GBP/USD: the pound is recovering

13 December 2018, 09:42

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.2675 |

| Take Profit | 1.2793, 1.2838 |

| Stop Loss | 1.2620 |

| Key Levels | 1.2476, 1.2533, 1.2574, 1.2600, 1.2670, 1.2722, 1.2763, 1.2793 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2590, 1.2570 |

| Take Profit | 1.2476, 1.2450 |

| Stop Loss | 1.2620, 1.2640 |

| Key Levels | 1.2476, 1.2533, 1.2574, 1.2600, 1.2670, 1.2722, 1.2763, 1.2793 |

Current trend

GBP showed strong growth against USD on Wednesday, recovering from an update of record lows of April 2017 the day before.

The pound is strengthening, despite the growing political uncertainty in the UK. Among the Conservative Party there are enough members to demand the removal of Teresa May from the post of chairman. On Wednesday evening, a vote was taken by members of the House of Commons from the ruling Conservative Party on the issue of confidence in the party leader and current Prime Minister Theresa May. 200 MPs backed May and 115 MPs voted against her. Now, according to British law, parliamentarians will not be able to repeat this procedure in the next 12 months.

Today, GBP is traded lower. RICS House Price Balance exerts moderate pressure on the instrument. In November, the figure fell by 11%, accelerating from the previous 10% in October.

Support and resistance

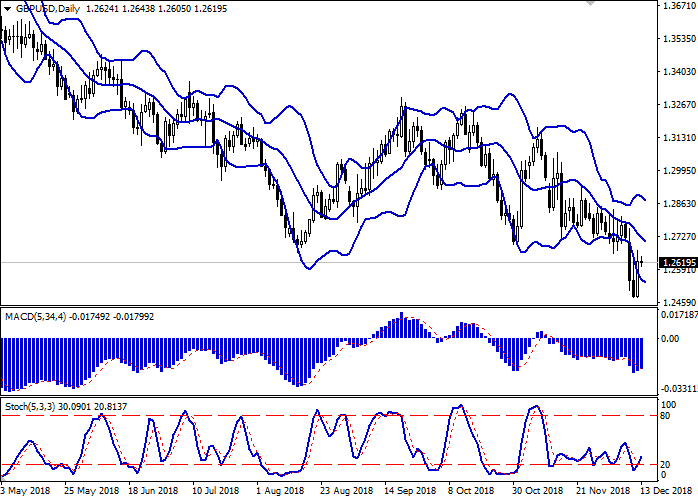

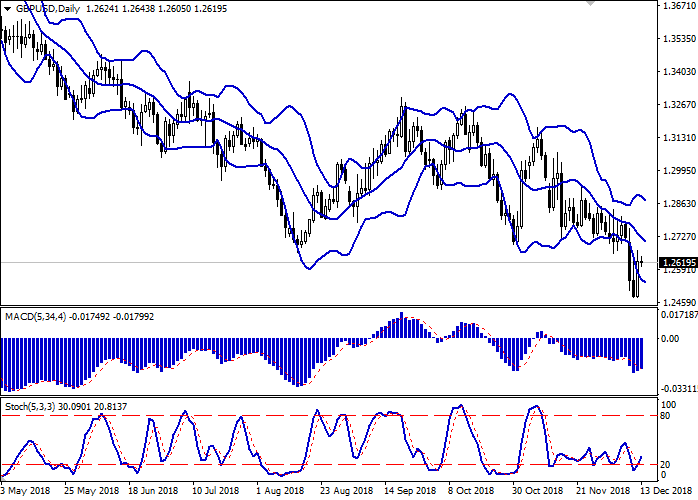

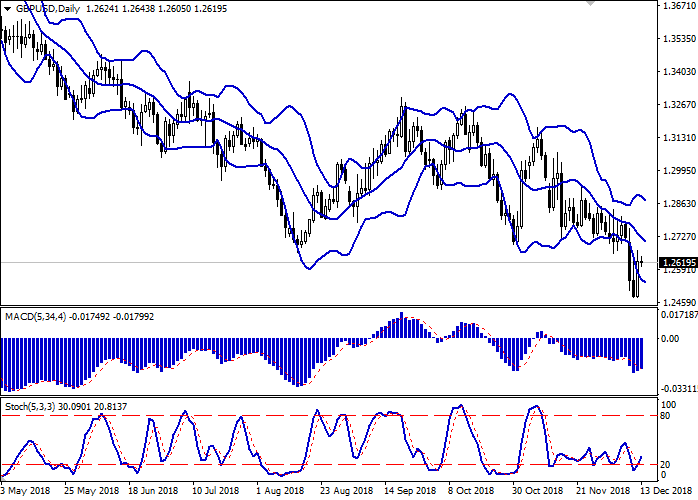

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is widening but does not conform to the development of the "bearish" trend yet. MACD indicator is growing and is about to form a new buy signal (it should be located above the signal line). Stochastic is growing, retreating from its minimum levels, indicating the oversold pound earlier.

Developing the upward dynamics in the near future is possible.

Resistance levels: 1.2670, 1.2722, 1.2763, 1.2793.

Support levels: 1.2600, 1.2574, 1.2533, 1.2476.

Trading tips

To open long positions, one can rely on the breakout of 1.2670. Take profit — 1.2793 or 1.2838. Stop loss — 1.2620.

The return of "bearish" trend with the breakdown of 1.2600 or 1.2574 may become a signal to resume sales with target at 1.2476 or 1.2450. Stop loss — 1.2620 or 1.2640.

Implementation period: 2-3 days.

GBP showed strong growth against USD on Wednesday, recovering from an update of record lows of April 2017 the day before.

The pound is strengthening, despite the growing political uncertainty in the UK. Among the Conservative Party there are enough members to demand the removal of Teresa May from the post of chairman. On Wednesday evening, a vote was taken by members of the House of Commons from the ruling Conservative Party on the issue of confidence in the party leader and current Prime Minister Theresa May. 200 MPs backed May and 115 MPs voted against her. Now, according to British law, parliamentarians will not be able to repeat this procedure in the next 12 months.

Today, GBP is traded lower. RICS House Price Balance exerts moderate pressure on the instrument. In November, the figure fell by 11%, accelerating from the previous 10% in October.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is widening but does not conform to the development of the "bearish" trend yet. MACD indicator is growing and is about to form a new buy signal (it should be located above the signal line). Stochastic is growing, retreating from its minimum levels, indicating the oversold pound earlier.

Developing the upward dynamics in the near future is possible.

Resistance levels: 1.2670, 1.2722, 1.2763, 1.2793.

Support levels: 1.2600, 1.2574, 1.2533, 1.2476.

Trading tips

To open long positions, one can rely on the breakout of 1.2670. Take profit — 1.2793 or 1.2838. Stop loss — 1.2620.

The return of "bearish" trend with the breakdown of 1.2600 or 1.2574 may become a signal to resume sales with target at 1.2476 or 1.2450. Stop loss — 1.2620 or 1.2640.

Implementation period: 2-3 days.

No comments:

Write comments