Bitcoin: technical analysis

17 December 2018, 10:54

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 3120.00 |

| Take Profit | 3046.88 |

| Stop Loss | 3146.30 |

| Key Levels | 3046.88, 3125.00, 3203.13, 3281.25, 3359.38, 3437.50 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 3440.00 |

| Take Profit | 3593.75 |

| Stop Loss | 3378.00 |

| Key Levels | 3046.88, 3125.00, 3203.13, 3281.25, 3359.38, 3437.50 |

Current trend

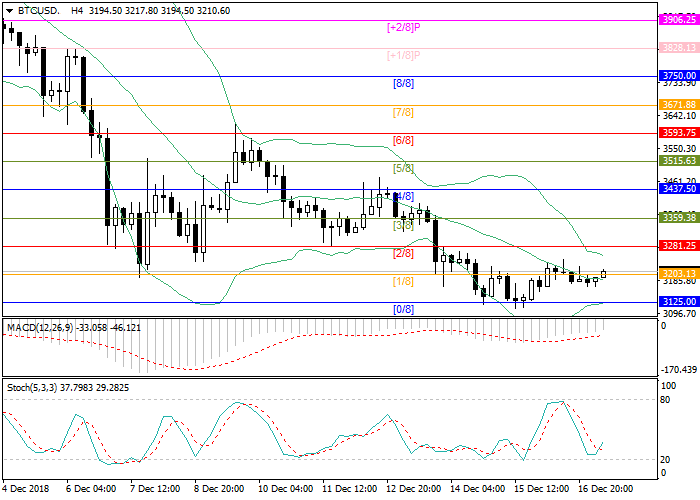

Due to the low trading activity, Bitcoin quotes are moving within a narrow range with borders at 3169.80 and 3244.90. Attempts to break through the lower border still remain unsuccessful, however, there are no hits to the formation of a sustainable growth. In the near future, the continuation of the current lateral trend within the existing range is most likely. If the price goes below the strong support level of 3125.00 (Murray [0/8]), a resumption of the downward trend will be possible, and the quotes would reach the area of 3046.88 (Murray [-1/8]). If buyers manage to raise and consolidate the rate above the level of 3281.25 (Murray [2/8]), then the growth may continue to the level of 3359.38 (Murray [3/8]). Technical indicators reflect a relative calmness in the market and a continuation of the sideways trend. The Bollinger bands and the Stochastic lines are directed sideways. MACD volumes are in the negative zone and are move along the zero line.

Support and resistance

Support levels: 3203.13, 3125.00, 3046.88.

Resistance levels: 3281.25, 3359.38, 3437.50.

Trading tips

Short positions can be opened below 3125.00 with targets around 3046.88 and a stop loss at 3146.30.

Long positions will become relevant above the level of 3437.50 with targets around 3593.75 and a stop loss at 3378.00.

Due to the low trading activity, Bitcoin quotes are moving within a narrow range with borders at 3169.80 and 3244.90. Attempts to break through the lower border still remain unsuccessful, however, there are no hits to the formation of a sustainable growth. In the near future, the continuation of the current lateral trend within the existing range is most likely. If the price goes below the strong support level of 3125.00 (Murray [0/8]), a resumption of the downward trend will be possible, and the quotes would reach the area of 3046.88 (Murray [-1/8]). If buyers manage to raise and consolidate the rate above the level of 3281.25 (Murray [2/8]), then the growth may continue to the level of 3359.38 (Murray [3/8]). Technical indicators reflect a relative calmness in the market and a continuation of the sideways trend. The Bollinger bands and the Stochastic lines are directed sideways. MACD volumes are in the negative zone and are move along the zero line.

Support and resistance

Support levels: 3203.13, 3125.00, 3046.88.

Resistance levels: 3281.25, 3359.38, 3437.50.

Trading tips

Short positions can be opened below 3125.00 with targets around 3046.88 and a stop loss at 3146.30.

Long positions will become relevant above the level of 3437.50 with targets around 3593.75 and a stop loss at 3378.00.

No comments:

Write comments