GBP/USD: the pound is corrected

07 September 2018, 09:27

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.2965 |

| Take Profit | 1.3048, 1.3100 |

| Stop Loss | 1.2910 |

| Key Levels | 1.2732, 1.2800, 1.2850, 1.2879, 1.2960, 1.3000, 1.3048, 1.3100 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2870 |

| Take Profit | 1.2800, 1.2750, 1.2732 |

| Stop Loss | 1.2930, 1.2940 |

| Key Levels | 1.2732, 1.2800, 1.2850, 1.2879, 1.2960, 1.3000, 1.3048, 1.3100 |

Current trend

Yesterday, GBP showed a slight increase against USD, continuing the development of the corrective impulse generated on Wednesday.

GBP is supported by data on possible progress in the Brexit negotiations. Currently, in addition to talks with EU representative Michel Barnier, British officials are discussing separate agreements with several EU countries. On Wednesday, Bloomberg reported that the UK and Germany agreed on a less detailed agreement on future trade relations between the EU and the UK. Later, both parties denied reports, saying that the positions remained the same and there is no progress in the negotiations. The German representative also noted that he fully trusts the EU chief negotiator Michel Barnier. Nevertheless, British investors remained positive.

Today, the focus of investor attention will be shifted to data from the US, where besides the publication of the August labor market report, there will also be speeches by Fed representatives Loretta Mester and Robert Kaplan, while statistics from the UK will be practically absent.

