USD/JPY: USD remains under pressure

07 September 2018, 10:18

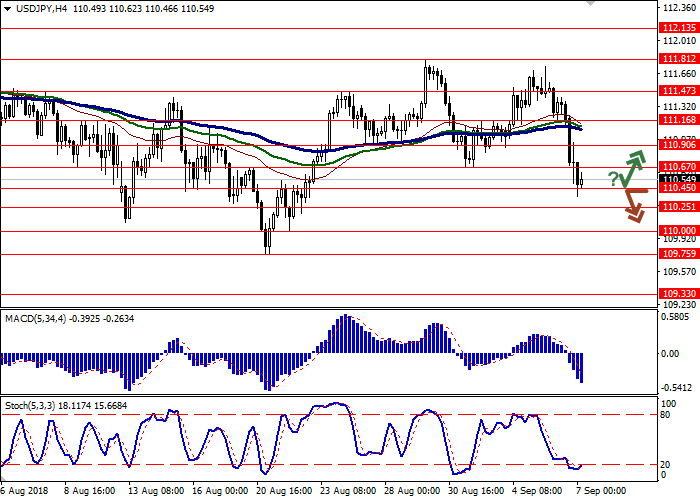

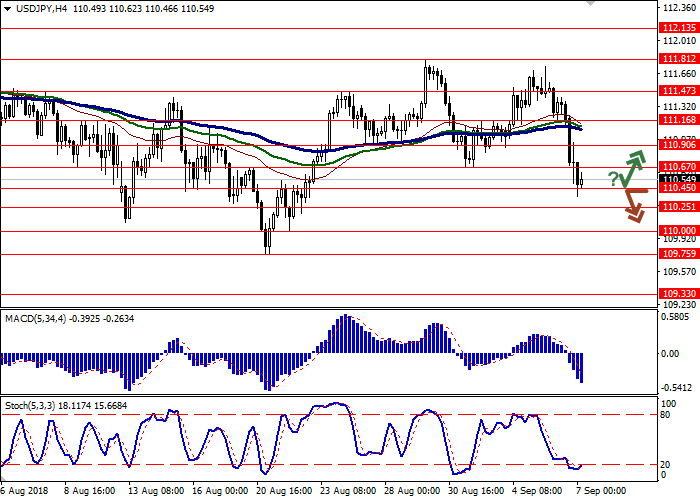

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 110.70 |

| Take Profit | 111.16, 111.47 |

| Stop Loss | 110.30 |

| Key Levels | 109.75, 110.00, 110.25, 110.45, 110.67, 110.90, 111.16, 111.47 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 110.40 |

| Take Profit | 110.00, 109.75 |

| Stop Loss | 110.67, 110.80 |

| Key Levels | 109.75, 110.00, 110.25, 110.45, 110.67, 110.90, 111.16, 111.47 |

Current trend

USD showed a strong decline against JPY on Thursday, having updated local lows of August 23. Dollar was under pressure from weak macroeconomic statistics from the USA.

ADP's report on employment in the private sector reflected the growth of new jobs in August by only 163K, which was significantly worse than analysts' forecasts of 190K. At the same time, unit labor costs in Q2 2018 decreased by 1.0%, and nonfarm productivity increased by 2.9% QoQ against the forecast of +3.0% QoQ.

The market is waiting for the possible introduction of increased US duties on the Chinese goods totaled USD 200 billion by the end of the week. New tariffs may hit consumer goods, including furniture, lighting, and bicycles.

