NZD/USD: general review

11 December 2018, 11:20

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 0.6835 |

| Take Profit | 0.6785 |

| Stop Loss | 0.6865 |

| Key Levels | 0.6967, 0.6954, 0.6931, 0.6904, 0.6886, 0.6855, 0.6839, 0.6820 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.6905 |

| Take Profit | 0.6954 |

| Stop Loss | 0.6875 |

| Key Levels | 0.6967, 0.6954, 0.6931, 0.6904, 0.6886, 0.6855, 0.6839, 0.6820 |

Current trend

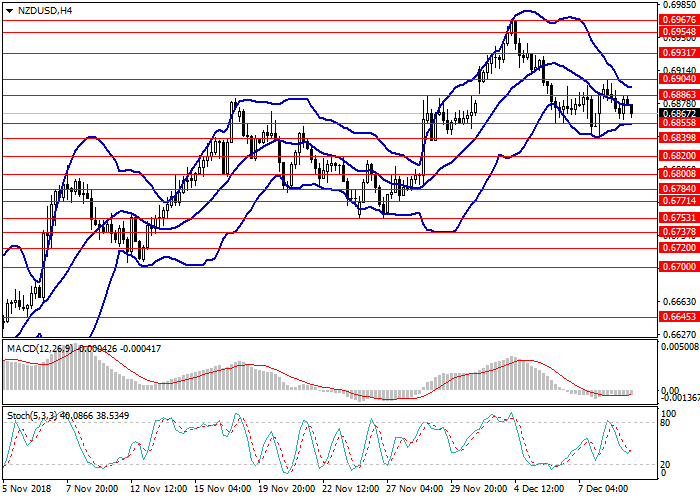

In the absence of significant macroeconomic releases from the United States, the movement of the pair is technical in nature, the instrument is moving in the sideways channel formed by the boundaries of the Bollinger Bands indicator.

ANZ Bank's monthly inflation report published today supported the New Zealand dollar: the inflation rate rose by 0.6% on a monthly basis and by 2.8% on an annualized basis.

As for the macroeconomic releases that could have an impact on the pair today, it is worth highlighting statistics on the producer price index in the US (15:30 GMT+2). Moderate volatility is expected in the market.

Support and resistance

On the 4-hour chart, the pair was corrected to the middle line of the "Bollinger Bands". The MACD histogram is in the negative area, maintaining a weak signal to open short positions.

Support levels: 0.6855, 0.6839, 0.6820.

Resistance levels are 0.6886, 0.6904, 0.6931, 0.6954, 0.6967.

Trading tips

Short positions can be opened at the level of 0.6835 with the target at 0.6785 and the stop loss at 0.6865.

Long positions will be relevant at 0.6905 with a target at 0.6954 and a stop loss at 0.6875.

Implementation period: 2-3 days.

In the absence of significant macroeconomic releases from the United States, the movement of the pair is technical in nature, the instrument is moving in the sideways channel formed by the boundaries of the Bollinger Bands indicator.

ANZ Bank's monthly inflation report published today supported the New Zealand dollar: the inflation rate rose by 0.6% on a monthly basis and by 2.8% on an annualized basis.

As for the macroeconomic releases that could have an impact on the pair today, it is worth highlighting statistics on the producer price index in the US (15:30 GMT+2). Moderate volatility is expected in the market.

Support and resistance

On the 4-hour chart, the pair was corrected to the middle line of the "Bollinger Bands". The MACD histogram is in the negative area, maintaining a weak signal to open short positions.

Support levels: 0.6855, 0.6839, 0.6820.

Resistance levels are 0.6886, 0.6904, 0.6931, 0.6954, 0.6967.

Trading tips

Short positions can be opened at the level of 0.6835 with the target at 0.6785 and the stop loss at 0.6865.

Long positions will be relevant at 0.6905 with a target at 0.6954 and a stop loss at 0.6875.

Implementation period: 2-3 days.

No comments:

Write comments