NZD/USD: the instrument is declining

10 September 2018, 10:14

| Scenario | |

|---|---|

| Timeframe | Intraday |

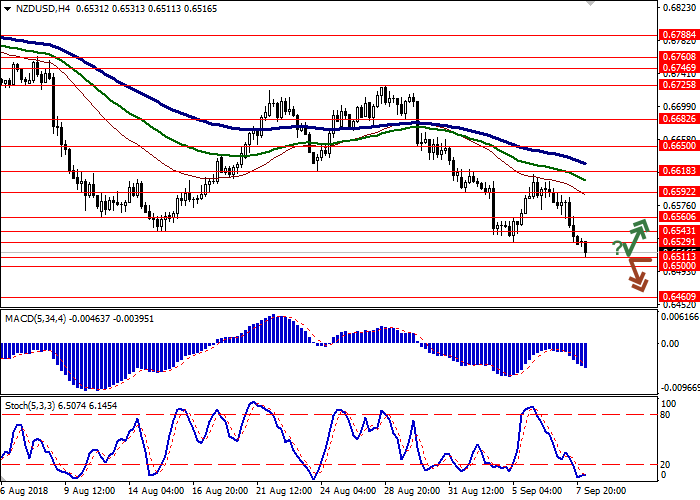

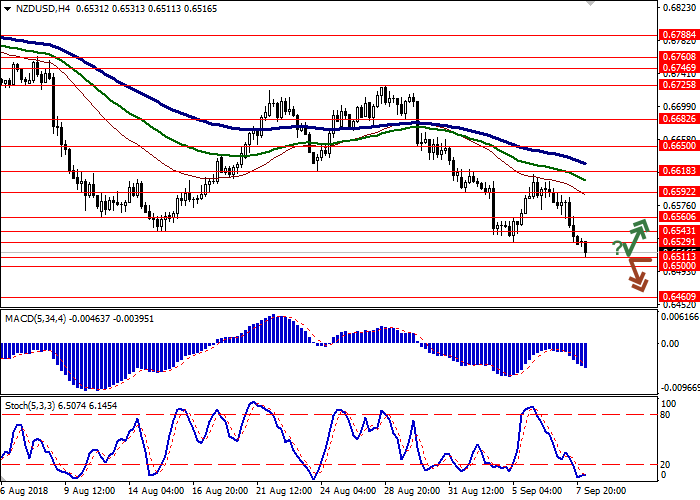

| Recommendation | BUY STOP |

| Entry Point | 0.6535, 0.6550 |

| Take Profit | 0.6618, 0.6650 |

| Stop Loss | 0.6511, 0.6500 |

| Key Levels | 0.6460, 0.6500, 0.6511, 0.6529, 0.6543, 0.6560, 0.6592, 0.6618 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6505 |

| Take Profit | 0.6460 |

| Stop Loss | 0.6543 |

| Key Levels | 0.6460, 0.6500, 0.6511, 0.6529, 0.6543, 0.6560, 0.6592, 0.6618 |

Current trend

On Friday, NZD fell against USD, returning to lows of the middle of the previous trading week. Today, the "bearish" dynamics continues to develop, and the NZD/USD pair is renewing its records.

The instrument is under pressure of a strong August US labor market data, published last Friday. Nonfarm Payrolls rose to 201K from 147K in July. The average hourly earnings, which is often mentioned by the Fed in discussing constraints, grew significantly, too. In August, the indicator increased by 2.9% YoY and 0.4% MoM against forecasts of +2.7% YoY and +0.2% MoM.

Support and resistance

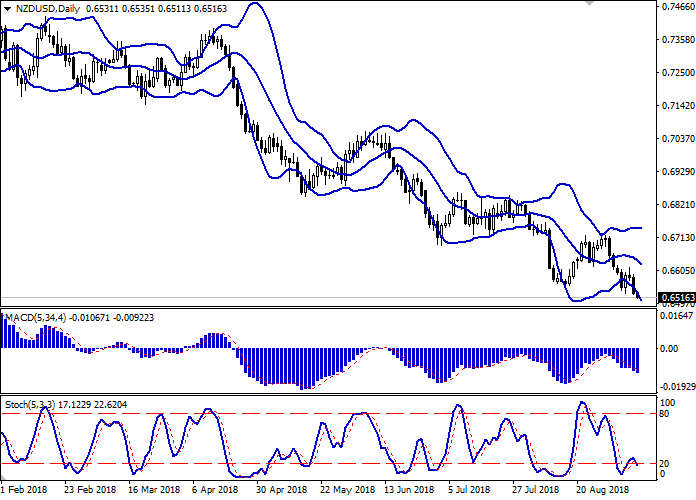

On the daily chart, Bollinger bands are steadily declining. The price range is widening from below, letting the "bears" renew the lows. MACD indicator is pointing down, keeping a strong sell signal (the histogram is below the signal line). After the growth at the end of the last trading week, Stochastic is reversing downwards under the pressure of "bearish" trades on Friday and Monday. However, the indicator reflects that NZD is strongly oversold in the short and ultra-short term.

Current indicators’ readings do not contradict the further development of the downward trend in the near future.

Resistance levels: 0.6529, 0.6543, 0.6560, 0.6592, 0.6618.

Support levels: 0.6511, 0.6500, 0.6460.

Trading tips

Long positions can be opened after rebound from the level of 0.6511 and breakout of the level of 0.6529 or 0.6543 with the targets at 0.6618–0.6650 and stop loss 0.6511–0.6500. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of the level of 0.6511 with a target at 0.6460 and stop loss 0.6543. Implementation period: 1–2 days.

On Friday, NZD fell against USD, returning to lows of the middle of the previous trading week. Today, the "bearish" dynamics continues to develop, and the NZD/USD pair is renewing its records.

The instrument is under pressure of a strong August US labor market data, published last Friday. Nonfarm Payrolls rose to 201K from 147K in July. The average hourly earnings, which is often mentioned by the Fed in discussing constraints, grew significantly, too. In August, the indicator increased by 2.9% YoY and 0.4% MoM against forecasts of +2.7% YoY and +0.2% MoM.

Support and resistance

On the daily chart, Bollinger bands are steadily declining. The price range is widening from below, letting the "bears" renew the lows. MACD indicator is pointing down, keeping a strong sell signal (the histogram is below the signal line). After the growth at the end of the last trading week, Stochastic is reversing downwards under the pressure of "bearish" trades on Friday and Monday. However, the indicator reflects that NZD is strongly oversold in the short and ultra-short term.

Current indicators’ readings do not contradict the further development of the downward trend in the near future.

Resistance levels: 0.6529, 0.6543, 0.6560, 0.6592, 0.6618.

Support levels: 0.6511, 0.6500, 0.6460.

Trading tips

Long positions can be opened after rebound from the level of 0.6511 and breakout of the level of 0.6529 or 0.6543 with the targets at 0.6618–0.6650 and stop loss 0.6511–0.6500. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of the level of 0.6511 with a target at 0.6460 and stop loss 0.6543. Implementation period: 1–2 days.

No comments:

Write comments