USD/CHF: technical analysis

06 September 2018, 12:28

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 0.9697 |

| Take Profit | 0.9615 |

| Stop Loss | 0.9740 |

| Key Levels | 0.9600, 0.9615, 0.9651, 0.9676, 0.9717, 0.9744, 0.9766, 0.9807, 0.9865 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.9770 |

| Take Profit | 0.9870 |

| Stop Loss | 0.9740 |

| Key Levels | 0.9600, 0.9615, 0.9651, 0.9676, 0.9717, 0.9744, 0.9766, 0.9807, 0.9865 |

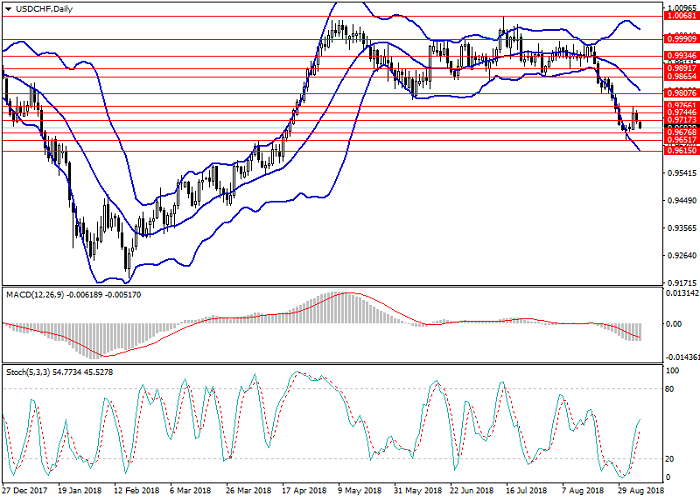

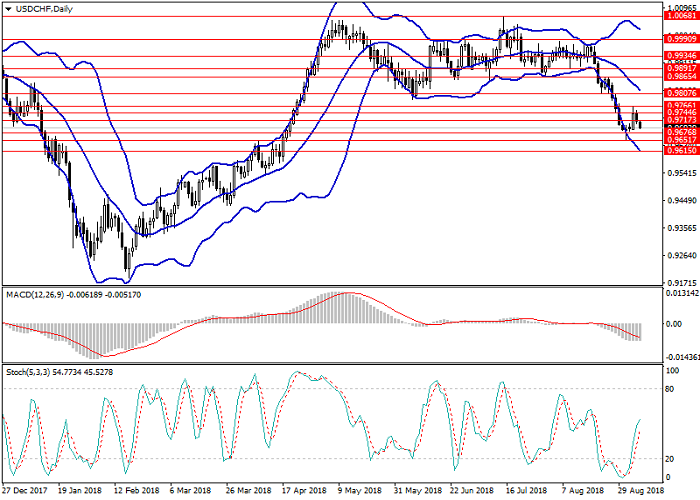

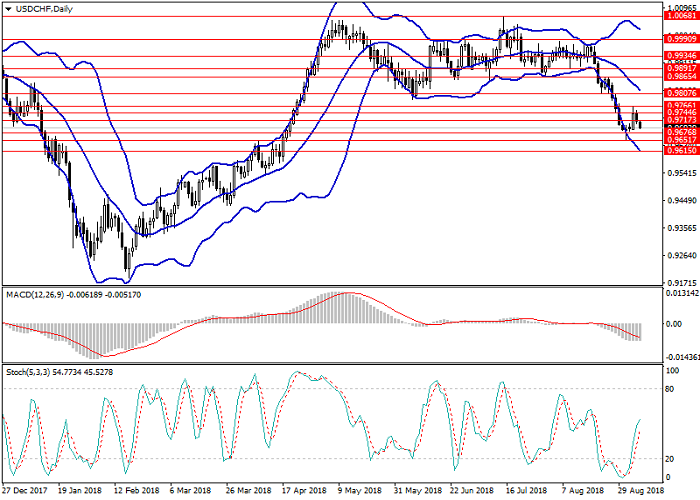

USD/CHF, D1

On D1 chart, the instrument returned to decline after a short-term correction; the pair is traded between the middle and lower lines of Bollinger Bands. MACD histogram is in the negative zone, the signal line is crossing its body from below, which is the signal for the opening of short orders. Stochastic moved out of the oversold zone and is in the neutral zone now; the oscillator lines are directed upwards.