Support and resistance

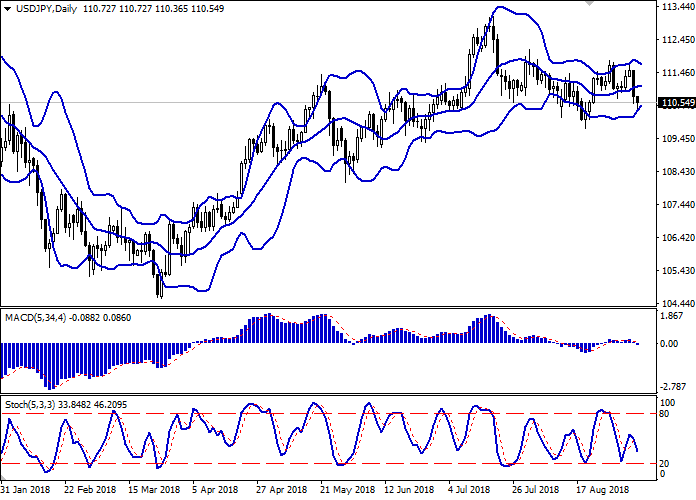

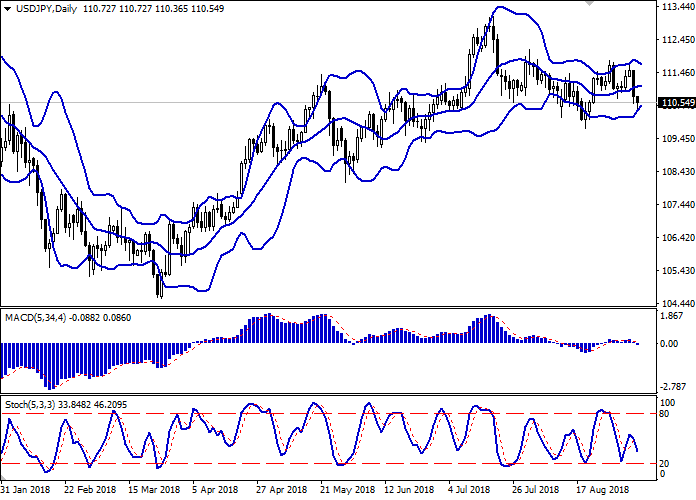

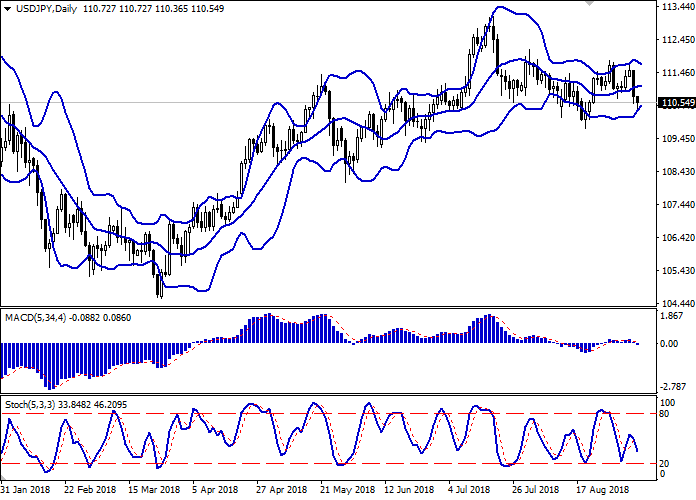

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is narrowing, reflecting a sharp change of trend in the short term. MACD reversed downwards having formed a sell signal (located below the signal line). In addition, the indicator is trying to consolidate below the zero mark. Stochastic shows a similar dynamics, having reversed downwards after a brief period of growth.

Existing short positions should be kept open until the situation clears up.

Resistance levels: 110.67, 110.90, 111.16, 111.47.

Support levels: 110.45, 110.25, 110.00, 109.75.

Trading tips

To open long positions, one can rely on the rebound from the support level of 110.45 with the subsequent breakout of 110.67. Take profit — 111.16 or 111.47. Stop loss — 110.30.

A confident breakdown of 110.45 may be a signal to further sales with target at 110.00 or 109.75. Stop loss — 110.67 or 110.80.

Implementation period: 2-3 days.

USD showed a strong decline against JPY on Thursday, having updated local lows of August 23. Dollar was under pressure from weak macroeconomic statistics from the USA.

ADP's report on employment in the private sector reflected the growth of new jobs in August by only 163K, which was significantly worse than analysts' forecasts of 190K. At the same time, unit labor costs in Q2 2018 decreased by 1.0%, and nonfarm productivity increased by 2.9% QoQ against the forecast of +3.0% QoQ.

The market is waiting for the possible introduction of increased US duties on the Chinese goods totaled USD 200 billion by the end of the week. New tariffs may hit consumer goods, including furniture, lighting, and bicycles.

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is narrowing, reflecting a sharp change of trend in the short term. MACD reversed downwards having formed a sell signal (located below the signal line). In addition, the indicator is trying to consolidate below the zero mark. Stochastic shows a similar dynamics, having reversed downwards after a brief period of growth.

Existing short positions should be kept open until the situation clears up.

Resistance levels: 110.67, 110.90, 111.16, 111.47.

Support levels: 110.45, 110.25, 110.00, 109.75.

Trading tips

To open long positions, one can rely on the rebound from the support level of 110.45 with the subsequent breakout of 110.67. Take profit — 111.16 or 111.47. Stop loss — 110.30.

A confident breakdown of 110.45 may be a signal to further sales with target at 110.00 or 109.75. Stop loss — 110.67 or 110.80.

Implementation period: 2-3 days.

No comments:

Write comments