Bitcoin: technical analysis

12 December 2018, 10:21

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 3270.00 |

| Take Profit | 3125.00 |

| Stop Loss | 3315.00 |

| Key Levels | 2968.75, 3125.00, 3281.25, 3437.50, 3593.75, 3750.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 3440.00 |

| Take Profit | 3593.75 |

| Stop Loss | 3388.00 |

| Key Levels | 2968.75, 3125.00, 3281.25, 3437.50, 3593.75, 3750.00 |

Current trend

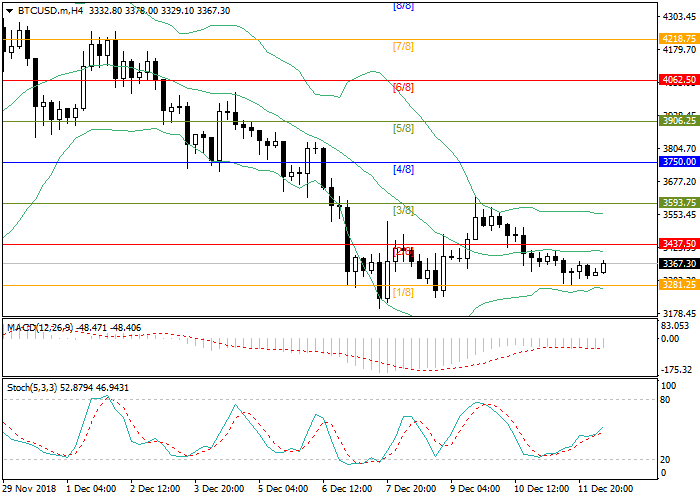

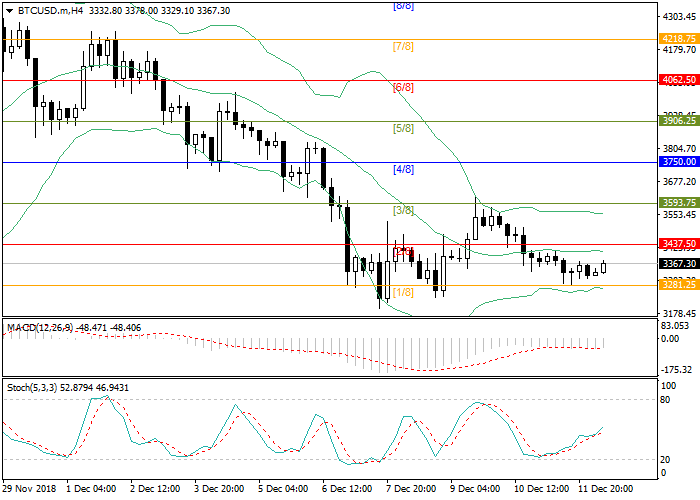

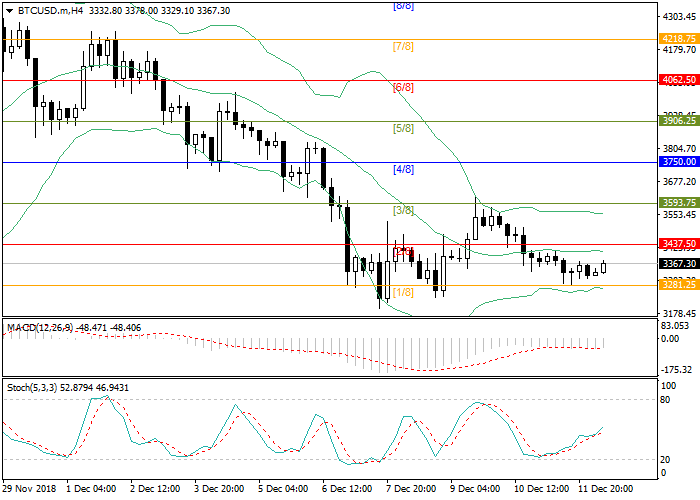

Bitcoin quotes are traded in the middle of a narrow range of 3281.25–3437.50 due to low volatility. Moderate positive trend is observed. If buyers manage to consolidate the rate above 3437.50 (Murrey [2/8]), the growth will continue to 3593.75 (Murrey [3/8]). The upward reversal of Stochastic confirms the upward trend. At the same time, other technical indicators show the preservation of the sideways trend. Bollinger Bands are directed sideways. MACD histogram is located in the negative zone and moving along the zero line.

Support and resistance

Resistance levels: 3437.50, 3593.75, 3750.00.

Support levels: 3281.25, 3125.00, 2968.75.

Trading tips

Short positions may be opened below 3281.25 with target at 3125.00 and stop loss at 3315.00.

Long positions may be opened above 3437.50 with target at 3593.75 and stop loss at 3388.00.

Bitcoin quotes are traded in the middle of a narrow range of 3281.25–3437.50 due to low volatility. Moderate positive trend is observed. If buyers manage to consolidate the rate above 3437.50 (Murrey [2/8]), the growth will continue to 3593.75 (Murrey [3/8]). The upward reversal of Stochastic confirms the upward trend. At the same time, other technical indicators show the preservation of the sideways trend. Bollinger Bands are directed sideways. MACD histogram is located in the negative zone and moving along the zero line.

Support and resistance

Resistance levels: 3437.50, 3593.75, 3750.00.

Support levels: 3281.25, 3125.00, 2968.75.

Trading tips

Short positions may be opened below 3281.25 with target at 3125.00 and stop loss at 3315.00.

Long positions may be opened above 3437.50 with target at 3593.75 and stop loss at 3388.00.

No comments:

Write comments