USD/CHF: the dollar is dropping

11 December 2018, 08:30

| Scenario | |

|---|---|

| Timeframe | Intraday |

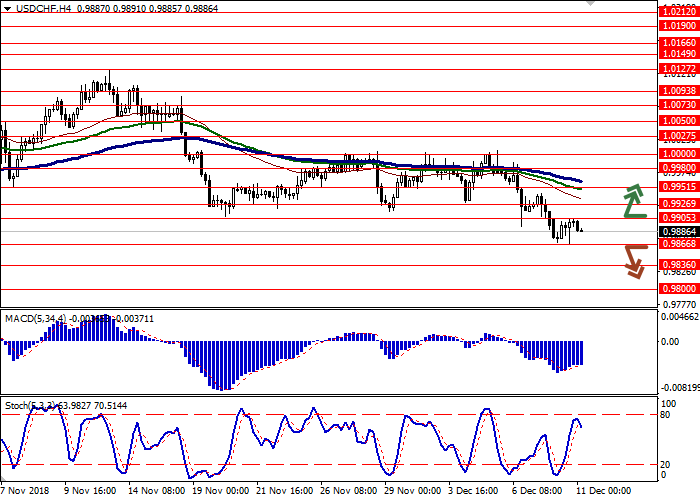

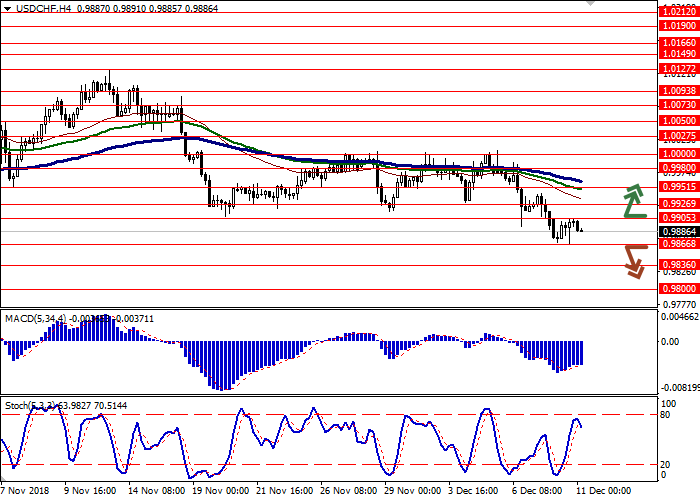

| Recommendation | BUY STOP |

| Entry Point | 0.9910 |

| Take Profit | 0.9980, 1.0000 |

| Stop Loss | 0.9870, 0.9866 |

| Key Levels | 0.9760, 0.9800, 0.9836, 0.9866, 0.9905, 0.9926, 0.9951, 0.9980, 1.0000 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9860 |

| Take Profit | 0.9800, 0.9780, 0.9860 |

| Stop Loss | 0.9900, 0.9905 |

| Key Levels | 0.9760, 0.9800, 0.9836, 0.9866, 0.9905, 0.9926, 0.9951, 0.9980, 1.0000 |

Current trend

USD declined against CHF on Monday, having updated local lows of October 16. However, the instrument failed to keep its positions, and by the moment of closing of the afternoon session it has regained the major part of its losses.

In the morning, USD was under pressure from Friday comments by the head of the St. Louis Fed, James Bullard. He said that the regulator may refuse to raise interest rates at the December meeting due to the inverted yield curve. Such a curve occurs when the yield on 2-year Treasury bonds exceeds the yield on 5-year Treasury bonds, and may indicate a near economic recession. According to Bullard, the increase can be postponed until January 2019. Earlier, hints of a slower increase of interest rates have already been made, but it was believed that this could happen only next year.

