USD/CAD: wave analysis

17 December 2018, 09:38

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1.3381 |

| Take Profit | 1.3700 |

| Stop Loss | 1.3319 |

| Key Levels | 1.3079, 1.3158, 1.3319, 1.3700 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3325 |

| Take Profit | 1.3158, 1.3079 |

| Stop Loss | 1.3385 |

| Key Levels | 1.3079, 1.3158, 1.3319, 1.3700 |

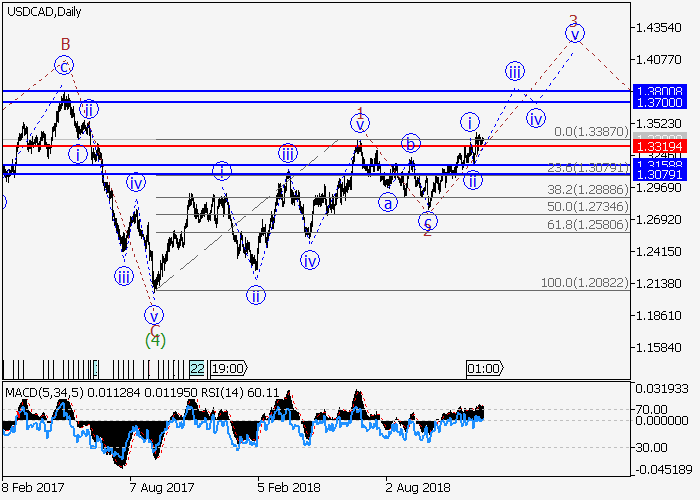

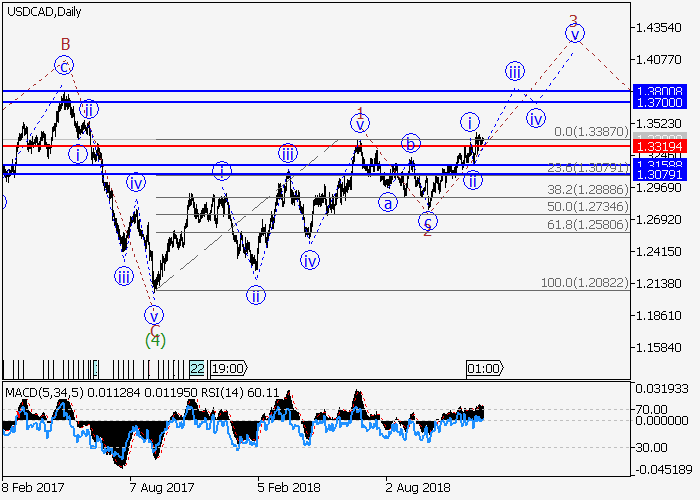

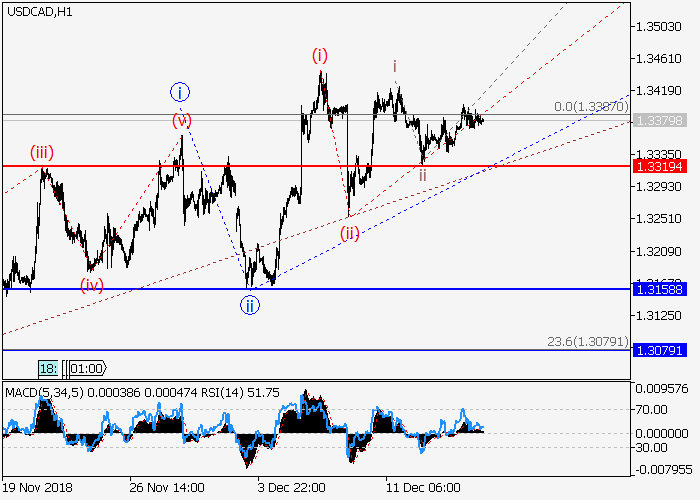

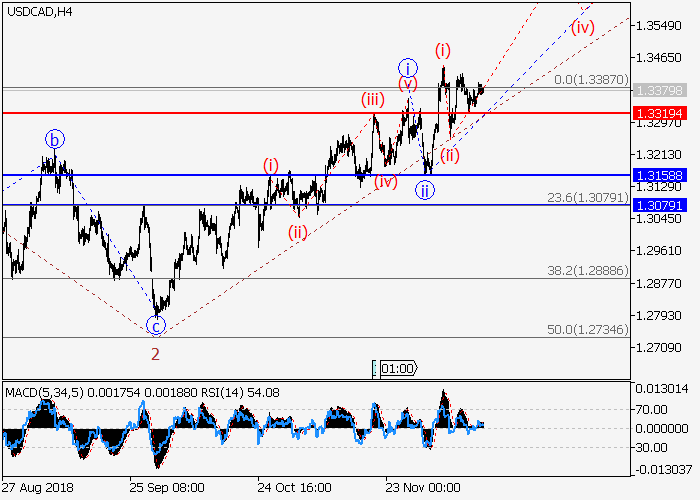

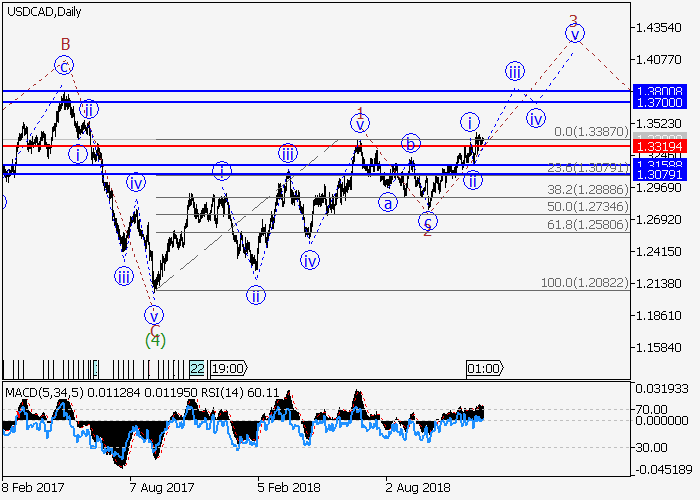

The pair is likely to grow.

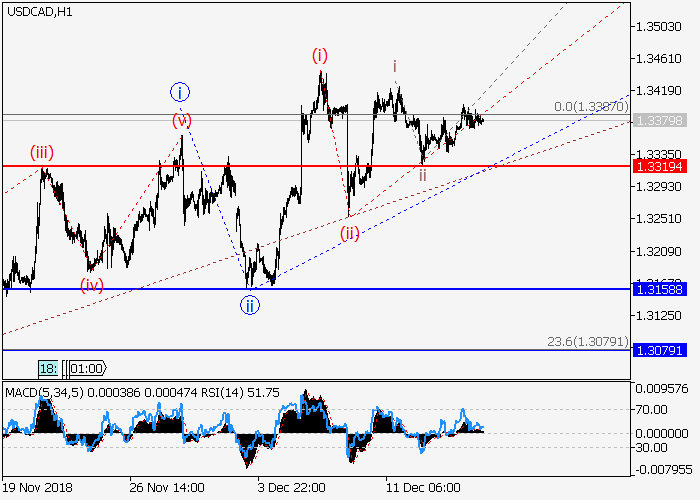

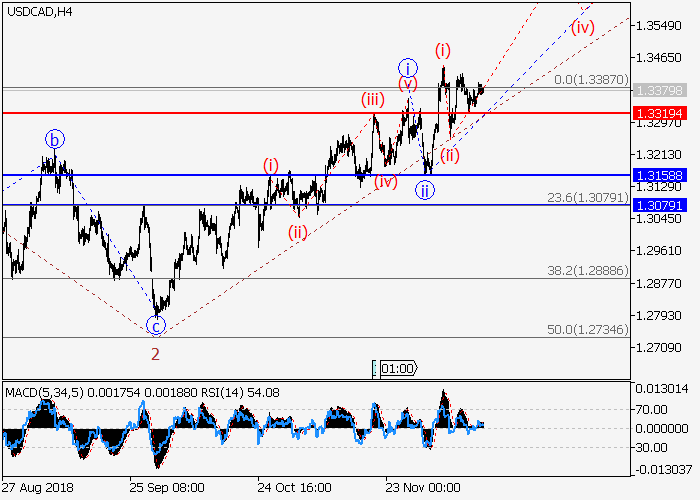

On the H4 graph, the third wave of the senior level 3 is developing. At the moment, it is likely that the third wave of the junior level iii of 3 is being formed, within which waves (i) and (ii) have ended. If the assumption is correct, the pair will continue to grow to the level of 1.3700 within wave (iii) of iii. The critical level for this scenario is 1.3319.

Main scenario

Long positions will become relevant above the level of 1.3319 with the target of 1.3700. Implementation period: 7+ days.

Alternative scenario

Breakdown and consolidation of the price below the level of 1.3319 will allow the pair to decline to the levels of 1.3158–1.3079.

On the H4 graph, the third wave of the senior level 3 is developing. At the moment, it is likely that the third wave of the junior level iii of 3 is being formed, within which waves (i) and (ii) have ended. If the assumption is correct, the pair will continue to grow to the level of 1.3700 within wave (iii) of iii. The critical level for this scenario is 1.3319.

Main scenario

Long positions will become relevant above the level of 1.3319 with the target of 1.3700. Implementation period: 7+ days.

Alternative scenario

Breakdown and consolidation of the price below the level of 1.3319 will allow the pair to decline to the levels of 1.3158–1.3079.

No comments:

Write comments