YM: general review

11 December 2018, 11:31

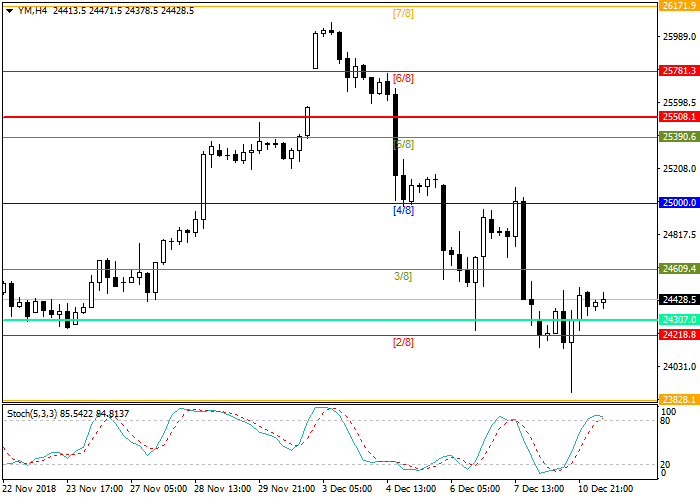

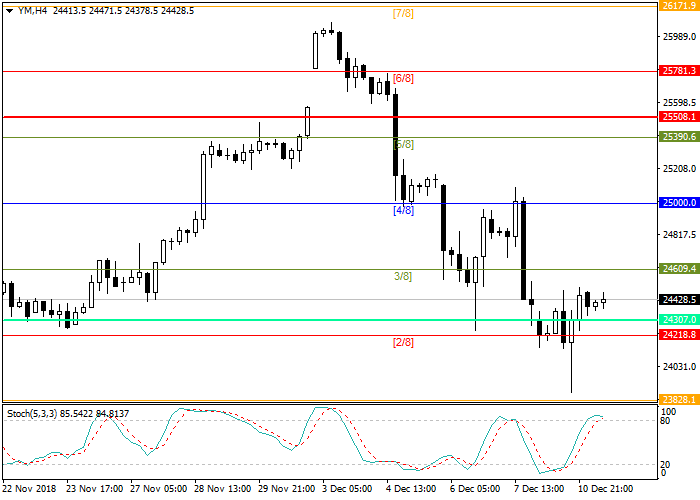

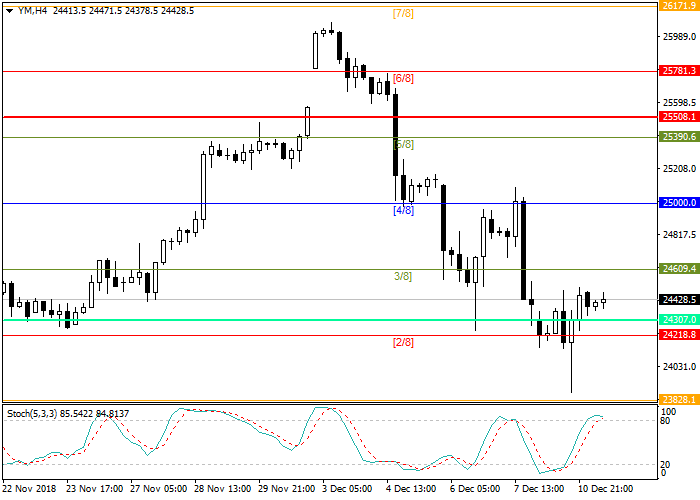

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL LIMIT |

| Entry Point | 24609.4 |

| Take Profit | 24218.8 |

| Stop Loss | 24722.0 |

| Key Levels | 23982.0, 24218.8, 24609.4, 24722.0 |

Current trend

The Dow Jones index is slightly recovering and trading above support level of 24218.8 (Murrey [2/8]). Demand in the markets was caused by the news that the Vice-Premier of China and a representative of the US Treasury discussed the next stage of negotiations.

The US dollar is strengthening against the backdrop of political risks that are associated with Brexit. On the other hand, economists at Goldman Sachs, a major investment bank, predict that the Fed may delay the further tightening of monetary policy next year, which in turn will support the stock market and reduce USD exchange rate. However, this is only a preliminary assessment and the regulator will make its decisions based on economic data.

The second important event for the market is the political crisis in the United States. It became known that the former lawyer of Donald Trump may be sentenced to prison because of tax evasion and various frauds during the election campaign. As a result, Democrats can begin hearings about the impeachment of the current US president.

Today, data on producer price index in the United States will be published.

Support and resistance

Stochastic is at the level of 80 points and indicates the possible correction.

Resistance levels: 24609.4, 24722.0.

Support levels: 24218.8, 23982.0.

Trading tips

Short positions may be opened from the resistance level of 24609.4 with take-profit at 24218.8 and stop loss at 24722.0.

The Dow Jones index is slightly recovering and trading above support level of 24218.8 (Murrey [2/8]). Demand in the markets was caused by the news that the Vice-Premier of China and a representative of the US Treasury discussed the next stage of negotiations.

The US dollar is strengthening against the backdrop of political risks that are associated with Brexit. On the other hand, economists at Goldman Sachs, a major investment bank, predict that the Fed may delay the further tightening of monetary policy next year, which in turn will support the stock market and reduce USD exchange rate. However, this is only a preliminary assessment and the regulator will make its decisions based on economic data.

The second important event for the market is the political crisis in the United States. It became known that the former lawyer of Donald Trump may be sentenced to prison because of tax evasion and various frauds during the election campaign. As a result, Democrats can begin hearings about the impeachment of the current US president.

Today, data on producer price index in the United States will be published.

Support and resistance

Stochastic is at the level of 80 points and indicates the possible correction.

Resistance levels: 24609.4, 24722.0.

Support levels: 24218.8, 23982.0.

Trading tips

Short positions may be opened from the resistance level of 24609.4 with take-profit at 24218.8 and stop loss at 24722.0.

No comments:

Write comments