Bitcoin: technical analysis

10 December 2018, 10:49

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 3430.00 |

| Take Profit | 3281.25 |

| Stop Loss | 3480.00 |

| Key Levels | 3125.00, 3281.25, 3437.50, 3593.75, 3750.00, 3906.25 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 3600.00 |

| Take Profit | 3750.00 |

| Stop Loss | 3550.00 |

| Key Levels | 3125.00, 3281.25, 3437.50, 3593.75, 3750.00, 3906.25 |

Current trend

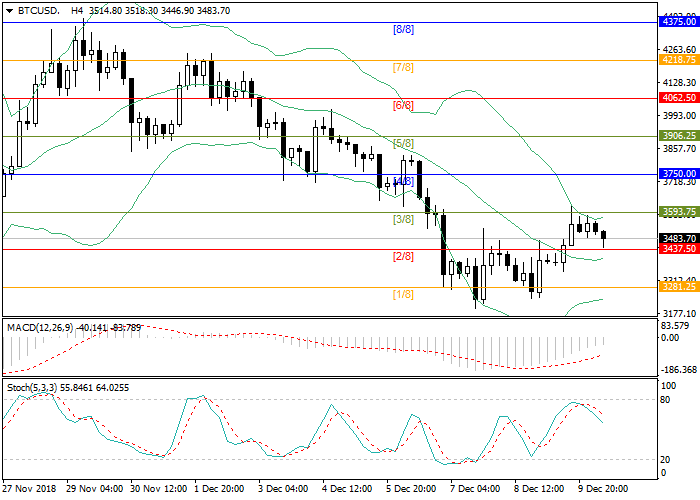

After a failed attempt to consolidate above the level of 3593.75 (Murray [3/8]), Bitcoin was corrected to the area of 3437.50 (Murray [2/8]), corresponding to the middle line of the Bollinger Bands. Currently there is a low trading activity. Bollinger bands are directed sideways, confirming the relative calmness in the market. MACD volumes are slowly growing in the negative zone, indicating the power of sellers. Stochastic is directed downwards.

In the current conditions, the course is most likely to move within the range of 3281.25–3593.75. If sellers manage to lower the rate below the level of 3437.50, the next target of the fall will be the lower limit of the range (3281.25). If buyers manage to raise the rate above 3593.75, then it will be possible to rise to the level of 3750.00 (Murray [4/8]), where there is a rather strong resistance zone.

Support and resistance

Support levels: 3437.50, 3281.25, 3125.00.

Resistance levels: 3593.75, 3750.00, 3906.25.

Trading tips

Short positions can be opened below 3437.50 with targets in the area of 3281.25 and a stop loss at 3480.00.

Long positions will become relevant above the level of 3593.75 with targets in the region of 3750.00 and a stop loss at 3550.00.

After a failed attempt to consolidate above the level of 3593.75 (Murray [3/8]), Bitcoin was corrected to the area of 3437.50 (Murray [2/8]), corresponding to the middle line of the Bollinger Bands. Currently there is a low trading activity. Bollinger bands are directed sideways, confirming the relative calmness in the market. MACD volumes are slowly growing in the negative zone, indicating the power of sellers. Stochastic is directed downwards.

In the current conditions, the course is most likely to move within the range of 3281.25–3593.75. If sellers manage to lower the rate below the level of 3437.50, the next target of the fall will be the lower limit of the range (3281.25). If buyers manage to raise the rate above 3593.75, then it will be possible to rise to the level of 3750.00 (Murray [4/8]), where there is a rather strong resistance zone.

Support and resistance

Support levels: 3437.50, 3281.25, 3125.00.

Resistance levels: 3593.75, 3750.00, 3906.25.

Trading tips

Short positions can be opened below 3437.50 with targets in the area of 3281.25 and a stop loss at 3480.00.

Long positions will become relevant above the level of 3593.75 with targets in the region of 3750.00 and a stop loss at 3550.00.

No comments:

Write comments