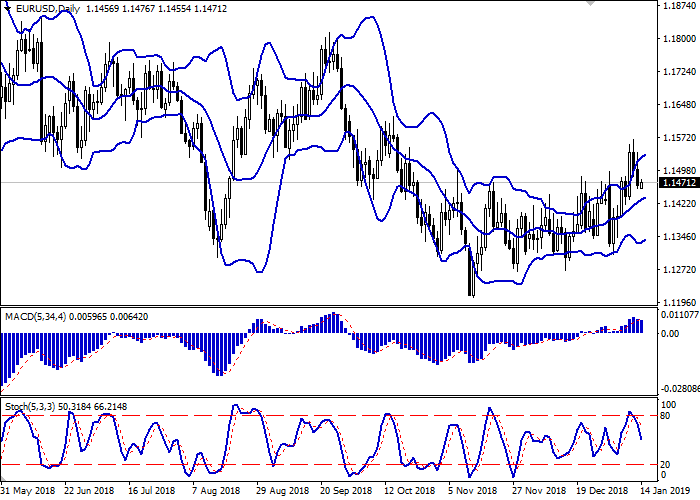

Bollinger Bands in D1 chart show moderate growth. The price range is narrowed being spacious enough for the current activity level. MACD is reversing downwards forming an unsteady sell signal (located below the signal line). Stochastic is showing a slightly more stable sell signal and is located approximately in the middle of its area.

The further development of the downtrend is possible in the short and/or ultra-short term.

Resistance levels: 1.1500, 1.1522, 1.1547, 1.1568.

Support levels: 1.1455, 1.1442, 1.1421, 1.1400.

Trading tips

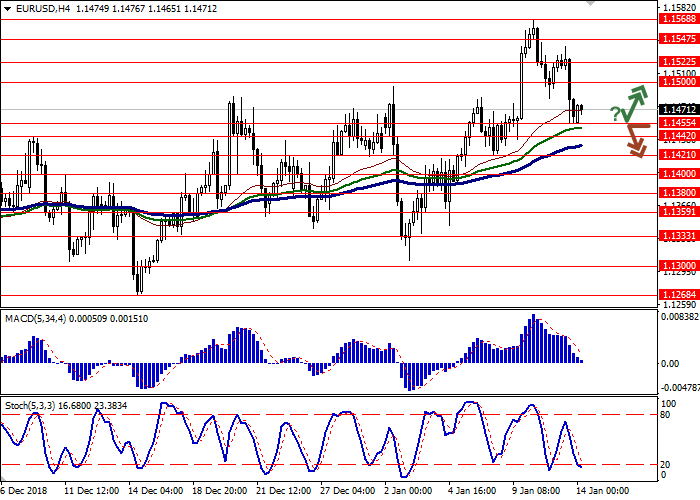

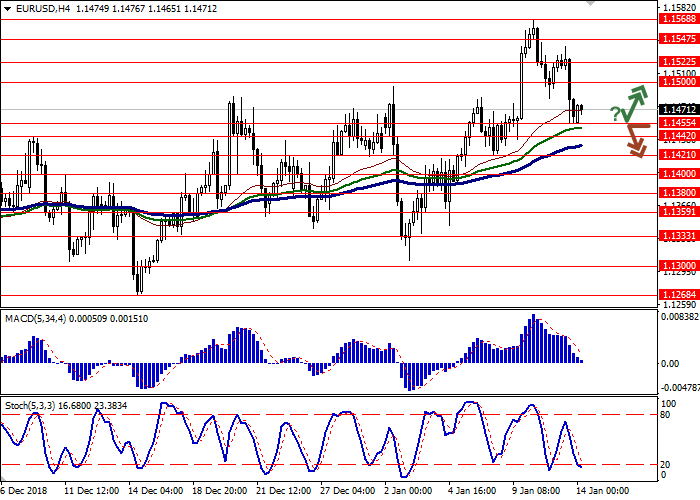

To open long positions, one can rely on the rebound from the support level of 1.1455 with subsequent breakout of 1.1480 or 1.1500. Take profit — 1.1568 or 1.1580. Stop loss — 1.1470 or 1.1450. Implementation period: 2-3 days.

A breakdown of 1.1455 or 1.1442 may be a signal to further sales with target at 1.1400 or 1.1380. Stop loss — 1.1470 or 1.1480. Implementation period: 1-2 days.

EUR declined against USD at the end of last week, retreating from local highs of October 17.

As there is a lack of significant economic releases, EUR is trading under the influence of American and British news. Investors remain optimistic about the negotiations between the US and China, which may become more specific. EUR is supported by the ongoing US government shutdown and the Fed's intention to wait with the next rate hike.

Today, investors are waiting for the publication of the November data on EU Industrial Production, which are expected to be poor. The indicator can fall by 1.5% MoM and by 2.3% YoY. The implementation of the forecast will affect EUR negatively. Investors expect the speech of the ECB President Mario Draghi on Tuesday. The official will focus on monetary policy prospects and updated assessments of the economic situation.

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range is narrowed being spacious enough for the current activity level. MACD is reversing downwards forming an unsteady sell signal (located below the signal line). Stochastic is showing a slightly more stable sell signal and is located approximately in the middle of its area.

The further development of the downtrend is possible in the short and/or ultra-short term.

Resistance levels: 1.1500, 1.1522, 1.1547, 1.1568.

Support levels: 1.1455, 1.1442, 1.1421, 1.1400.

Trading tips

To open long positions, one can rely on the rebound from the support level of 1.1455 with subsequent breakout of 1.1480 or 1.1500. Take profit — 1.1568 or 1.1580. Stop loss — 1.1470 or 1.1450. Implementation period: 2-3 days.

A breakdown of 1.1455 or 1.1442 may be a signal to further sales with target at 1.1400 or 1.1380. Stop loss — 1.1470 or 1.1480. Implementation period: 1-2 days.

No comments:

Write comments