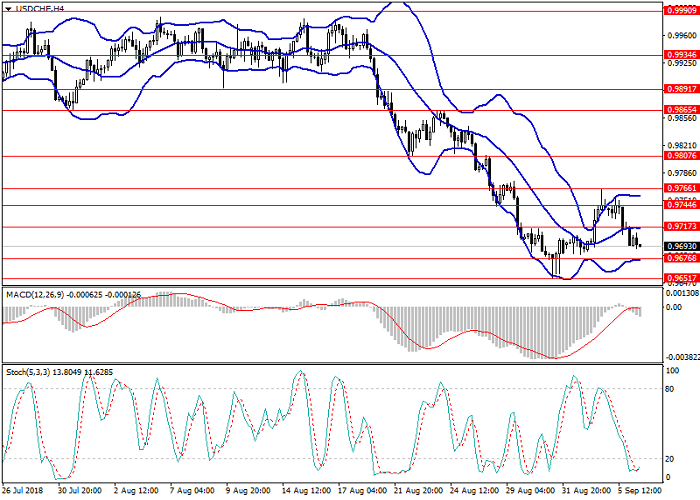

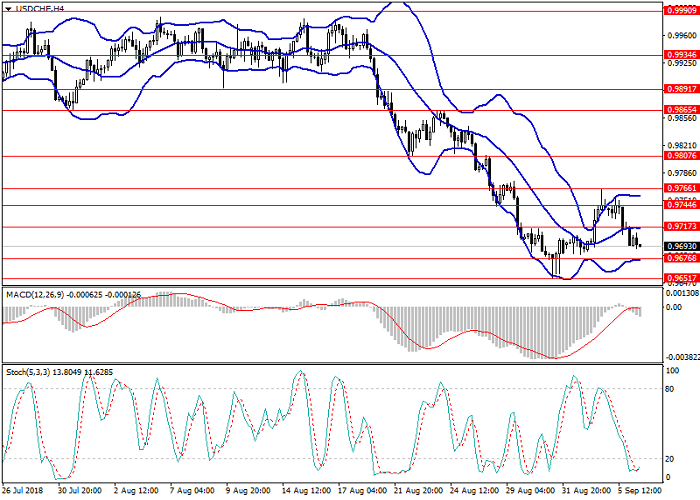

USD/CHF, H4

On H4 chart, the downtrend is still in effect, the instrument is declining to the lower border of Bollinger Bands. MACD histogram is near the zero level, and its volume is minimal. Stochastic has entered the oversold zone, and the lines of the oscillator are reversing upwards.

Key levels

Support levels: 0.9676, 0.9651, 0.9615, 0.9600.

Resistance levels: 0.9717, 0.9744, 0.9766, 0.9807, 0.9865.

Trading tips

According to technical indicators, short positions could be opened from the current level with the target at 0.9615 and stop loss at 0.9740. Implementation time: 1-3 days.

Long positions may be opened from the level of 0.9770 with the target at 0.9870 and stop loss at 0.9740. Implementation time: 3-5 days.

On D1 chart, the instrument returned to decline after a short-term correction; the pair is traded between the middle and lower lines of Bollinger Bands. MACD histogram is in the negative zone, the signal line is crossing its body from below, which is the signal for the opening of short orders. Stochastic moved out of the oversold zone and is in the neutral zone now; the oscillator lines are directed upwards.

USD/CHF, H4

On H4 chart, the downtrend is still in effect, the instrument is declining to the lower border of Bollinger Bands. MACD histogram is near the zero level, and its volume is minimal. Stochastic has entered the oversold zone, and the lines of the oscillator are reversing upwards.

Key levels

Support levels: 0.9676, 0.9651, 0.9615, 0.9600.

Resistance levels: 0.9717, 0.9744, 0.9766, 0.9807, 0.9865.

Trading tips

According to technical indicators, short positions could be opened from the current level with the target at 0.9615 and stop loss at 0.9740. Implementation time: 1-3 days.

Long positions may be opened from the level of 0.9770 with the target at 0.9870 and stop loss at 0.9740. Implementation time: 3-5 days.

No comments:

Write comments