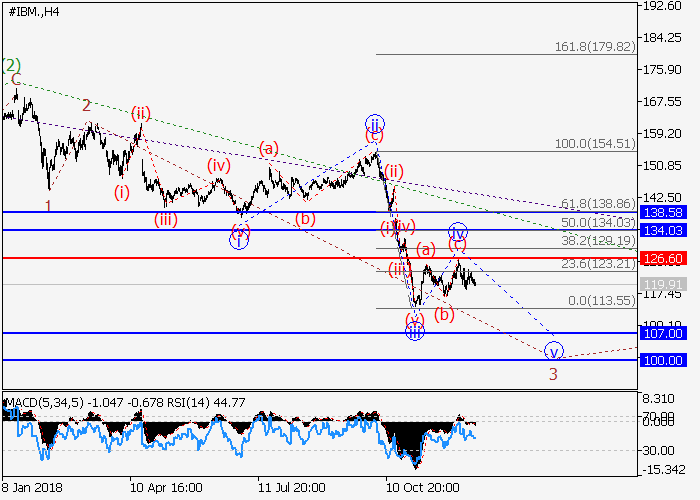

IBM Corp: wave analysis

17 December 2018, 09:40

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 123.84 |

| Take Profit | 107.00, 100.00 |

| Stop Loss | 126.60 |

| Key Levels | 107.00, 107.00, 126.60, 134.03, 138.58 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 126.65 |

| Take Profit | 134.03, 138.58 |

| Stop Loss | 124.15 |

| Key Levels | 107.00, 107.00, 126.60, 134.03, 138.58 |

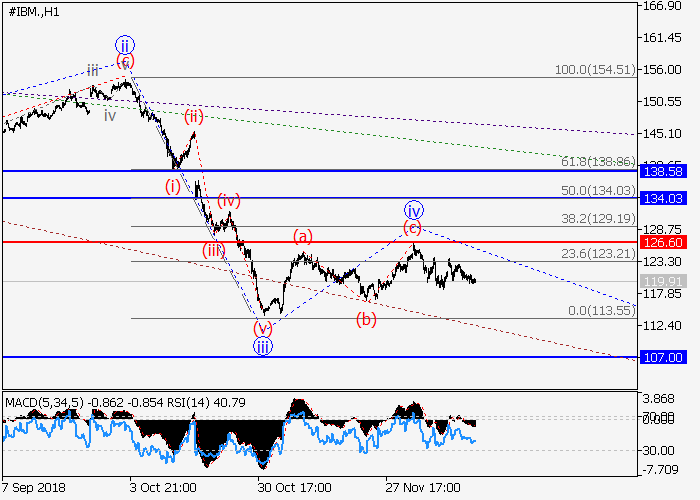

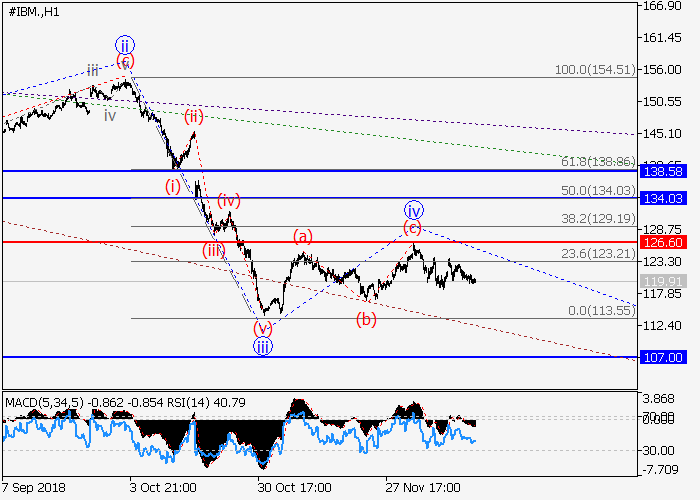

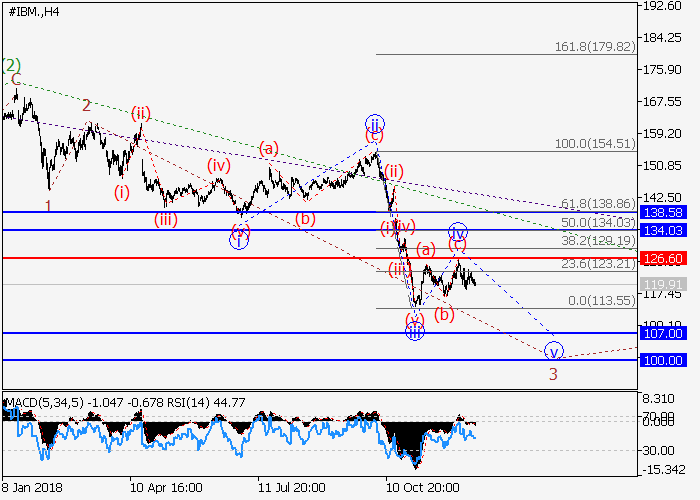

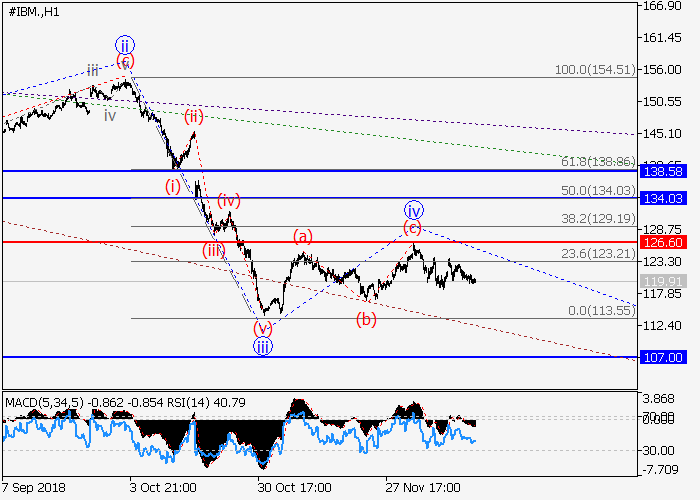

The probability of a decrease is still strong.

On the H4 chart, the downward trend continues to develop as the third wave of the senior level 3. At the moment, the upward correction iv of 3 has apparently completed, and the wave v of 3 has begun to form. The price may reach the levels of 107.00–100.00. The critical level for this scenario is 126.60.

Main scenario

Short positions will become relevant below the level of 126.60 with a target in the range of 107.00–100.00. Implementation period: 7+ days.

Alternative scenario

Breakout and consolidation of the price above the level of 126.60 will allow the asset to grow to the levels of 134.03–138.58.

On the H4 chart, the downward trend continues to develop as the third wave of the senior level 3. At the moment, the upward correction iv of 3 has apparently completed, and the wave v of 3 has begun to form. The price may reach the levels of 107.00–100.00. The critical level for this scenario is 126.60.

Main scenario

Short positions will become relevant below the level of 126.60 with a target in the range of 107.00–100.00. Implementation period: 7+ days.

Alternative scenario

Breakout and consolidation of the price above the level of 126.60 will allow the asset to grow to the levels of 134.03–138.58.

No comments:

Write comments