Support and resistance

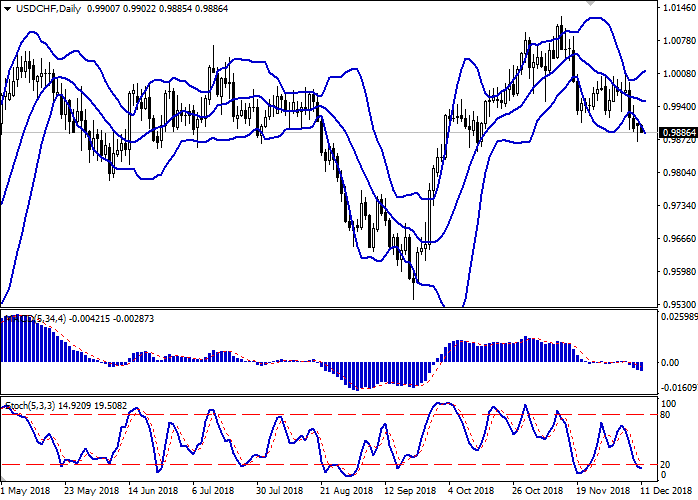

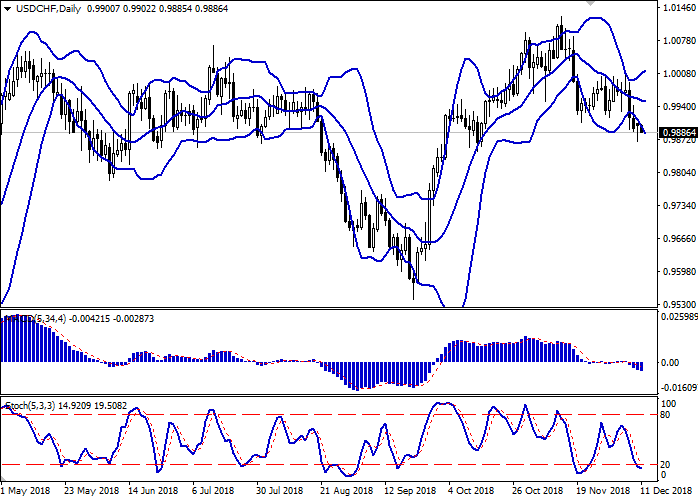

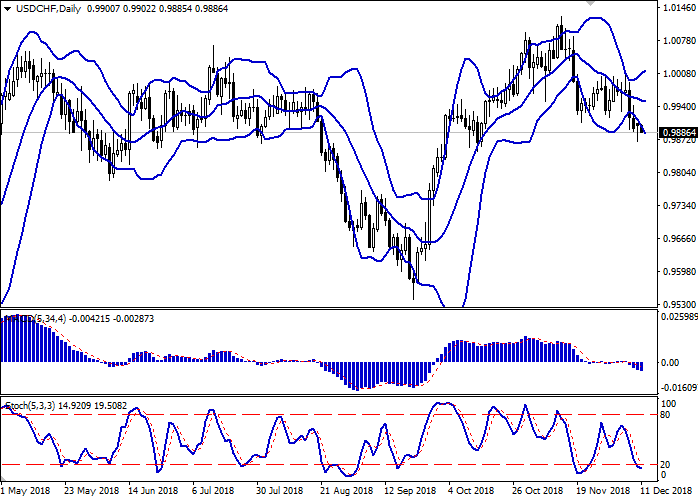

In the D1 chart Bollinger Bands demonstrate a tendency to reverse into a horizontal plane. The price range is widening but does not conform to the development of the "bearish" trend yet. MACD is going down keeping a fairly stable sell signal (located below the signal line). Stochastic keeps a downward direction but is already approaching its minimum levels, which indicates the oversold USD in the ultra-short term.

Existing short positions should be kept until the situation clears up.

Resistance levels: 0.9905, 0.9926, 0.9951, 0.9980, 1.0000.

Support levels: 0.9866, 0.9836, 0.9800, 0.9760.

Trading tips

To open long positions, one can rely on the breakout of 0.9905. Take profit – 0.9980 or 1.0000. Stop loss — 0.9870 or 0.9866.

A confident breakdown of 0.9866 may be a signal to further sales with targets at 0.9800 or 0.9780, 0.9860. Stop-loss should be placed no further than 0.9900 or 0.9905.

Implementation period: 2-3 days.

USD declined against CHF on Monday, having updated local lows of October 16. However, the instrument failed to keep its positions, and by the moment of closing of the afternoon session it has regained the major part of its losses.

In the morning, USD was under pressure from Friday comments by the head of the St. Louis Fed, James Bullard. He said that the regulator may refuse to raise interest rates at the December meeting due to the inverted yield curve. Such a curve occurs when the yield on 2-year Treasury bonds exceeds the yield on 5-year Treasury bonds, and may indicate a near economic recession. According to Bullard, the increase can be postponed until January 2019. Earlier, hints of a slower increase of interest rates have already been made, but it was believed that this could happen only next year.

Support and resistance

In the D1 chart Bollinger Bands demonstrate a tendency to reverse into a horizontal plane. The price range is widening but does not conform to the development of the "bearish" trend yet. MACD is going down keeping a fairly stable sell signal (located below the signal line). Stochastic keeps a downward direction but is already approaching its minimum levels, which indicates the oversold USD in the ultra-short term.

Existing short positions should be kept until the situation clears up.

Resistance levels: 0.9905, 0.9926, 0.9951, 0.9980, 1.0000.

Support levels: 0.9866, 0.9836, 0.9800, 0.9760.

Trading tips

To open long positions, one can rely on the breakout of 0.9905. Take profit – 0.9980 or 1.0000. Stop loss — 0.9870 or 0.9866.

A confident breakdown of 0.9866 may be a signal to further sales with targets at 0.9800 or 0.9780, 0.9860. Stop-loss should be placed no further than 0.9900 or 0.9905.

Implementation period: 2-3 days.

No comments:

Write comments