AUD/USD: general analysis

17 January 2019, 09:18

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.7156 |

| Take Profit | 0.7220 |

| Stop Loss | 0.7195 |

| Key Levels | 0.6986, 0.7042, 0.7089, 0.7150, 0.7192, 0.7224, 0.7251, 0.7290 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7135 |

| Take Profit | 0.7080 |

| Stop Loss | 0.7175 |

| Key Levels | 0.6986, 0.7042, 0.7089, 0.7150, 0.7192, 0.7224, 0.7251, 0.7290 |

Current trend

Today, the AUD/USD pair was moderately declining due to the poor macroeconomic statistics on inflation and mortgage lending in Australia.

On Thursday, the Melbourne Institute published a forecast on consumer price inflation. Weak inflationary expectations correspond to the cautious position of the Australian regulator and do not imply a tightening of monetary policy in the long term. In addition, AUD was under pressure from a drop in the volume of investments in the Australian housing market in November 2018.

At the same time, the delegate from the United States, Robert Lighthizer, a member of the trade negotiations with China, said that there was no progress on the topic of structural reforms. Investors were disappointed with the rhetoric of the American representative, while AUD suffered more than USD.

Today, the publication of data on the US labor market, scheduled for 15:30 (GMT+2), may influence the dynamics of the pair.

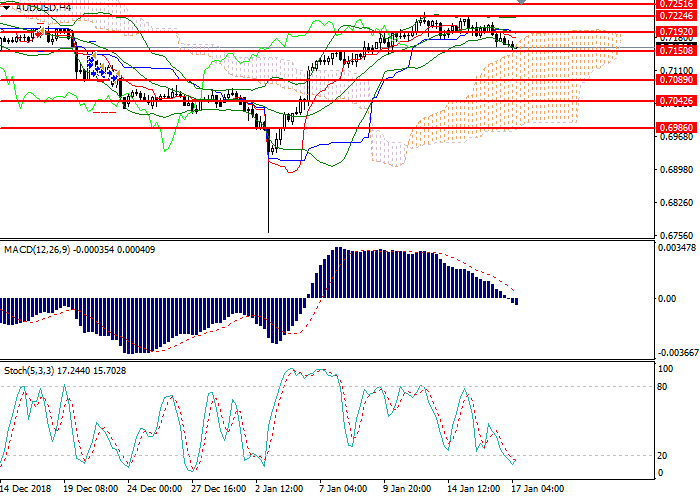

Support and resistance

On the 4-hour chart, the instrument is falling along the lower border of Bollinger bands. The key support level is 0.7150. Bollinger bands are directed horizontally, and the price range widens, indicating a continuation of the downward trend. MACD histogram is being corrected in the neutral zone. Stochastic is preparing to leave the overbought area, a strong buy signal can be formed in the coming hours.

Support levels: 0.7150, 0.7089, 0.7042, 0.6986.

Resistance levels: 0.7192, 0.7224, 0.7251, 0.7290.

Trading tips

Long positions can be opened from the current level with the target at 0.7220 and stop loss 0.7195. Implementation period: 1 day.

Short positions can be opened below the level of 0.7140 with the target at 0.7080 and stop loss 0.7175. Implementation period: 1–2 days.

Today, the AUD/USD pair was moderately declining due to the poor macroeconomic statistics on inflation and mortgage lending in Australia.

On Thursday, the Melbourne Institute published a forecast on consumer price inflation. Weak inflationary expectations correspond to the cautious position of the Australian regulator and do not imply a tightening of monetary policy in the long term. In addition, AUD was under pressure from a drop in the volume of investments in the Australian housing market in November 2018.

At the same time, the delegate from the United States, Robert Lighthizer, a member of the trade negotiations with China, said that there was no progress on the topic of structural reforms. Investors were disappointed with the rhetoric of the American representative, while AUD suffered more than USD.

Today, the publication of data on the US labor market, scheduled for 15:30 (GMT+2), may influence the dynamics of the pair.

Support and resistance

On the 4-hour chart, the instrument is falling along the lower border of Bollinger bands. The key support level is 0.7150. Bollinger bands are directed horizontally, and the price range widens, indicating a continuation of the downward trend. MACD histogram is being corrected in the neutral zone. Stochastic is preparing to leave the overbought area, a strong buy signal can be formed in the coming hours.

Support levels: 0.7150, 0.7089, 0.7042, 0.6986.

Resistance levels: 0.7192, 0.7224, 0.7251, 0.7290.

Trading tips

Long positions can be opened from the current level with the target at 0.7220 and stop loss 0.7195. Implementation period: 1 day.

Short positions can be opened below the level of 0.7140 with the target at 0.7080 and stop loss 0.7175. Implementation period: 1–2 days.

No comments:

Write comments