SPX: general review

18 December 2018, 11:14

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 2538.0 |

| Take Profit | 2500.0 |

| Stop Loss | 2560.0 |

| Key Levels | 2500.0, 2539.1, 2578.1, 2597.1 |

Current trend

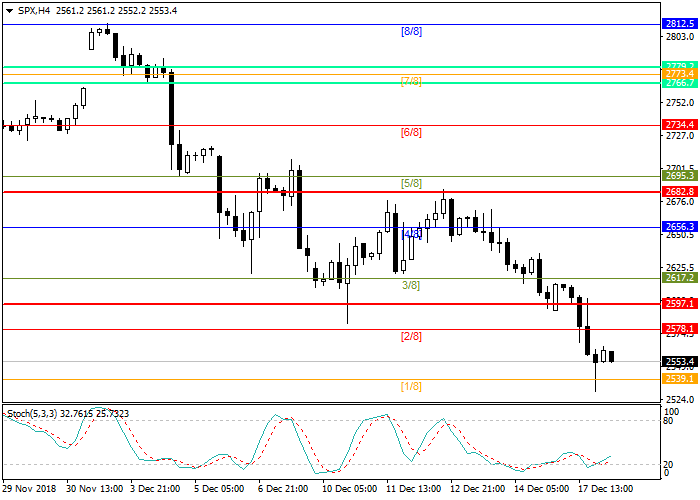

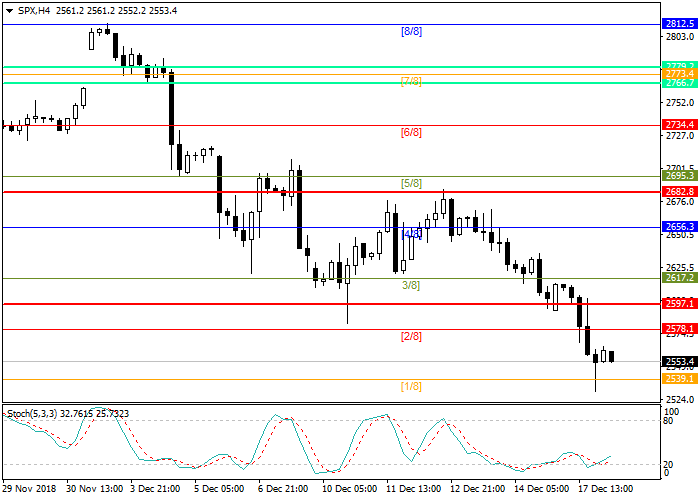

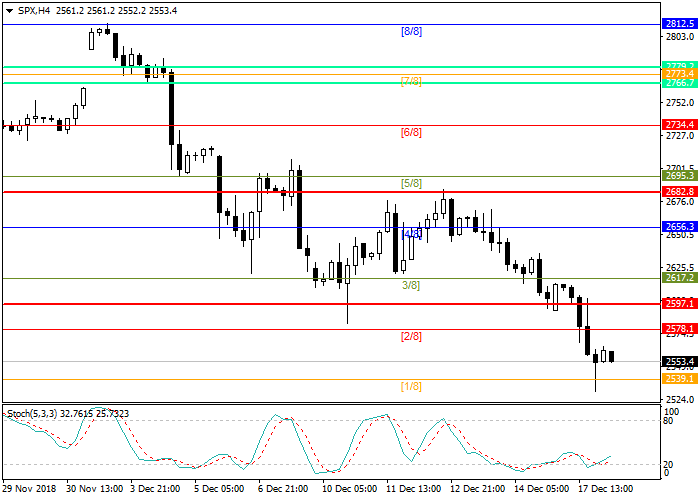

S&P 500 continues declining. The closest support level is at 2539.1 (Murrey [1/8]).

The last Fed meeting in 2018 is due this week. The probability of an interest rate increase by 25 basis points is above 80%, although market prices are probably reflecting this already. Comments that the regulator will make regarding future monetary policy are important, as there are concerns that the policy will change more slowly than previously expected. On the other hand, the US economy is still growing, and the Fed will rely on fundamental data to make its decisions. On Friday the third estimated GDP and consumer spending index will be published. A negative factor for the market is the disagreement between the US Congress and President Donald Trump over the construction of a wall on the border with Mexico, which could lead to a government shutdown.

Support and resistance

Stochastic is at the level of 15 points and indicates the possible correction.

Resistance levels: 2578.1, 2597.1.

Support levels: 2539.1, 2500.0.

Trading tips

Open short positions after the breakdown of the support level of 2539.1 with take profit at 2500.0 and stop loss at 2560.0.

S&P 500 continues declining. The closest support level is at 2539.1 (Murrey [1/8]).

The last Fed meeting in 2018 is due this week. The probability of an interest rate increase by 25 basis points is above 80%, although market prices are probably reflecting this already. Comments that the regulator will make regarding future monetary policy are important, as there are concerns that the policy will change more slowly than previously expected. On the other hand, the US economy is still growing, and the Fed will rely on fundamental data to make its decisions. On Friday the third estimated GDP and consumer spending index will be published. A negative factor for the market is the disagreement between the US Congress and President Donald Trump over the construction of a wall on the border with Mexico, which could lead to a government shutdown.

Support and resistance

Stochastic is at the level of 15 points and indicates the possible correction.

Resistance levels: 2578.1, 2597.1.

Support levels: 2539.1, 2500.0.

Trading tips

Open short positions after the breakdown of the support level of 2539.1 with take profit at 2500.0 and stop loss at 2560.0.

No comments:

Write comments