USD/JPY: the dollar is growing

05 September 2018, 15:15

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 111.52 |

| Take Profit | 113.70, 114.00, 114.50 |

| Stop Loss | 110.60 |

| Key Levels | 110.20, 110.50, 110.70, 110.85, 111.00, 111.15, 111.40, 111.75, 112.15, 112.40, 113.25, 113.70, 114.00, 114.50 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 111.00, 110.85 |

| Take Profit | 113.70, 114.00, 114.50 |

| Stop Loss | 110.60 |

| Key Levels | 110.20, 110.50, 110.70, 110.85, 111.00, 111.15, 111.40, 111.75, 112.15, 112.40, 113.25, 113.70, 114.00, 114.50 |

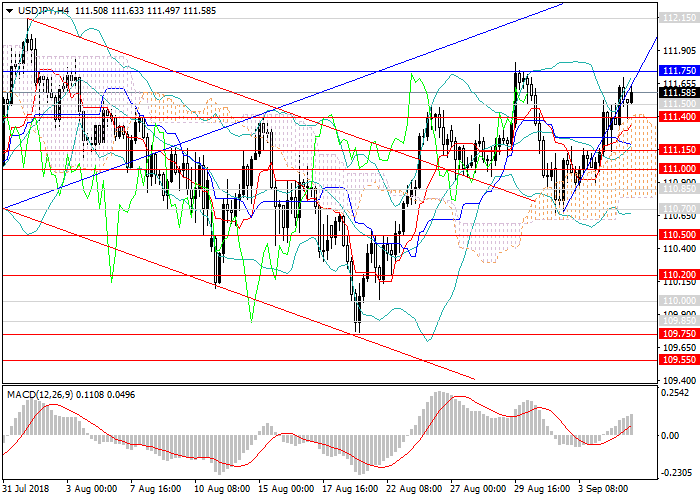

Current trend

At the end of August, the pair USD/JPY left the downward channel. In early September, USD against JPY is trading within a wide sideways channel. After the rebound from the key resistance level of 111.80, the instrument fell by more than 100 points, but then returned to the levels of 111.50, 111.75 due to the growing demand for USD.

Positive US statistics strengthen USD against all major currencies. Key data on the labor market, including Nonfarm Payrolls and the unemployment rate, will be published at the end of the trading week. Also, it is better to pay attention to the data on Japan's GDP next Monday.

Support and resistance

In the medium term, the upward trend is expected to continue with the target at 112.15. In the future, the pair can return to the long-term ascending channel and continue testing new highs up to the levels of 114.00, 114.50.

An alternative scenario would be the consolidating of the pair within the narrowing sideways channel, which ends with a peak to the same levels. Technical indicators confirm the growth forecast, the volumes of long positions of MACD are growing, Bollinger bands are directed upwards.

Resistance levels: 111.75, 112.15, 112.40, 113.25, 113.70, 114.00, 114.50.

Support levels: 111.40, 111.15, 111.00, 110.85, 110.70, 110.50, 110.20.

Trading tips

It is relevant to open long positions from the current level or pending positions from the levels of 111.00, 110.85 with the target at 113.70, in the long term at 114.00, 114.50 and stop loss 110.60.

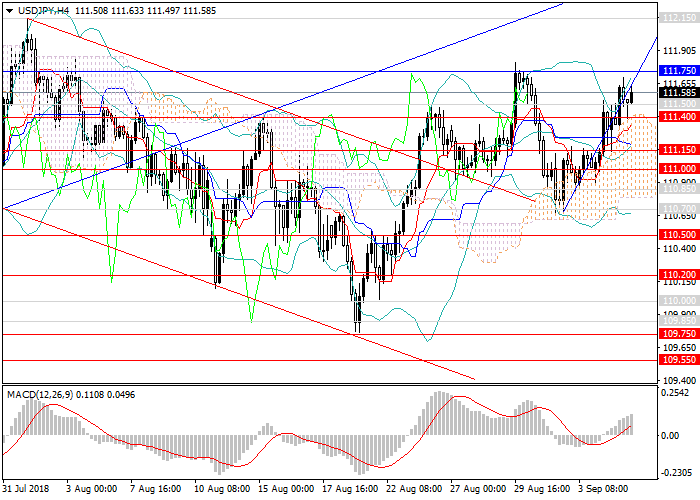

At the end of August, the pair USD/JPY left the downward channel. In early September, USD against JPY is trading within a wide sideways channel. After the rebound from the key resistance level of 111.80, the instrument fell by more than 100 points, but then returned to the levels of 111.50, 111.75 due to the growing demand for USD.

Positive US statistics strengthen USD against all major currencies. Key data on the labor market, including Nonfarm Payrolls and the unemployment rate, will be published at the end of the trading week. Also, it is better to pay attention to the data on Japan's GDP next Monday.

Support and resistance

In the medium term, the upward trend is expected to continue with the target at 112.15. In the future, the pair can return to the long-term ascending channel and continue testing new highs up to the levels of 114.00, 114.50.

An alternative scenario would be the consolidating of the pair within the narrowing sideways channel, which ends with a peak to the same levels. Technical indicators confirm the growth forecast, the volumes of long positions of MACD are growing, Bollinger bands are directed upwards.

Resistance levels: 111.75, 112.15, 112.40, 113.25, 113.70, 114.00, 114.50.

Support levels: 111.40, 111.15, 111.00, 110.85, 110.70, 110.50, 110.20.

Trading tips

It is relevant to open long positions from the current level or pending positions from the levels of 111.00, 110.85 with the target at 113.70, in the long term at 114.00, 114.50 and stop loss 110.60.

No comments:

Write comments