AUD/USD: general review

09 January 2019, 12:40

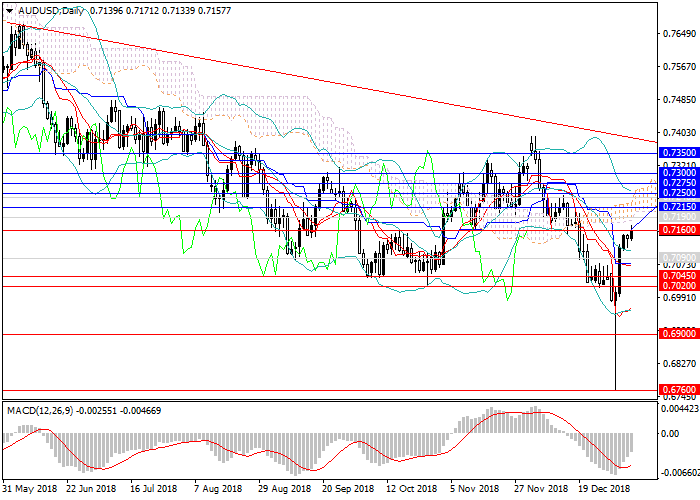

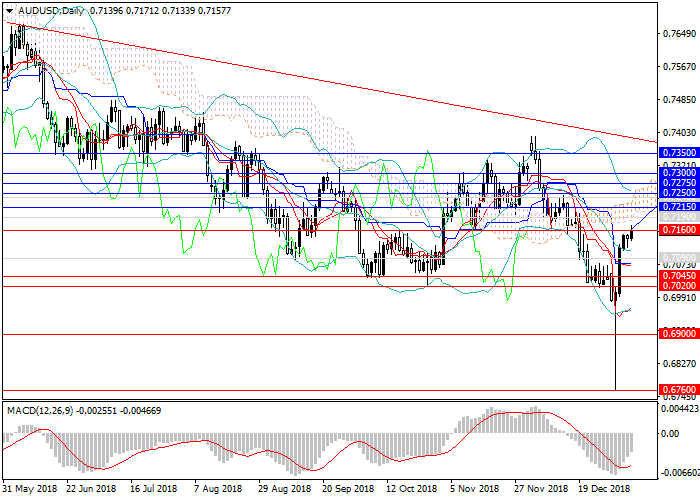

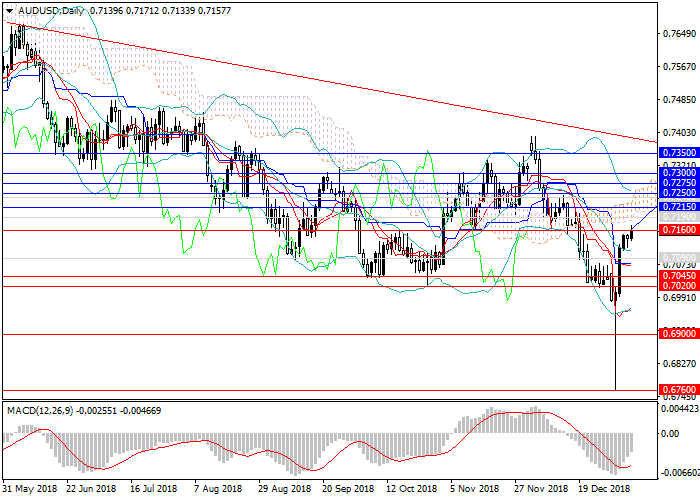

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 0.7157 |

| Take Profit | 0.7020, 0.6900, 0.6760 |

| Stop Loss | 0.7275 |

| Key Levels | 0.6760, 0.6900, 0.7020, 0.7045, 0.7090, 0.7160, 0.7190, 0.7215, 0.7250, 0.7275, 0.7300, 0.7350 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL LIMIT |

| Entry Point | 0.7215, 0.7275, 0.7300 |

| Take Profit | 0.7020, 0.6900, 0.6760 |

| Stop Loss | 0.7410 |

| Key Levels | 0.6760, 0.6900, 0.7020, 0.7045, 0.7090, 0.7160, 0.7190, 0.7215, 0.7250, 0.7275, 0.7300, 0.7350 |

Current trend

The Australian currency is rapidly recovering against the US dollar after a significant drop in the early days of the new year.

In a few days, the pair won back more than 400 points and reached a mid-December level of 0.7160. Sharp growth was replaced by a measured upward movement. The instrument also grows on fundamental releases: USD was pressured by weak labor market data; in particular, the unemployment rate rose by 0.2% in December. Australia's indices and construction sector releases were also weak, but the US dollar is showing a more rapid decline.

Today, one should focus on the publication of the FOMC minutes. At the end of the week, there will be data on the labor market and inflation in the US, and Australia will respond with releases on retail sales.

Support and resistance

In the short term, an upward momentum with target levels of 0.7275 and 0.7300 is expected to continue. From them, the pair will form a narrowing side channel. In the medium term, there is a high probability of wide lateral movement, after which the instrument will head towards new lows of 0.6900, 0.6760.

Technical indicators confirm the fall outlook in the medium term: MACD indicates the preservation of the high volume of short positions, and Bollinger Bands are still pointing downwards.

Support levels: 0.7160, 0.7090, 0.7045, 0.7020, 0.6900, 0.6760.

Resistance levels: 0.7190, 0.7215, 0.7250, 0.7275, 0.7300, 0.7350.

Trading tips

Short positions can be opened from the current level; deferred short positions may be opened from the levels of 0.7215, 0.7275, 0.7300 with the target at 0.7020 (in the medium term – 0.6900, 0.6760) and stop loss at 0.7410.

The Australian currency is rapidly recovering against the US dollar after a significant drop in the early days of the new year.

In a few days, the pair won back more than 400 points and reached a mid-December level of 0.7160. Sharp growth was replaced by a measured upward movement. The instrument also grows on fundamental releases: USD was pressured by weak labor market data; in particular, the unemployment rate rose by 0.2% in December. Australia's indices and construction sector releases were also weak, but the US dollar is showing a more rapid decline.

Today, one should focus on the publication of the FOMC minutes. At the end of the week, there will be data on the labor market and inflation in the US, and Australia will respond with releases on retail sales.

Support and resistance

In the short term, an upward momentum with target levels of 0.7275 and 0.7300 is expected to continue. From them, the pair will form a narrowing side channel. In the medium term, there is a high probability of wide lateral movement, after which the instrument will head towards new lows of 0.6900, 0.6760.

Technical indicators confirm the fall outlook in the medium term: MACD indicates the preservation of the high volume of short positions, and Bollinger Bands are still pointing downwards.

Support levels: 0.7160, 0.7090, 0.7045, 0.7020, 0.6900, 0.6760.

Resistance levels: 0.7190, 0.7215, 0.7250, 0.7275, 0.7300, 0.7350.

Trading tips

Short positions can be opened from the current level; deferred short positions may be opened from the levels of 0.7215, 0.7275, 0.7300 with the target at 0.7020 (in the medium term – 0.6900, 0.6760) and stop loss at 0.7410.

No comments:

Write comments