NZD/USD: New Zealand dollar is growing

04 December 2018, 09:12

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6975, 0.7005 |

| Take Profit | 0.7052, 0.7075 |

| Stop Loss | 0.6950, 0.6920 |

| Key Levels | 0.6815, 0.6843, 0.6885, 0.6920, 0.6970, 0.7000, 0.7052 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6915 |

| Take Profit | 0.6815, 0.6780 |

| Stop Loss | 0.6970 |

| Key Levels | 0.6815, 0.6843, 0.6885, 0.6920, 0.6970, 0.7000, 0.7052 |

Current trend

NZD rose against USD on Monday, updating local highs of June 19. The active growth of the instrument can also be traced during today's Asian session.

Investors are focused on the results of a meeting of Donald Trump and Xi Jinping at the G20 summit in Buenos Aires. The leaders managed to negotiate a truce for 90 days. This time will be used for further negotiations, primarily on the issue of protecting American intellectual property in China. Also for this period, the US administration pledged to abandon the implementation of new taxes. In response, the PRC promises to increase purchases of American goods, primarily agricultural ones, in order to reduce the trade deficit of the US and China.

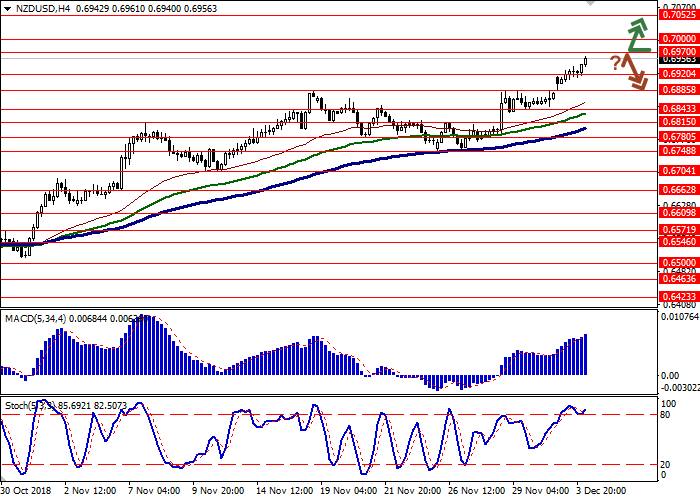

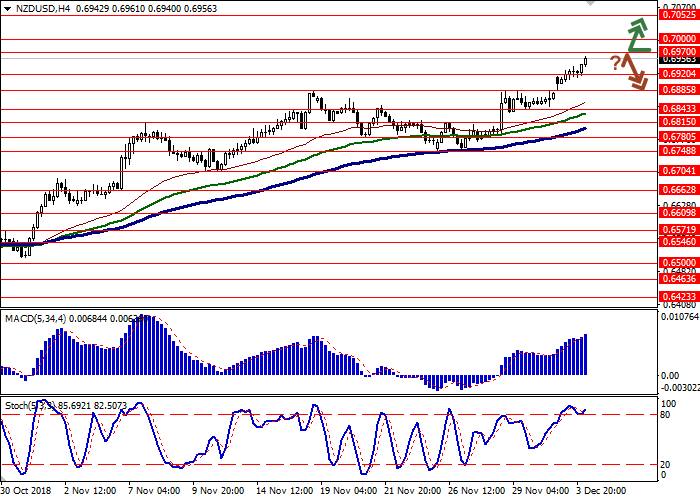

Support and resistance

Bollinger Bands in D1 chart show active growth. The price range is expanding, but it fails to catch the development of "bullish" trend at the moment. MACD indicator is growing, keeping a stable buy signal (located above the signal line). Stochastic retains an upward direction, but is located in close proximity to its maximum levels, which signals about the overbought NZD.

The existing long positions in the short term should be kept until the trading signals from the indicators are clarified.

Resistance levels: 0.6970, 0.7000, 0.7052.

Support levels: 0.6920, 0.6885, 0.6843, 0.6815.

Trading tips

To open long positions, one can rely on the breakout of 0.6970 or 0.7000. Take profit — 0.7052 or 0.7075. Stop loss — 0.6950 or 0.6920. Implementation period: 1-2 days.

