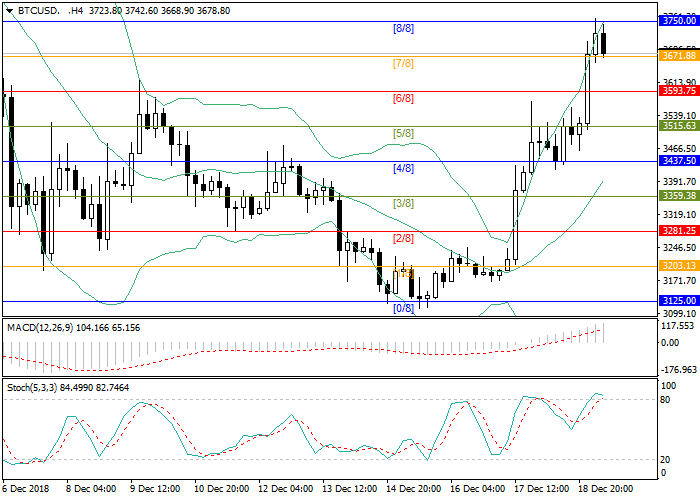

Bitcoin: technical analysis

19 December 2018, 09:52

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 3660.00 |

| Take Profit | 3593.75, 3515.63 |

| Stop Loss | 3712.00 |

| Key Levels | 3515.63, 3593.75, 3671.88, 3750.00, 3828.13, 3906.25 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 3760.00 |

| Take Profit | 3828.13, 3906.25 |

| Stop Loss | 3708.00 |

| Key Levels | 3515.63, 3593.75, 3671.88, 3750.00, 3828.13, 3906.25 |

Current trend

Bitcoin quotes are actively growing after a long consolidation around the level of 3125.00. The price has risen to the level of 3750.00 (Murrey [8/8]). Growth potential is maintained but the level of 3750.00 can be a quite strong resistance. In the short term, from this mark a downward correction may start, which is confirmed by Stochastic, being in the overbought zone and directed downwards. To continue the upward trend, it the price should consolidate above the level of 3750.00. In this case, the next buyers’ targets will be 3828.13 (Murrey [+1/8])–3906.25 (Murrey [+2/8]).

MACD volumes are growing in the positive zone, keeping the buy signal. Bollinger bands are directed upwards.

Support and resistance

Resistance levels: 3750.00, 3828.13, 3906.25.

Support levels: 3671.88, 3593.75, 3515.63.

Trading tips

Short positions can be opened below the level of 3671.88 with the targets around 3593.75–3515.63 and stop loss 3712.00.

Long positions can be opened above the level of 3750.00 with the targets around 3828.13–3906.25 and stop loss 3708.00.

Bitcoin quotes are actively growing after a long consolidation around the level of 3125.00. The price has risen to the level of 3750.00 (Murrey [8/8]). Growth potential is maintained but the level of 3750.00 can be a quite strong resistance. In the short term, from this mark a downward correction may start, which is confirmed by Stochastic, being in the overbought zone and directed downwards. To continue the upward trend, it the price should consolidate above the level of 3750.00. In this case, the next buyers’ targets will be 3828.13 (Murrey [+1/8])–3906.25 (Murrey [+2/8]).

MACD volumes are growing in the positive zone, keeping the buy signal. Bollinger bands are directed upwards.

Support and resistance

Resistance levels: 3750.00, 3828.13, 3906.25.

Support levels: 3671.88, 3593.75, 3515.63.

Trading tips

Short positions can be opened below the level of 3671.88 with the targets around 3593.75–3515.63 and stop loss 3712.00.

Long positions can be opened above the level of 3750.00 with the targets around 3828.13–3906.25 and stop loss 3708.00.

No comments:

Write comments