EUR/USD: general review

13 December 2018, 13:49

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.1380 |

| Take Profit | 1.1413, 1.1474 |

| Stop Loss | 1.1350 |

| Key Levels | 1.1230, 1.1291, 1.1352, 1.1413, 1.1474, 1.1535 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1345 |

| Take Profit | 1.1291, 1.1230 |

| Stop Loss | 1.1380 |

| Key Levels | 1.1230, 1.1291, 1.1352, 1.1413, 1.1474, 1.1535 |

Current trend

Today, the pair continues to grow moderately due to progress in US-China trade relations and positive news from Italy. China resumed the purchase of American soybeans. The total volume of purchases amounted to about 2 million tons, and supplies should begin in the first quarter of next year. Thus, the pressure on the American agricultural sector is reduced, and overall trade tensions are relaxed.

Meanwhile, Italian Prime Minister Giuseppe Conte presented to the European Commission a new draft budget for the next year, where the national debt was significantly reduced from 2.4% to 2.04%. At the same time, Conte noted that the reduction of public debt will not affect the implementation of pension reform and the increase in social benefits. Representatives of the European Commission appreciated the efforts of the Italian government and promised to evaluate the new budget in the near future.

Today, the market is waiting for the ECB meeting on the interest rate decision. The rate will probably remain at the same level of 0.00%, and future policy of the regulator will be hinted at a press conference with Mario Draghi. Draghi will probably confirm the raise of the rate at the end of next summer.

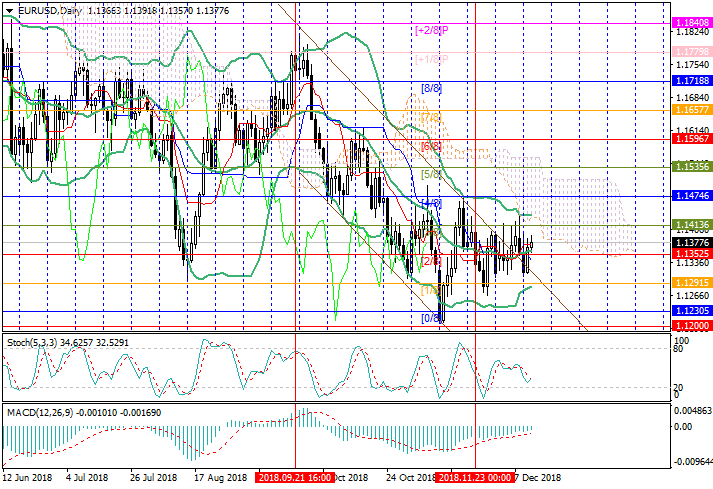

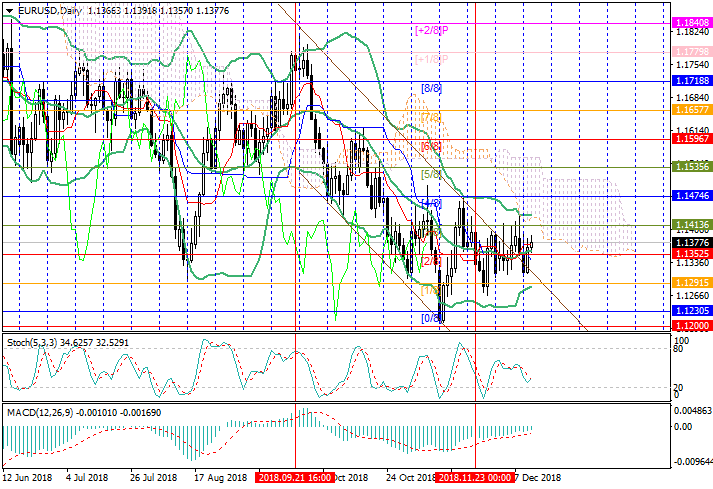

Support and resistance

The price consolidated above the level of 1.1352 (Murray [2/8] the middle line of the Bollinger Bands) and can continue to rise to the levels of 1.1413 (Murray [3/8]) and 1.1474 (Murray [4/8]). A breakdown to 1.1352 will provide a decrease to 1.1291 (Murray [1/8]) and 1.1230 (Murray [0/8]). However, judging by the Stochastic reversal, the growth of quotes looks preferable.

Support levels: 1.1352, 1.1291, 1.1230.

Resistance levels: 1.1413, 1.1474, 1.1535.

Trading tips

Long positions can be opened at 1.1380 with targets at 1.1413, 1.1474 and a stop loss around 1.1350. Short positions will become relevant below 1.1352 with targets at 1.1291, 1.1230 and a stop loss at 1.1380. Implementation period: 4-5 days.

Today, the pair continues to grow moderately due to progress in US-China trade relations and positive news from Italy. China resumed the purchase of American soybeans. The total volume of purchases amounted to about 2 million tons, and supplies should begin in the first quarter of next year. Thus, the pressure on the American agricultural sector is reduced, and overall trade tensions are relaxed.

Meanwhile, Italian Prime Minister Giuseppe Conte presented to the European Commission a new draft budget for the next year, where the national debt was significantly reduced from 2.4% to 2.04%. At the same time, Conte noted that the reduction of public debt will not affect the implementation of pension reform and the increase in social benefits. Representatives of the European Commission appreciated the efforts of the Italian government and promised to evaluate the new budget in the near future.

Today, the market is waiting for the ECB meeting on the interest rate decision. The rate will probably remain at the same level of 0.00%, and future policy of the regulator will be hinted at a press conference with Mario Draghi. Draghi will probably confirm the raise of the rate at the end of next summer.

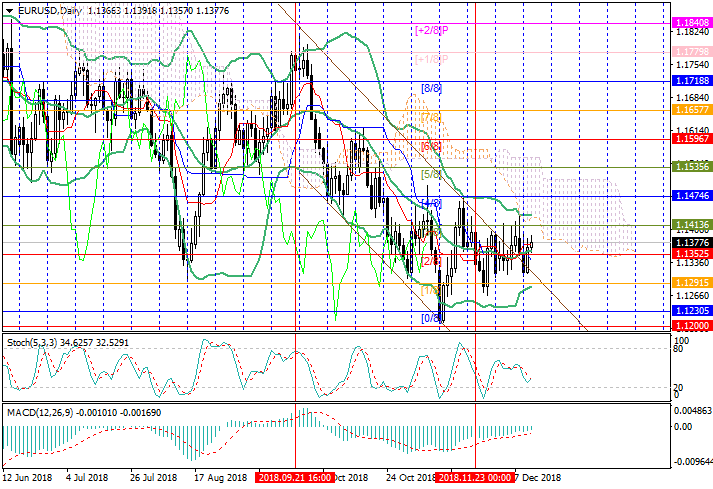

Support and resistance

The price consolidated above the level of 1.1352 (Murray [2/8] the middle line of the Bollinger Bands) and can continue to rise to the levels of 1.1413 (Murray [3/8]) and 1.1474 (Murray [4/8]). A breakdown to 1.1352 will provide a decrease to 1.1291 (Murray [1/8]) and 1.1230 (Murray [0/8]). However, judging by the Stochastic reversal, the growth of quotes looks preferable.

Support levels: 1.1352, 1.1291, 1.1230.

Resistance levels: 1.1413, 1.1474, 1.1535.

Trading tips

Long positions can be opened at 1.1380 with targets at 1.1413, 1.1474 and a stop loss around 1.1350. Short positions will become relevant below 1.1352 with targets at 1.1291, 1.1230 and a stop loss at 1.1380. Implementation period: 4-5 days.

No comments:

Write comments