The rebound from 0.6970 as from resistance with the subsequent breakdown of 0.6920 can become a signal to begin correctional sales with target at 0.6815 or 0.6780. Stop loss — 0.6970. Implementation period: 2-3 days.

NZD rose against USD on Monday, updating local highs of June 19. The active growth of the instrument can also be traced during today's Asian session.

Investors are focused on the results of a meeting of Donald Trump and Xi Jinping at the G20 summit in Buenos Aires. The leaders managed to negotiate a truce for 90 days. This time will be used for further negotiations, primarily on the issue of protecting American intellectual property in China. Also for this period, the US administration pledged to abandon the implementation of new taxes. In response, the PRC promises to increase purchases of American goods, primarily agricultural ones, in order to reduce the trade deficit of the US and China.

Support and resistance

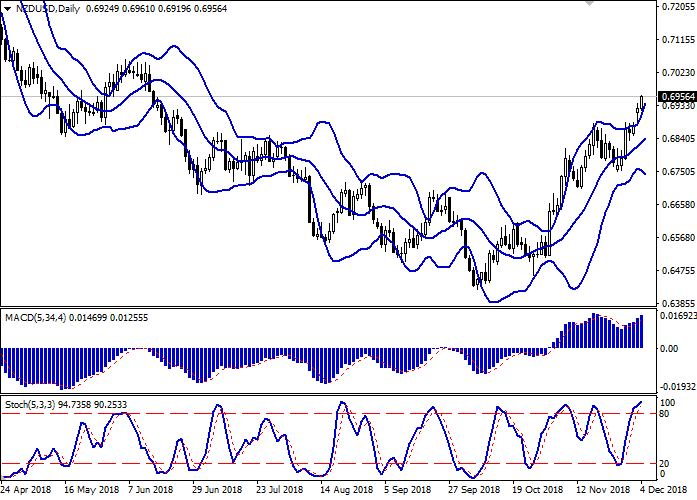

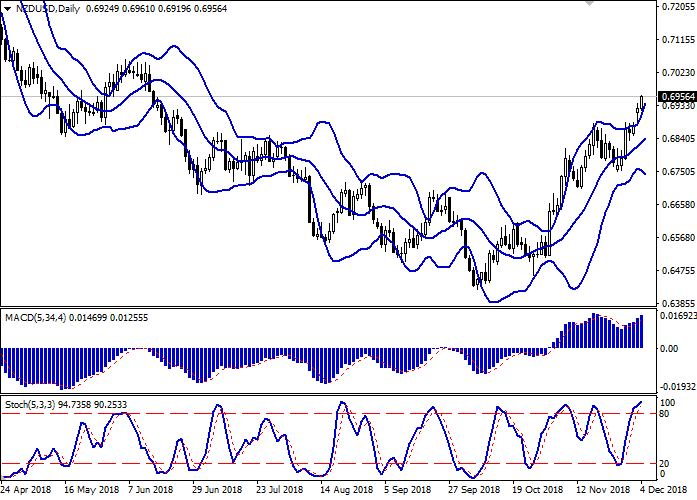

Bollinger Bands in D1 chart show active growth. The price range is expanding, but it fails to catch the development of "bullish" trend at the moment. MACD indicator is growing, keeping a stable buy signal (located above the signal line). Stochastic retains an upward direction, but is located in close proximity to its maximum levels, which signals about the overbought NZD.

The existing long positions in the short term should be kept until the trading signals from the indicators are clarified.

Resistance levels: 0.6970, 0.7000, 0.7052.

Support levels: 0.6920, 0.6885, 0.6843, 0.6815.

Trading tips

To open long positions, one can rely on the breakout of 0.6970 or 0.7000. Take profit — 0.7052 or 0.7075. Stop loss — 0.6950 or 0.6920. Implementation period: 1-2 days.

The rebound from 0.6970 as from resistance with the subsequent breakdown of 0.6920 can become a signal to begin correctional sales with target at 0.6815 or 0.6780. Stop loss — 0.6970. Implementation period: 2-3 days.

No comments:

Write comments