Support and resistance

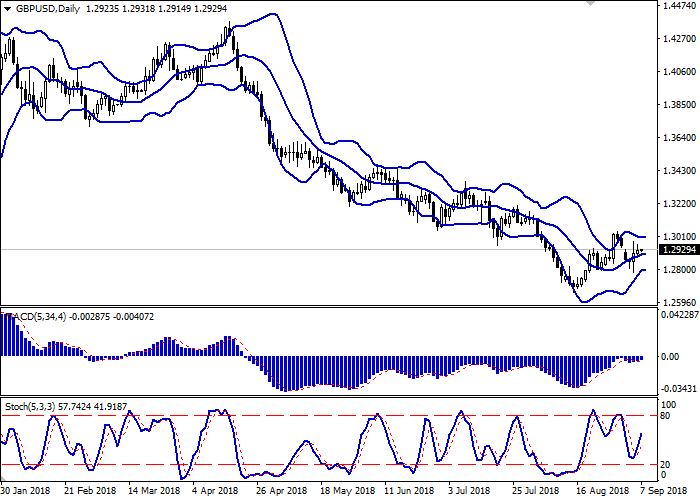

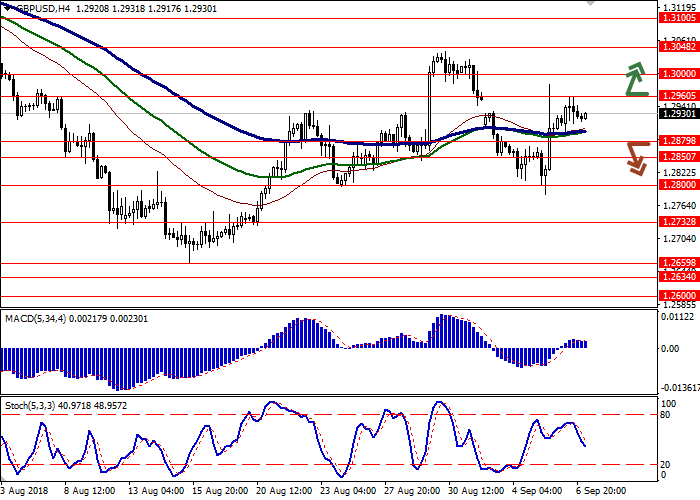

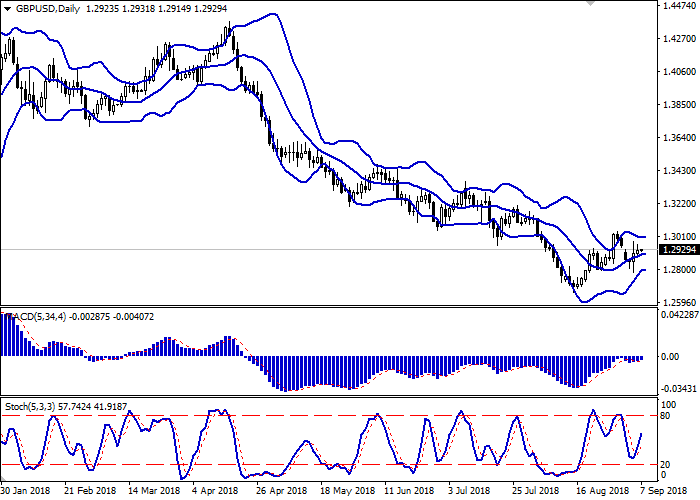

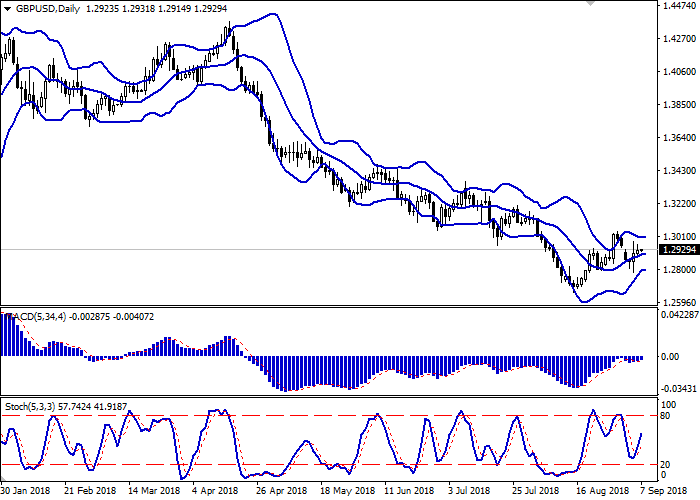

On the D1 chart Bollinger Bands are reversing horizontally. The price range is trying to consolidate, reflecting the flat nature of trading in the short term. MACD is growing keeping a weak buy signal (located above the signal line). Stochastic is growing more actively, quickly approaching its maximum levels.

The current showings of the indicators do not contradict the further development of the "bullish" trend.

Resistance levels: 1.2960, 1.3000, 1.3048, 1.3100.

Support levels: 1.2879, 1.2850, 1.2800, 1.2732.

Trading tips

To open long positions, one can rely on the breakout of 1.2960. Take profit — 1.3048 or 1.3100. Stop loss — 1.2910 or 1.2900.

A breakdown of 1.2879 may become a signal for returning to sales with target at 1.2800 or 1.2750, 1.2732. Stop loss — 1.2930 or 1.2940.

Implementation period: 2-3 days.

Yesterday, GBP showed a slight increase against USD, continuing the development of the corrective impulse generated on Wednesday.

GBP is supported by data on possible progress in the Brexit negotiations. Currently, in addition to talks with EU representative Michel Barnier, British officials are discussing separate agreements with several EU countries. On Wednesday, Bloomberg reported that the UK and Germany agreed on a less detailed agreement on future trade relations between the EU and the UK. Later, both parties denied reports, saying that the positions remained the same and there is no progress in the negotiations. The German representative also noted that he fully trusts the EU chief negotiator Michel Barnier. Nevertheless, British investors remained positive.

Today, the focus of investor attention will be shifted to data from the US, where besides the publication of the August labor market report, there will also be speeches by Fed representatives Loretta Mester and Robert Kaplan, while statistics from the UK will be practically absent.

Support and resistance

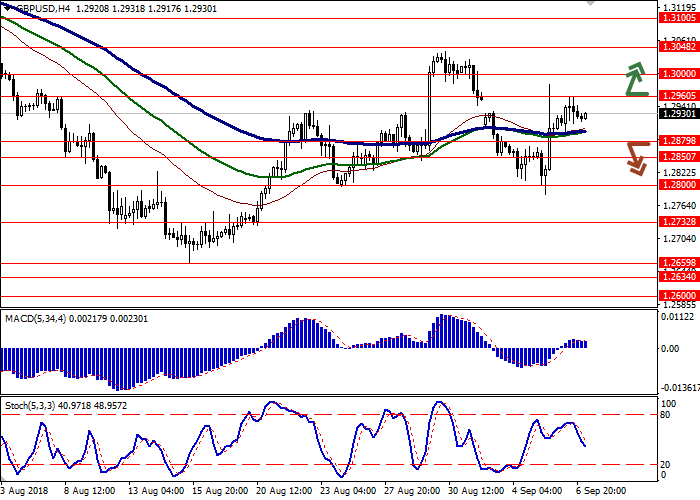

On the D1 chart Bollinger Bands are reversing horizontally. The price range is trying to consolidate, reflecting the flat nature of trading in the short term. MACD is growing keeping a weak buy signal (located above the signal line). Stochastic is growing more actively, quickly approaching its maximum levels.

The current showings of the indicators do not contradict the further development of the "bullish" trend.

Resistance levels: 1.2960, 1.3000, 1.3048, 1.3100.

Support levels: 1.2879, 1.2850, 1.2800, 1.2732.

Trading tips

To open long positions, one can rely on the breakout of 1.2960. Take profit — 1.3048 or 1.3100. Stop loss — 1.2910 or 1.2900.

A breakdown of 1.2879 may become a signal for returning to sales with target at 1.2800 or 1.2750, 1.2732. Stop loss — 1.2930 or 1.2940.

Implementation period: 2-3 days.

No comments:

Write comments