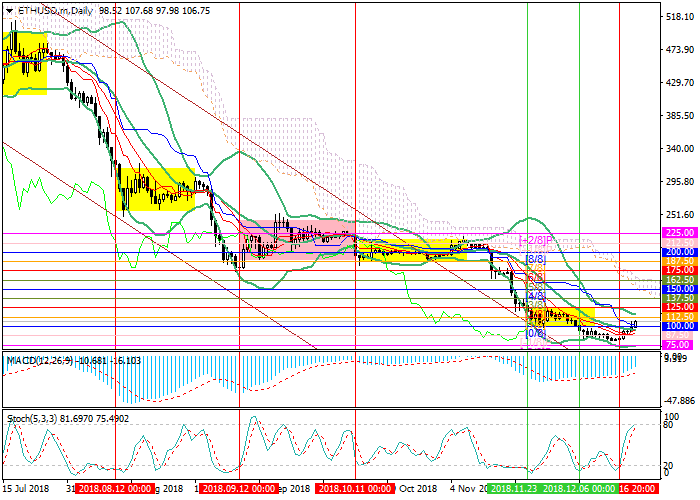

Ethereum: technical analysis

20 December 2018, 11:33

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 108.80 |

| Take Profit | 125.00, 150.00 |

| Stop Loss | 105.00 |

| Key Levels | 75.00, 87.50, 100.00, 125.00, 150.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 95.00 |

| Take Profit | 87.50, 75.00 |

| Stop Loss | 115.00 |

| Key Levels | 75.00, 87.50, 100.00, 125.00, 150.00 |

Current trend

Ether quotes continue to strengthen along with the rest of the cryptocurrency market. The price consolidated above the level of 100.00 and re-entered the main trading Murrey range. Further growth is possible to the levels of 125.00 (Murrey [2/8]) and 150.00 (Murrey [4/8]). The resumption of the reduction will be possible after the consolidation below 100.00 (Murrey [8/8]). In this case, the “bearish” targets will be the levels of 87.50 (Murrey [–1/8]) and 75.00 (Murrey [–2/8], the lower border of Bollinger bands).

According to the indicators’ readings, in the near future, moderate growth is more likely. MACD histogram is decreasing in the negative zone. Stochastic is directed upwards but it approaches the overbought zone, which gives the possibility of a reversal.

Support and resistance

Resistance levels: 125.00, 150.00.

Support levels: 100.00, 87.50, 75.00.

Trading tips

Long positions can be opened from the current level with targets at 125.00, 150.00 and stop loss around 105.00.

Short positions can be opened after the price is set below the level of 100.00 with the targets at 87.50, 75.00 and stop loss around 115.00.

Implementation period: 3–5 days.

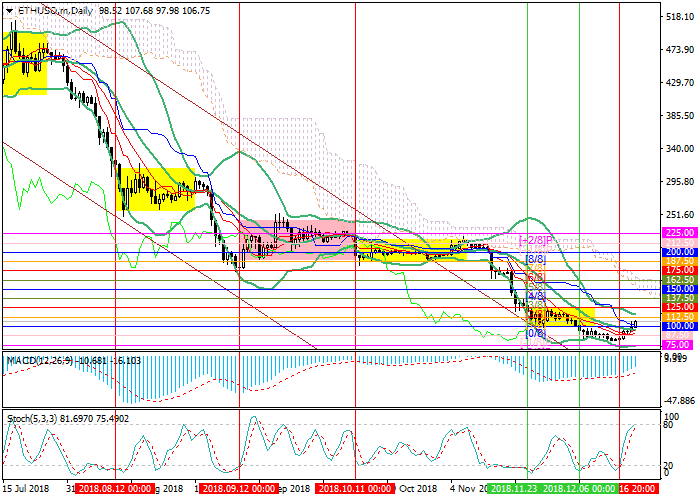

Ether quotes continue to strengthen along with the rest of the cryptocurrency market. The price consolidated above the level of 100.00 and re-entered the main trading Murrey range. Further growth is possible to the levels of 125.00 (Murrey [2/8]) and 150.00 (Murrey [4/8]). The resumption of the reduction will be possible after the consolidation below 100.00 (Murrey [8/8]). In this case, the “bearish” targets will be the levels of 87.50 (Murrey [–1/8]) and 75.00 (Murrey [–2/8], the lower border of Bollinger bands).

According to the indicators’ readings, in the near future, moderate growth is more likely. MACD histogram is decreasing in the negative zone. Stochastic is directed upwards but it approaches the overbought zone, which gives the possibility of a reversal.

Support and resistance

Resistance levels: 125.00, 150.00.

Support levels: 100.00, 87.50, 75.00.

Trading tips

Long positions can be opened from the current level with targets at 125.00, 150.00 and stop loss around 105.00.

Short positions can be opened after the price is set below the level of 100.00 with the targets at 87.50, 75.00 and stop loss around 115.00.

Implementation period: 3–5 days.

No comments:

Write comments