EUR/USD: the euro is strengthening

06 September 2018, 09:28

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1665 |

| Take Profit | 1.1749, 1.1780 |

| Stop Loss | 1.1610, 1.1600 |

| Key Levels | 1.1500, 1.1526, 1.1573, 1.1621, 1.1657, 1.1718, 1.1749 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1615 |

| Take Profit | 1.1526, 1.1500 |

| Stop Loss | 1.1670, 1.1680 |

| Key Levels | 1.1500, 1.1526, 1.1573, 1.1621, 1.1657, 1.1718, 1.1749 |

Current trend

EUR showed moderate growth against USD on Wednesday, departing from local lows, updated the day before.

However, the instrument traded mainly with a decrease in the morning. Euro was under pressure by poor economic statistics. In July, EU Retail Sales declined by 0.2% MoM, and grew only by 1.1% YoY (1.3% growth was expected). August EU Services PMI remained at the same level of 54.4 points, and in Germany it fell from 55.2 to 55.0 points over the same period. Investors are focused on the US-Canada negotiations on NAFTA and are waiting for the introduction of new US duties on Chinese goods worth USD 200B.

Today, the pair is trading in both directions, waiting for the appearance of new drivers at the market. The focus will be on the ADP Employment Change report, as well as a block of statistics on Markit Services PMI.

Support and resistance

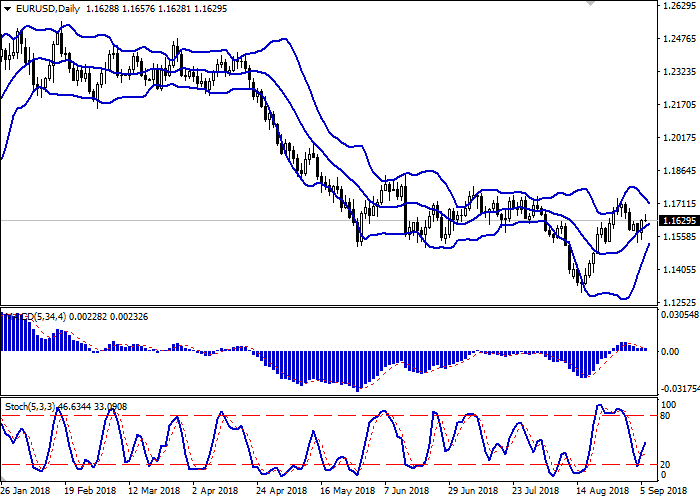

Bollinger Bands in D1 chart show moderate growth. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD is reversing upwards preserving a sell signal (located below the signal line). Stochastic is growing, having showed a rebound from the level "20", which can be called a formal margin of oversoldness of EUR.

One should keep existing long positions in the short and ultra-short term.

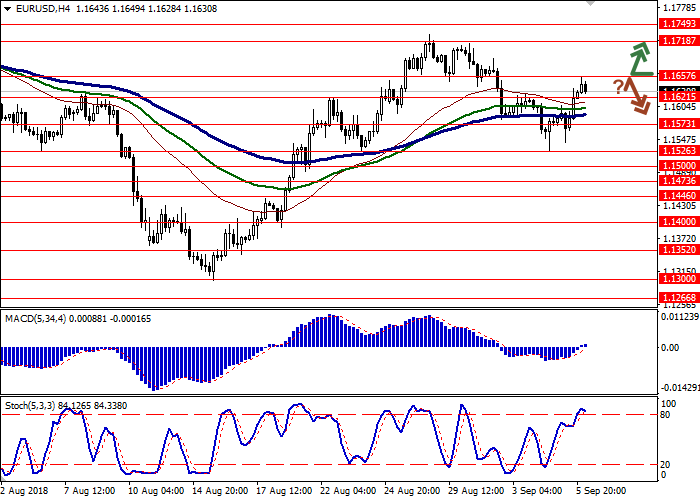

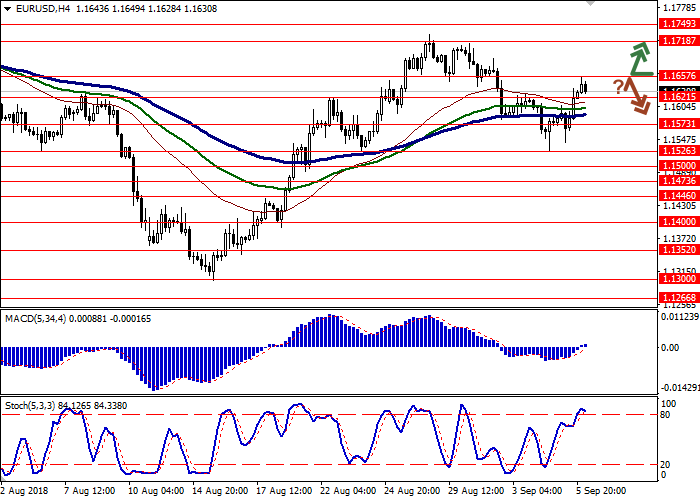

Resistance levels: 1.1657, 1.1718, 1.1749.

Support levels: 1.1621, 1.1573, 1.1526, 1.1500.

Trading tips

To open long positions one can rely on the breakout of 1.1657 while maintaining "bullish" signals from technical indicators. Take profit — 1.1749 or 1.1780. Stop loss — 1.1610 or 1.1600.

The rebound from 1.1657 as from resistance with the subsequent breakdown of 1.1621 can become a signal to further sales with target at 1.1526 or 1.1500. Stop loss — 1.1670 or 1.1680.

Implementation period: 2-3 days.

EUR showed moderate growth against USD on Wednesday, departing from local lows, updated the day before.

However, the instrument traded mainly with a decrease in the morning. Euro was under pressure by poor economic statistics. In July, EU Retail Sales declined by 0.2% MoM, and grew only by 1.1% YoY (1.3% growth was expected). August EU Services PMI remained at the same level of 54.4 points, and in Germany it fell from 55.2 to 55.0 points over the same period. Investors are focused on the US-Canada negotiations on NAFTA and are waiting for the introduction of new US duties on Chinese goods worth USD 200B.

Today, the pair is trading in both directions, waiting for the appearance of new drivers at the market. The focus will be on the ADP Employment Change report, as well as a block of statistics on Markit Services PMI.

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD is reversing upwards preserving a sell signal (located below the signal line). Stochastic is growing, having showed a rebound from the level "20", which can be called a formal margin of oversoldness of EUR.

One should keep existing long positions in the short and ultra-short term.

Resistance levels: 1.1657, 1.1718, 1.1749.

Support levels: 1.1621, 1.1573, 1.1526, 1.1500.

Trading tips

To open long positions one can rely on the breakout of 1.1657 while maintaining "bullish" signals from technical indicators. Take profit — 1.1749 or 1.1780. Stop loss — 1.1610 or 1.1600.

The rebound from 1.1657 as from resistance with the subsequent breakdown of 1.1621 can become a signal to further sales with target at 1.1526 or 1.1500. Stop loss — 1.1670 or 1.1680.

Implementation period: 2-3 days.

No comments:

Write comments