Brent Crude Oil: general analysis

06 December 2018, 10:58

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 60.85 |

| Take Profit | 59.37 |

| Stop Loss | 61.40 |

| Key Levels | 57.18, 59.37, 60.93, 62.50, 64.06, 65.62 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 62.55 |

| Take Profit | 64.06 |

| Stop Loss | 62.00 |

| Key Levels | 57.18, 59.37, 60.93, 62.50, 64.06, 65.62 |

Current trend

Oil prices are moving horizontally within the range of 60.70–63.12. Yesterday, the monitoring committee OPEC+ agreed to extend the agreement to reduce the production of "black gold" in the first half of 2019. In the coming days, December 6 and 7, OPEC and non-OPEC countries will have to make a formal decision upon the question at the ministerial level. The Russian Federation and OPEC have disagreements over the expected volume of reductions. Russia is ready to reduce daily production by no more than 140K barrels, while OPEC insists on 250–300K barrels. However, Iran refuses to reduce the volume of extraction of raw materials at all. The oil market reacts with restraint to the news.

Today, market participants will pay attention to the publication of the official data from the Department of Energy on the weekly change in oil reserves in the US. It is predicted that the figure will decline by 0.942 million barrels per week. Confirming forecasts can support Brent in the short term.

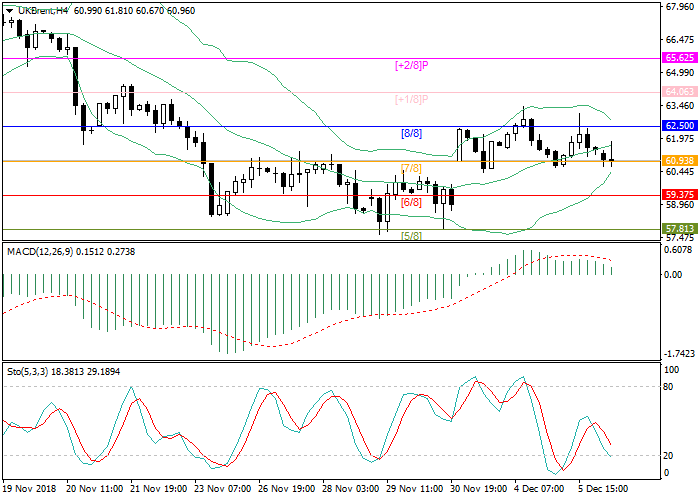

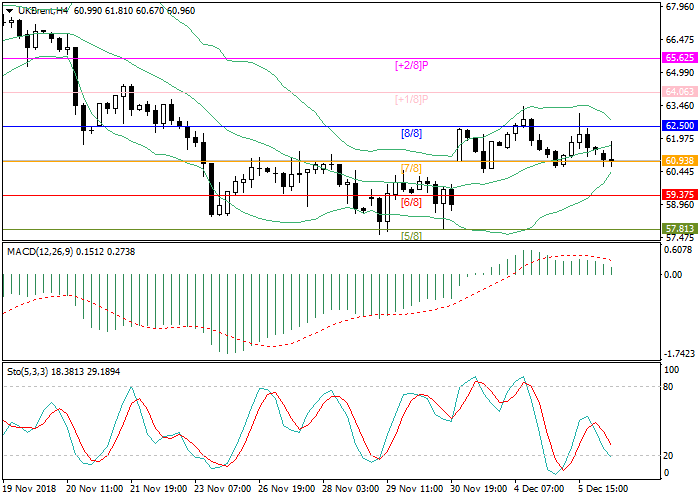

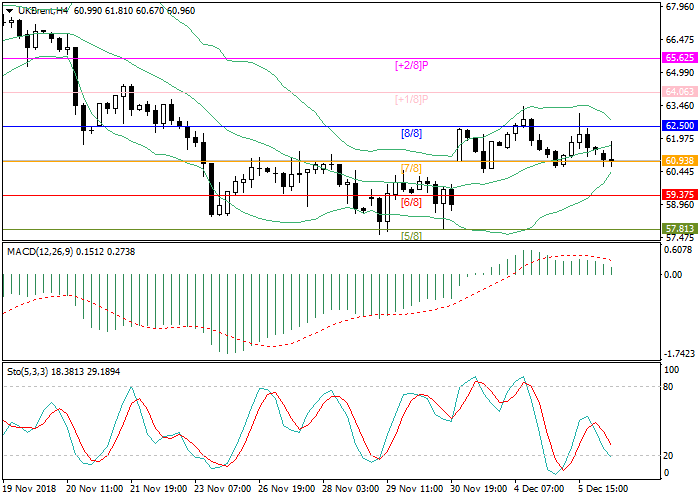

Support and resistance

Technical indicators do not give a single signal. Bollinger bands are directed horizontally, indicating that the sideways trend continues. Stochastic lines are directed downwards and approach the oversold zone. MACD volumes are gradually decreasing in the positive zone, reflexing the development of a downward trend.

Support levels: 60.93, 59.37, 57.18.

Resistance levels: 62.50, 64.06, 65.62.

Trading tips

Short positions can be opened below the level of 60.93 with the targets around 59.37 and stop loss 61.40.

Long positions can be opened above the level of 62.50 with the targets near 64.06 and stop loss 62.00.

Implementation period: 2–3 days.

Oil prices are moving horizontally within the range of 60.70–63.12. Yesterday, the monitoring committee OPEC+ agreed to extend the agreement to reduce the production of "black gold" in the first half of 2019. In the coming days, December 6 and 7, OPEC and non-OPEC countries will have to make a formal decision upon the question at the ministerial level. The Russian Federation and OPEC have disagreements over the expected volume of reductions. Russia is ready to reduce daily production by no more than 140K barrels, while OPEC insists on 250–300K barrels. However, Iran refuses to reduce the volume of extraction of raw materials at all. The oil market reacts with restraint to the news.

Today, market participants will pay attention to the publication of the official data from the Department of Energy on the weekly change in oil reserves in the US. It is predicted that the figure will decline by 0.942 million barrels per week. Confirming forecasts can support Brent in the short term.

Support and resistance

Technical indicators do not give a single signal. Bollinger bands are directed horizontally, indicating that the sideways trend continues. Stochastic lines are directed downwards and approach the oversold zone. MACD volumes are gradually decreasing in the positive zone, reflexing the development of a downward trend.

Support levels: 60.93, 59.37, 57.18.

Resistance levels: 62.50, 64.06, 65.62.

Trading tips

Short positions can be opened below the level of 60.93 with the targets around 59.37 and stop loss 61.40.

Long positions can be opened above the level of 62.50 with the targets near 64.06 and stop loss 62.00.

Implementation period: 2–3 days.

No comments:

Write comments